Remember late 2007/ early 2008?

The US economy was entering a recession; the worst recession in decades. But 99% of economists didn’t see it.

Night after night the media proclaimed that the economy was rock solid. They missed the warning signs as experts emerged to proclaim the S&P 500 would be soaring to new highs.

Well, we are right back to that environment.

The US is screaming recession.

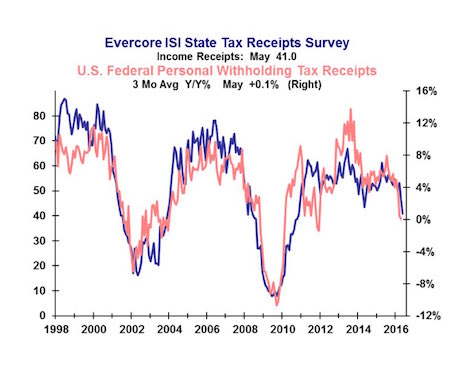

The best measures for economic activity in the US are tax receipts. The two that matter most are state sales tax receipts, which indicate how much people are spending, and Federal Personal tax receipts which show who has a job.

BOTH are collapsing into recessionary territory.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

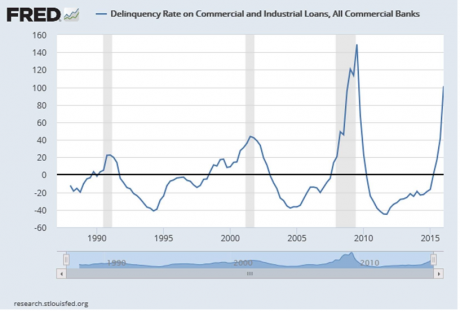

Another major warning sign…

The delinquency rate on commercial and industrial loans is skyrocketing. This means that businesses are late making loan payments… they only do this when they don’t have the cash handy to pay the bank.

This ONLY occurs during recessions.

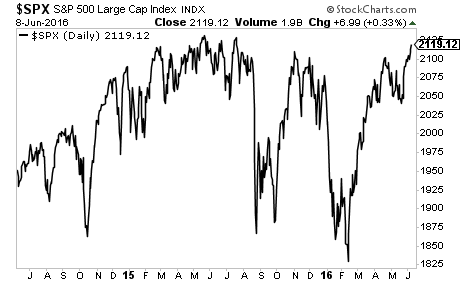

Meanwhile, stocks are just 1% away from their all time highs.

More and more this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 Crash back in late 2007? We did, and our clients made triple digit returns when the markets imploded.

We’re currently preparing for a similar situation today.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.