Bitcoin price today: inks new record high near $119k as ETF inflows surge

Oil consolidated its gains overnight as a larger than expected American Petroleum Institute (API) Crude Inventory drawdown and continuing worries over U.S./Iran relations and Iraqi/Kurdistan combined to support prices.

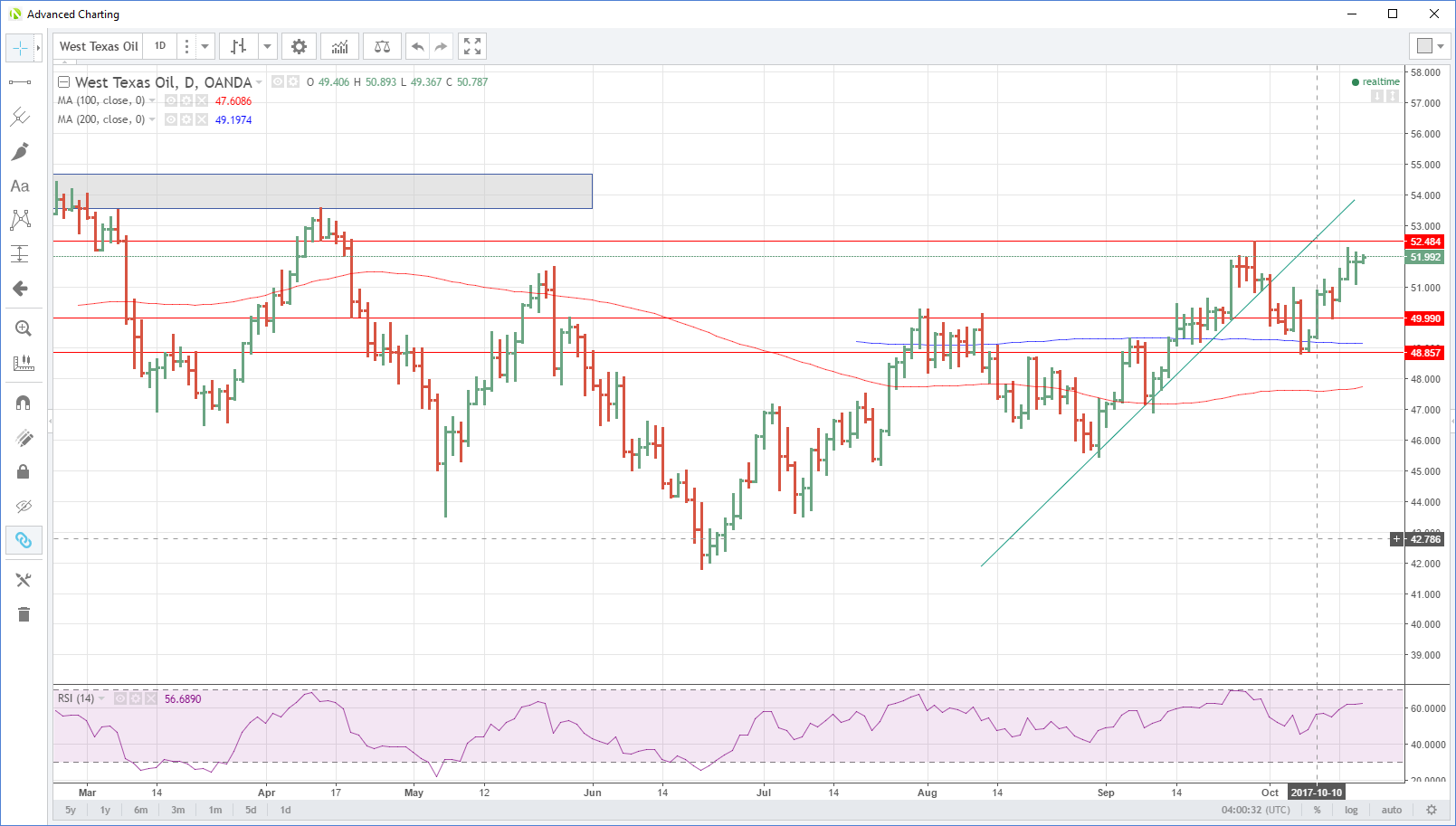

The API drawdown came in at a massive 7.1 million barrels against an expected drop of 3.4 million barrels saw WTI rush higher to the 52.00 region where is closed in New York. Prices should probably have moved higher, but the crude drawdown was tempered by a nearly 2 million barrel rise in gasoline inventories. Traders will now look for confirmation that this year’s inventory fall remains on track with the official DOE Crude Inventory data this evening, with the Street looking for a drop of 3.2 million barrels.

Today in Asia we expect the bid tone to remain with trading muted as Singapore is on holiday. Both contracts will remain acutely sensitive to news headlines from the Middle East.

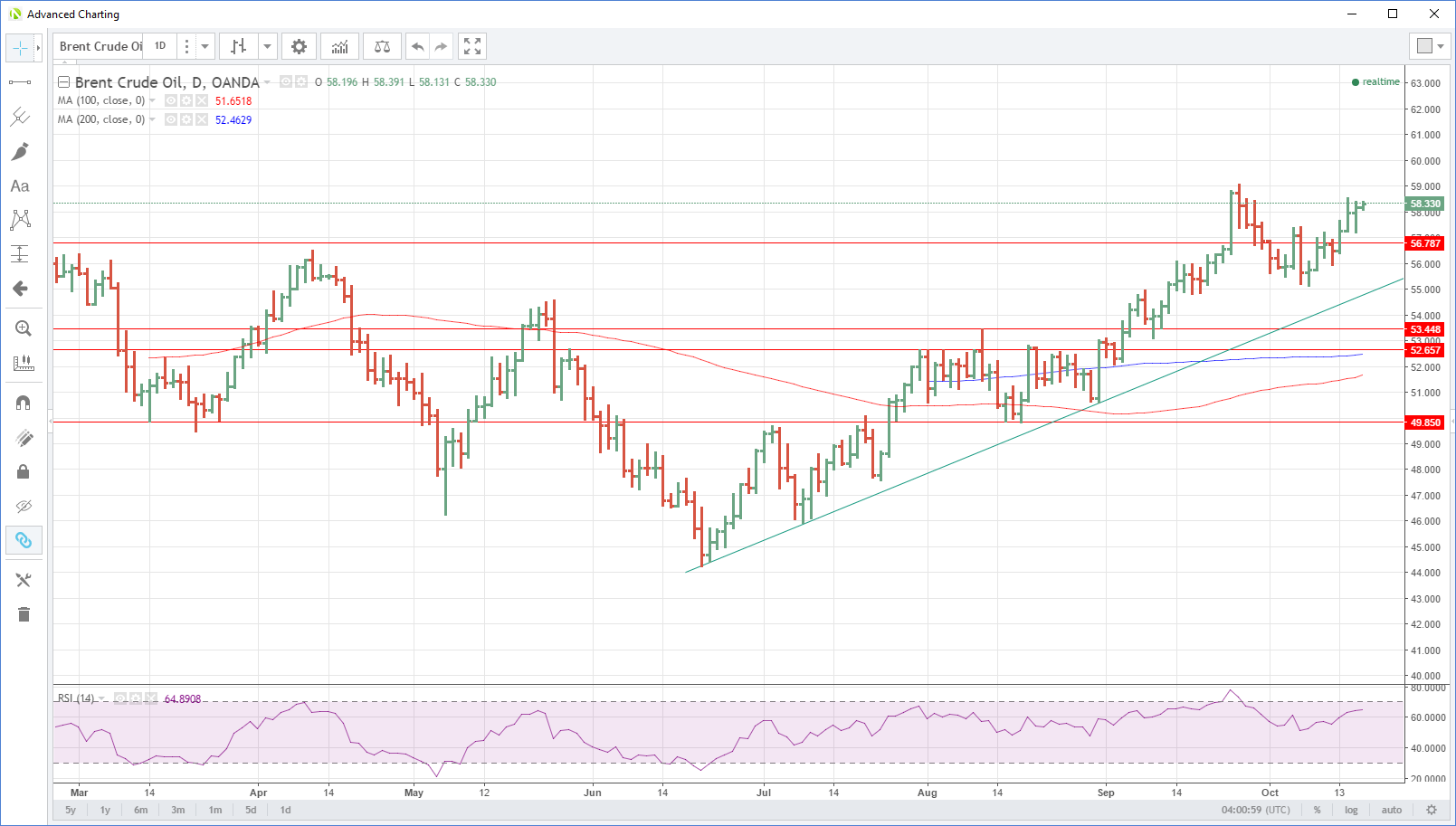

Brent has risen 20 cents from its 58.20 New York close to trade at 58.40, just shy of the overnight high at 58.55 and initial resistance. Above here will bring the 59.10 September high into sight ahead of the much more formidable 60.00 level. Support is at 57.30 with a break suggesting a correction is possible to 56.00.

WTI closed unchanged at 51.85 and has traded slightly higher to 52.05 in early Asia. Nearby resistance is at 52.50 with a break bringing the long-term resistance zone between 52.50/53.50 into play. Support rests at 51.10 with a break suggesting a correction to 50.00 could occur.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI