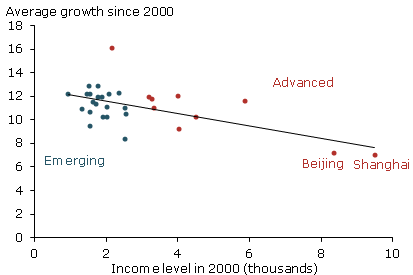

A recent economic letter from the San Francisco Fed (Israel Malkin and Mark Spiegel) discusses a model used to project China's economic growth. In their analysis the researchers separate China into two economies: "Advanced" and "Emerging." They point out that historically (across Asian nations), as economies move from Emerging to Advanced, their growth slows. China's provinces should follow the same trend of rising per capita income levels and declining growth rates.

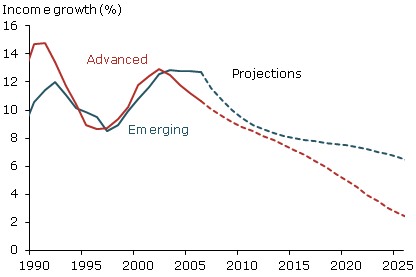

The model projects that the recent slowdown is a structural one and growth will indeed continue to moderate. However the "two Chinas" (Advanced and Emerging) will have very different growth paths going forward.

SF Fed: China’s relatively undeveloped areas may be able to grow at high rates for some time before reaching income levels associated with slowdown. This could delay a middle-income trap growth slowdown for the nation as a whole. Emerging Chinese provinces are likely to maintain their high growth rates for some time after their wealthier counterparts have slowed.

This trend of emerging provinces catching up to the wealthier ones should keep the economy as a whole growing (unlike Japan for example which is far more homogeneous). Of course uncertainties about the differences in relative growth trajectories remain.

SF Fed: ... other developments could influence the relative pace of growth in different regions of China, including government expenditure on infrastructure in the outlying regions, the pursuit of policies designed to reduce income inequality, and the impact of continued labor migration from emerging provinces. Substantial uncertainty remains about the relative pace of growth in the emerging and advanced Chinese provinces.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.