The Brunner Investment Trust (LON:BUT) aims to generate long-term growth in capital and income from a portfolio of high-quality global equities. Over time the exposure to overseas stocks has increased, providing a broader opportunity to generate income and capital growth, and the number of holdings has been reduced.

Since June 2016, BUT has had a single manager, Lucy Macdonald, who has refined the UK stock selection process in line with that for overseas companies. Under her sole tenure, the trust has outperformed the composite benchmark by more than 4pp. BUT has a distinguished record of dividend growth; annual dividends have increased for the last 45 consecutive years and the current yield is 2.3%.

Investment strategy: Fundamental stock selection

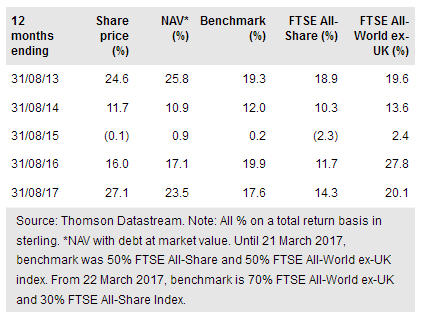

The recent change in BUT’s benchmark, shown in the note to the table above, is illustrative of the exposure shifts towards more overseas and fewer UK equities. The manager selects stocks on a bottom-up basis, with an awareness of the macro environment, seeking companies with attractive fundamentals that are trading on reasonable valuations. She is able to draw on the well-resourced Allianz (DE:ALVG) Global Investors (AllianzGI) investment team. Gearing of up to 20% of net assets is permitted; at end-August 2017, net gearing was 6.3%.

To read the entire report please click on the pdf file below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.