With 2020 only a few days away, I want to discuss the “calendar effect”. I alluded to this phenomenon in recent posts, but this is an important concept and worthy of the entire spotlight today.

In a lot of ways, the calendar doesn’t matter. For example, Year-to-Date gains/losses are a meaningless statistic, especially early in the year. The same can be said for annual gains. 2019 will go down in history as the second-best performance of the last two decades and everyone is cheering these nearly 30% gains.

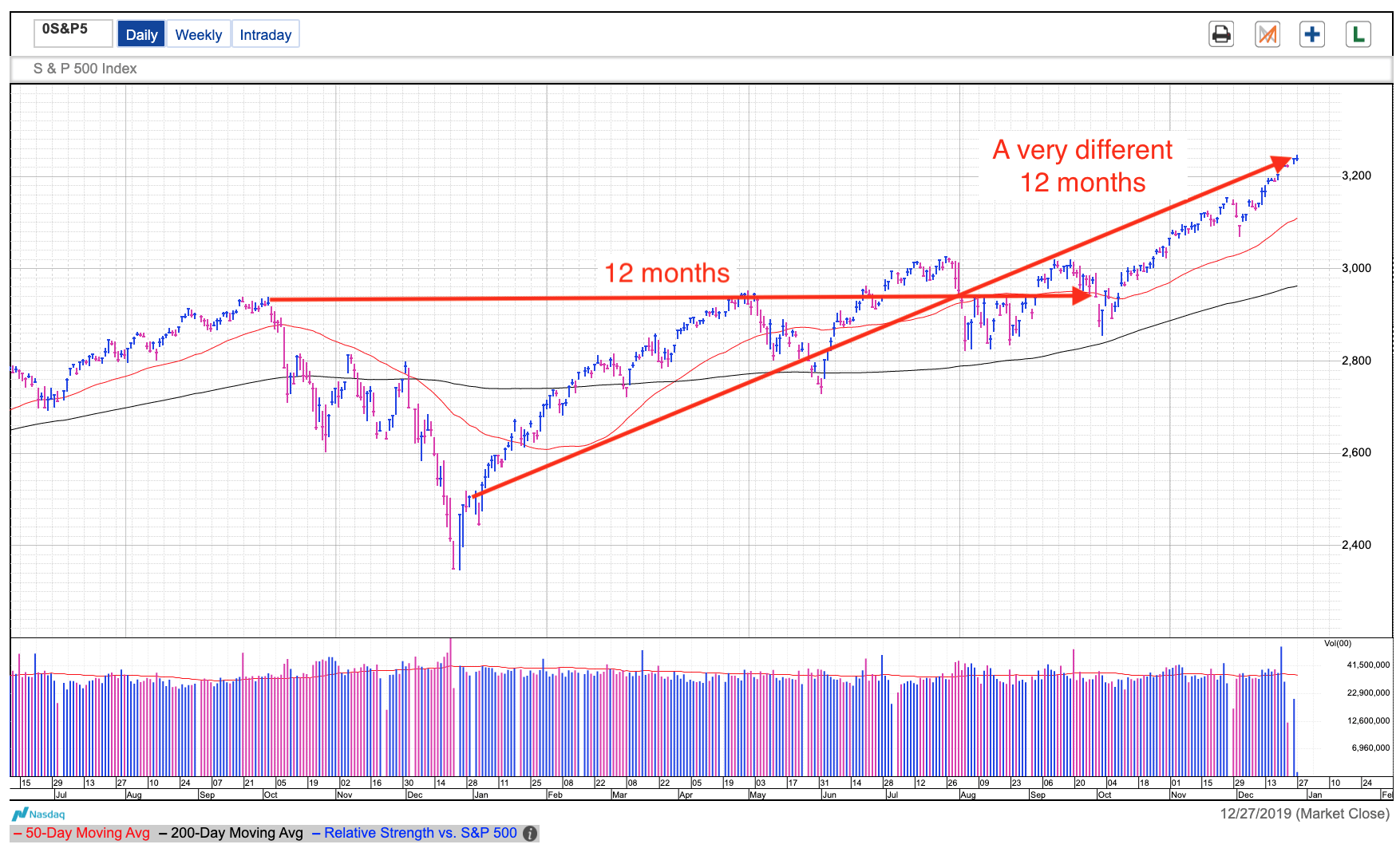

Unfortunately, 2019’s headline number isn’t so much about how good 2019 has been, but how bad 2018’s fourth quarter was. If we adjust the rolling 12-month period from October 1st, 2018 to October 1st, 2019, these impressive 12-months gains tumble all the way to a measly 0.5% annual return. That’s right, just half-of-a-percent in 12 whole months! If our calendar went from October to October instead of January to January, the second-best year in two decades turns into a very forgettable performance. Ouch.

While we need to question these somewhat arbitrary rolling periods when making performance comparisons, there are times when the calendar actually matters to the market. It isn’t so much about the calendar itself or even the seasonality of the business cycle, but how institutional investors’ performance is measured and how their managers are paid.

Most institutional funds are judged by their annual performance and that means the managers running these funds live and die by where they stand at the end of every calendar year. There is nothing more important in their world. Next in importance comes the quarterly statements that get mailed to investors. If you want to keep people’s money, then you better show respectable gains at the end of every third month. And lastly, monthly gains, but they don’t matter as much because only the nerdiest of the nerds keep track of those.

Institutional money managers’ entire mindset revolves around March 31st, June 30th, September 30th, and December 31st. All of their decision are driven by how they will look on those four critical days. And since most market moves are propelled by institutional buying and selling, those four days matter to us too.

Currently, there is a lot of pressure on large money managers who are trailing this very impressive year. If they cannot match the market’s gains, at the very least they need to be able to tell their investors that they are in all the right stocks and that the results will come. This chasing of performance is what gives us strong moves in the final months of good quarters and years.

But here’s the important thing, once the calendar rolls over to the next quarter or year, these institutions are starting with a clean slate. Those that were compelled to buy in the final weeks of the year no longer need to chase prices higher because they have just been given three months of breathing room.

This herd buying and selling ahead of the end of quarters and years is what gives quarters and years consistent personalities. Quarters and years are most often up, down, or flat. But once those quarters/years end, we move into a new quarter/year, one that most likely will have a much different personality than the one that preceded it. 2019 was a good year for stocks. Chances are, 2020 will look a lot different. Be ready for it.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.