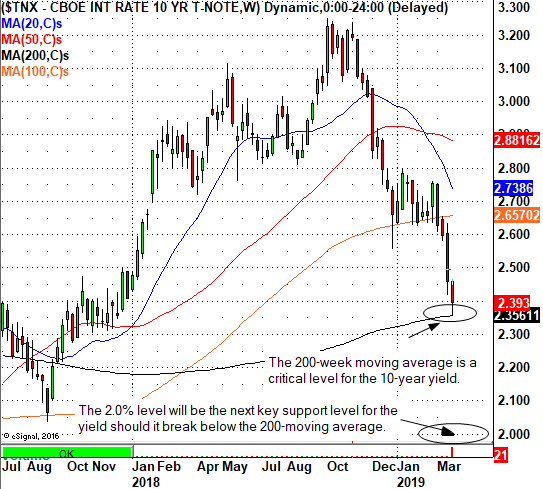

Everyone is talking about about the falling yield on the 10-Year U.S. Treasury Note. Today that yield is around 2.395%. Yesterday, the 10-year yield hit the 200-week moving average, which looks to be a critical support level. Trader and investors should note that the 10-year yield is in a confirmed down-trend on the daily chart. The yield has declined below it's 200- and 50-day moving averages. This is a very weak technical formation and generally a sign that bond yields will decline further in the next few months.

What To Expect

If yields break below this important 200-week moving average it will generally signal a move down to the 2% area. If this happens, the fed funds rate (2.25 - 2.50%) would be above the 10-year yield, which is why the Federal Reserve would likely lower the fed funds rate in the second half of 2019.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.