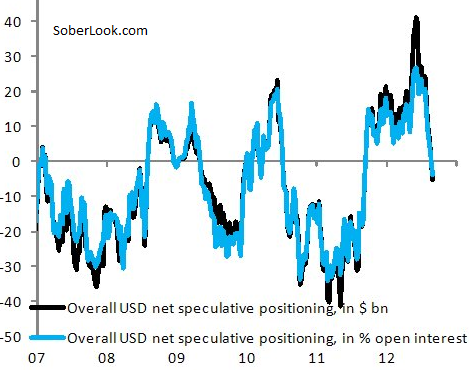

Remember the crowded trade in long USD positions (discussed here)? Well, it's not crowded any more as many of the longs have been blown out. The sentiment has quickly shifted (of you wonder why, just read this) and the short dollar bias is currently in place. The speculative futures players net exposure (from CFTC) shows them now to be net short the dollar.

Reuters: Currency speculators turned negative on the U.S. dollar in the latest week for the first time in nearly a year, according to data from the Commodity Futures Trading Commission released on Friday. The value of the U.S. dollar's short position totaled $441.7 million from a net long position of position of $4.57 billion the previous week. It's the first net short position on the dollar since the week of September 6, 2011. To be short a currency is to bet it will fall in value, while being long is a view its value will rise.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.