Often times the difficult aspect of writing blog commentary is posting articles that are interesting to investors and, more importantly, not a repeat of the commentary written by others. At times some of the same topics are repeated on the web during a given week where each article provides no new insight to readers. The repeating of similar topics begins to give investors the sense that a consensus view is developing. And one factor we know about the market is it likes to prove the consensus wrong. A good example of this fact is displayed when looking back at prognosticators' predictions at the beginning of the year. Most predictions were of the general theme that stocks would outperform bonds, but as the below chart shows, bonds have actually outperformed stocks. So what is the point?

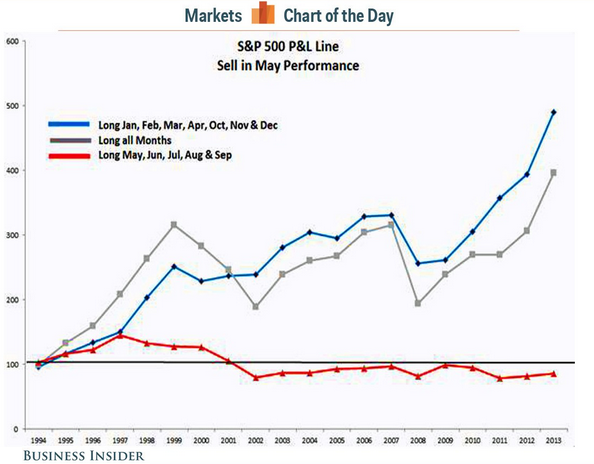

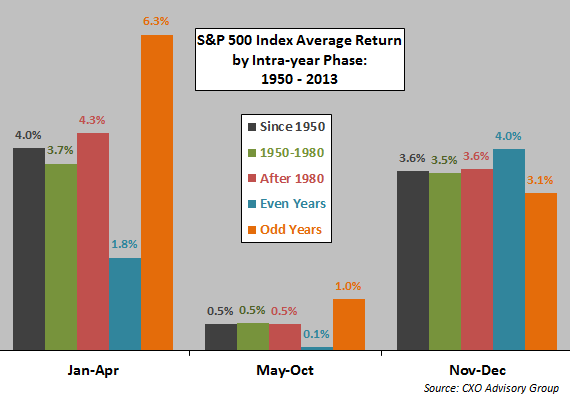

A theme currently getting a great deal of attention is the "sell in May and go away" topic. Even we have written about this seasonal market factor a number of times, as recently as mid-March. The importance of this theme is best explained by the below chart.

"The seasonal slogans often substitute for thinking and analysis. The powerful-looking chart...actually translates into a 1% monthly difference in performance. The "good months" gain 1.3% on average while the "bad months" gain about 0.3% (emphasis added).

To make a wise decision you need to make an objective quantitative comparison between the economic trends and the small seasonal impact. The Great Recession has been followed by a slow and plodding recovery. We have an extended business cycle with plenty of central bank support. Since I am expecting the current cycle to feature (eventually) a period of robust growth, I do not want to miss it. The 1% seasonal effect will be minor in a month where we get a real economic surge."

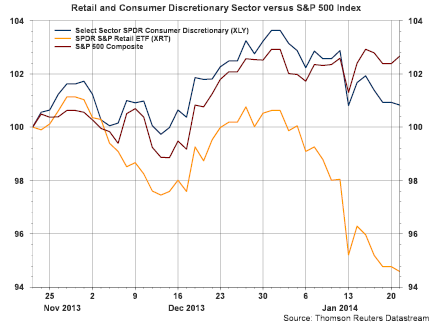

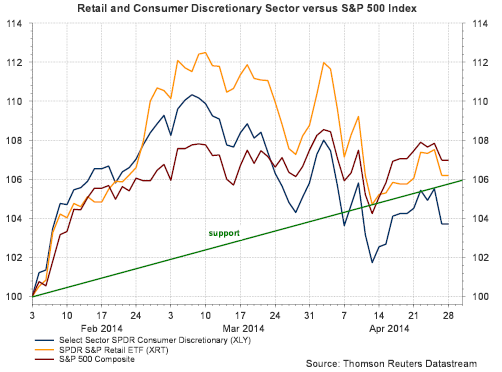

- "if the pervasive market sentiment is the consumer has rolled over, vis-à-vis the market and the economy, the efficient market hypothesis would imply this type of news is factored into current stock prices."

- "The weaknesses in some consumer stocks is certainly worth paying attention to; however, the market/investor already knows a lot about this weakness and a majority of this bad news may be factored into stock prices [emphasis added]."

- Second-quarter outlooks for S&P 500 companies so far are much more optimistic than the last two quarters. Fewer companies are cutting estimates and those that are reducing forecasts haven't done so as aggressively as in the past.

- "The downward revisions for the second quarter right now are very, very mild," said Nick Raich, chief executive officer of The Earnings Scout, an independent research firm specializing in earnings trends."

- Surprisingly strong results have come from many high-profile names, including Apple , Caterpillar , Netflix and United Technologies . That's offset what Wall Street had expected to be a lackluster first quarter. Estimates were slashed, heading into this earnings period as the unusually harsh winter hampered transportation, kept people out of stores and raised heating costs.

- So far, 69 percent of companies have beaten analysts' expectations, above the long-term average of 63 percent, Thomson Reuters data showed.

- Helping to relieve concerns, United Technologies, Coca-Cola , General Motors and McDonald's all reported strong results from their China operations. That's negated one of the market's primary worries that weak demand from the world's second-largest economy would hit profits. "It is still a little surprising how strong China remains, given what you read," United Technologies' Chief Financial Officer Greg Hayes said in an interview, in reference to the conglomerate's building systems businesses.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI