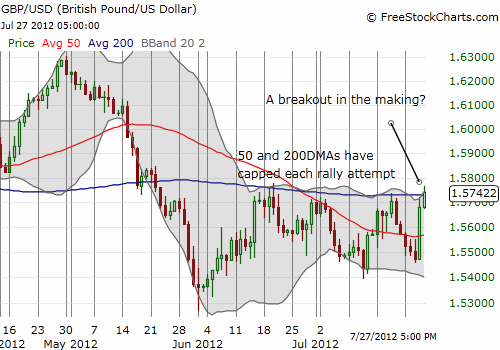

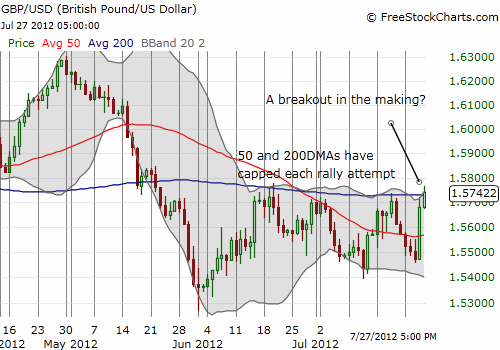

I started with a bullish strategy to trade the British pound against the U.S. dollar (FXB) after fiscal and monetary authorities rallied to airlift more liquidity into the economy. It worked well but required accumulating into selling on GBP/USD and then selling quickly into large but brief rallies into resistance provided by the 50-day moving average (DMA). After several flourishes, I finally decided to switch to a bearish strategy that seemed more amenable to managing risk in the apparent trading range. Of course, after that, GBP/USD rallied further into resistance at the 200DMA. Fortunately, the currency pair promptly sold off from there to deliver another profitable exit.

One key to how this latest drama unfolds is the direction of the U.S. Dollar Index (UUP).

Be careful out there!

Full disclosure: Net short British pound.

One key to how this latest drama unfolds is the direction of the U.S. Dollar Index (UUP).

Be careful out there!

Full disclosure: Net short British pound.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.