Chinese chip stocks jump as Beijing reportedly warns against Nvidia’s H20

Any good investor knows about the compound interest effect. It works in such a way that earnings of an asset are reinvested in order to generate additional earnings. Or as Ben Franklin once said: “The money that earns money, earns money”.

Suppose an investor makes an investment of $100,000 and achieves an annual return of 5%. At the end of the first year his account balance is $105,000. If he reinvests $105,000 without withdrawing the profit of $5,000 his 5% return in the following year will grow from $5,000 to $5,250. The $250 additional earnings are due to the so-called compound interest effect. Over the years this effect is increasing. After 10 years of investment using compounding, the investor has a profit of $62,889 on his account, while an investor who does not use compounding only has $50,000 profit in the same period.

Short-term traders can exploit this effect as well. The only thing a short-term trader has to do in order to use compounding is to answer the question in the headline with “Keep your profits (or at least part of them) in your account”.

Most traders are working with a percentage risk of their equity as initial risk in trading. Suppose a trader is working with an average risk of 2% on each trade he will risk $100 dollar per trade on a $50,000 account. With a balance of $60,000 the average risk grows to $120. Thus the potential profits are also correspondingly larger and the account grows faster.

In my opinion, the effect of compound interest is the most underestimated tool of a trader. If you have the possibility to leave the profits in the account you can achieve a reasonable trading account size in a relatively short period of time. As most beginning traders do have the problem of a small account, not withdrawing their profits is a good way to overcome this problem and start making a living through trading. When using compounding to grow an account one does not need exorbitant returns, but can rather rely on a good stable return, which can be reached also taking into account important aspects as money management and risk of ruin.

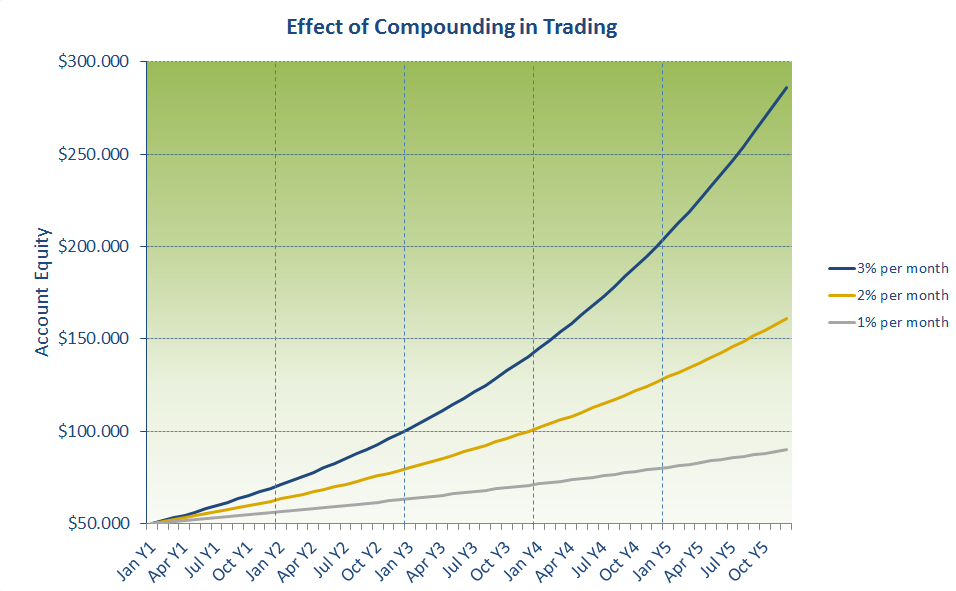

Figure 1: Effect of compounding on a $50,000 account

In the chart above you can see a comparison of different monthly returns over a trading period of five years. Seed capital is $50,000. The gray line shows the account development at a yield of 1% per month, the yellow line at 2% monthly returns, and the blue line represents a monthly rate of return of 3%, which is quite realistic for a day trader.

Even with a performance of 2% a month using compounding you would have doubled your account in three years - that is a 100% gain. Without compounding, you would only have a profit of 72%. And remember: the effect of compounding is increasing with each profit you are able to make. In order to clarify the whole thing I took the $50,000 account and made a comparison of the equity development with and without compounding for a trader who is able to make earnings of 3% each month.

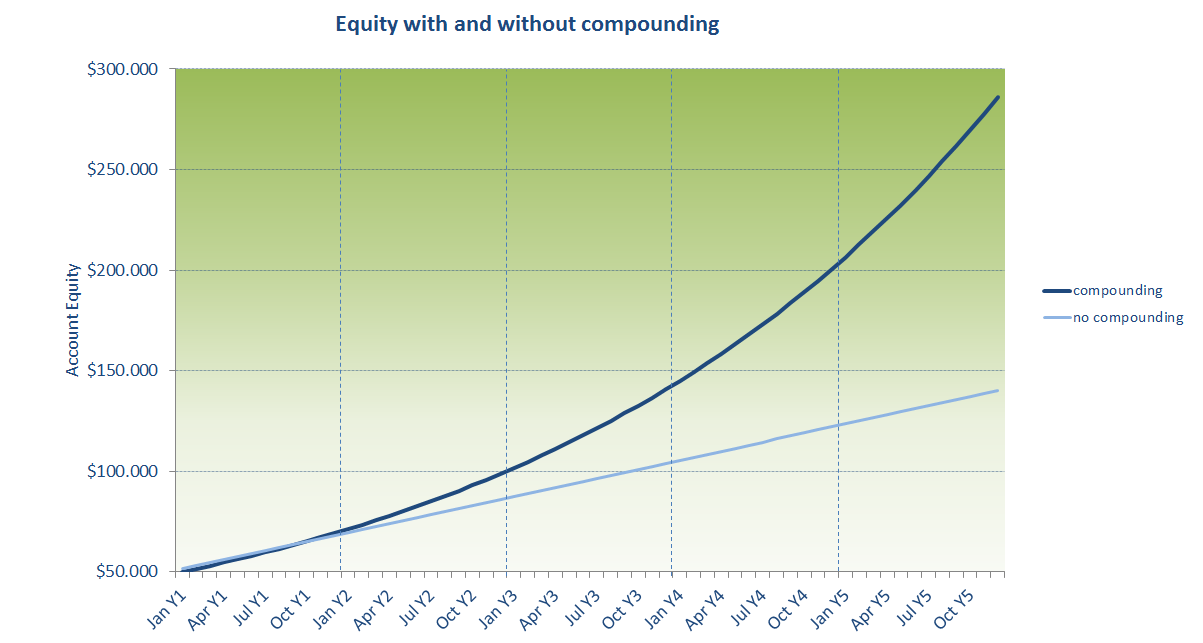

After a trading period of five years a balance of $140,000 without the compounding effect is offset by a balance of no less than $286,000 with compounding effect. Note well that both curves are created with identical trades and identical percentage risk.

Figure 2: Comparison of an account with and without compounding

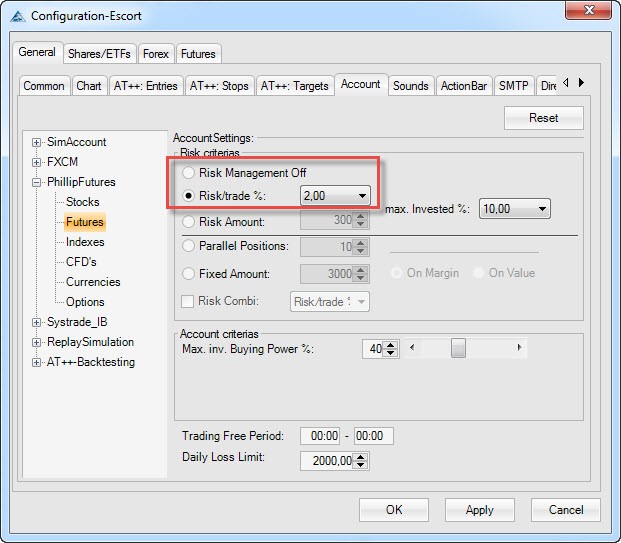

Traders should therefore make a plan on how to deal with their earned profits. At least in the beginning it is recommended to leave as much money as possible on the account to be able to achieve an account size that allows an existence as a fulltime trader. The use of the compounding effect is one of the many reasons why I am using AgenaTrader as my trading platform. AgenaTrader provides me with the possibility to enter a percentage risk for my trades in the settings. It than automatically calculates the correct position size according to the entry, the stop and the current account balance. This gives me the opportunity to use compounding on each trade.

Figure 3: Riskmanagement with AgenaTrader

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI