Shall we compare the damage that will be done when all these bubbles pop?

Regardless of one's own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the electrical consumption of bitcoin is "shocking," "ridiculous," etc.

Since the U.S. consumes about 20% of the world's energy, we can guesstimate the total amount of electricity wasted on stand-by and similar sources of waste is more on the order of $100 billion annually.

What's shocking and ridiculous is that upwards of $100 billion in electricity is squandered globally annually on stand-by devices and other painfully obvious sources of waste. But this attracts essentially zero concern or commentary. Do you notice any asymmetry in the scrutiny being applied to the status quo and to bitcoin et al.? The status quo-- wasteful beyond measure--is just fine: nobody questions the staggering waste built into the status quo, from hundreds of millions of devices consuming electricity but doing no work to hundreds of millions of vehicles idling in traffic for hours each and every day across the globe--nope, the really big issue is bitcoin / blockchain consumption.

Does anyone question how much electricity the vast server farms of Google (NASDAQ:GOOGL) and Facebook (NASDAQ:FB) consume in order to serve up adverts and store photos of puppies and kittens? And how about the energy consumed by the NSA and the dozens of National Security agencies that have proliferated over the past 16 years? How much coal gets burned to serve adverts, archive photos of puppies and kittens, and store billions of emails, phone calls to Aunt Sadie, etc. for future analysis? (Dear old Sadie could be a jihadist--ya never know...)

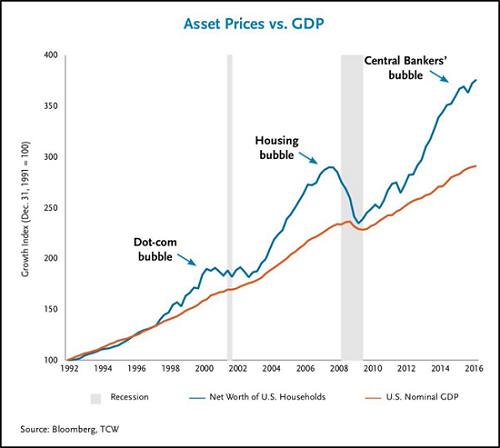

There's also an interesting asymmetry in pronouncements of bubbles. Almost every pundit/commentator agrees that the cryptocurrencies are in crazy bubbles akin to the tulip-bulb mania, but how many of these folks publicly ask if fiat currencies might be the greatest bubbles in human history, pyramids of illusion that are supposedly worth tens of trillions of dollars?

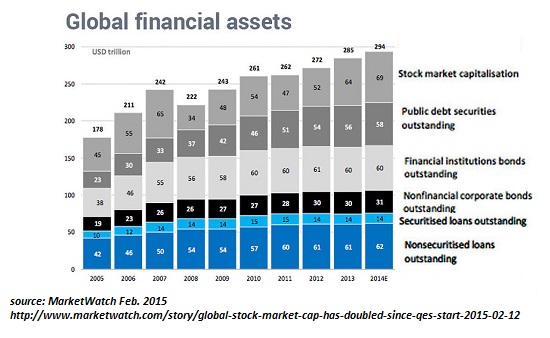

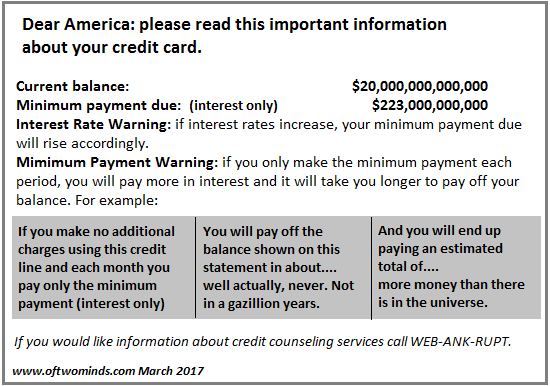

Do the bubbles in bonds, stocks and real estate get the same scrutiny as the bubble in cryptos? Do any of the conventional critics deriding the bubble in bitcoin bother comparing the scale of all these bubbles? So bitcoin is in a bubble at a market cap of $170 billion, but the unprecedented $500 trillion bubble in stocks, bonds, debt instruments and real estate is perfectly fine and no risk at all? (Approximately $300 trillion in global financial assets and $200 trillion in real estate.)

Shall we compare the damage that will be done when all these bubbles pop? Owners of bitcoin would suffer a collective loss of $85 billion should bitcoin fall in half from $10,000 to $5,000, while the owners of stocks, bonds, debt instruments and real estate will suffer a collective loss of $250 trillion when these bubbles pop--an event that history tells us is inevitable.

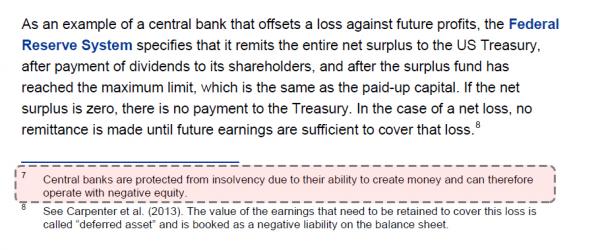

The status quo does an excellent job assuring us that these $500 trillion bubbles will never pop-- never, ever, ever; they will continue expanding until the end of time because central banks are the greatest power in the Universe and they will never ever let these markets decline.

Meanwhile, history is conclusive: ultimate financial powers in the Universe are 0 for 100 in terms of staving off collapses of asset bubbles, especially asset bubbles based on the infinite expansion of credit.

So which bubble is more dangerous? Which one should be attracting the most scrutiny and risk assessment? The mainstream will answer "bitcoin," but if we strip away the astounding asymmetry that's being applied to all things bitcoin/blockchain, we might find that worrying about the destruction of $250 trillion is considerably worthier of close examination than the potential for what amounts to signal-noise (in comparison to losses that will be measured in the tens of trillions) losses in bitcoin.

The asymmetry of bubbles will generate an asymmetry of losses.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI