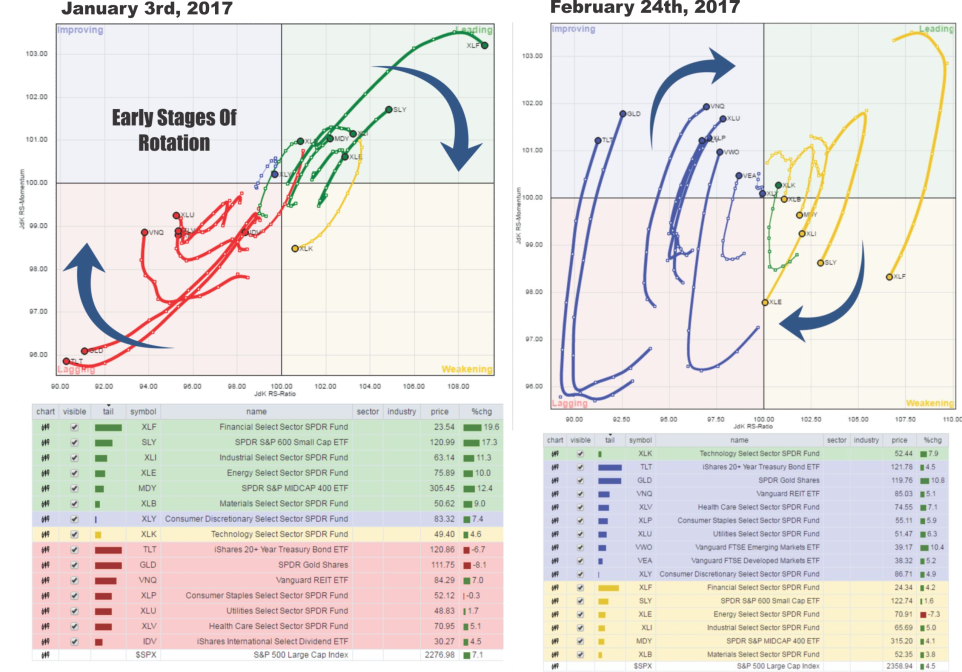

Since December, I have been discussing the opportunity that exists in the potential for a rotation from the “risk-on” Trump Rally to the “risk-off” safety trade. I stated that in December we began buying these “risk off” trades based on this expectation and adding bonds, utilities, health care, preferred stocks and REIT’s to our portfolios.

The addition of bonds was also done under the premise that while the majority of analysis was discussing the long-term bottom in rates and the obvious move higher, I have not agreed. This is because “real inflation” remains nascent outside of health care and rent. The recent bump in commodity prices has also been a contributing factor to a small degree but has the negative side of fueling input costs that reduce corporate profitability. The rise in commodity prices, primarily oil, has been driven by a strengthening dollar, which was something I said would happen in May of 2015.

Interestingly, Jeff Gundlach caught up with my stance last week discussing the “stealth rotation.” To wit:

Not only is the Trump rally over, but stocks are the last to get the memo. That’s the current market summary according to DoubleLine’s Jeff Gundlach who told Reuters that ‘there is a stealth flight to safety going on.’

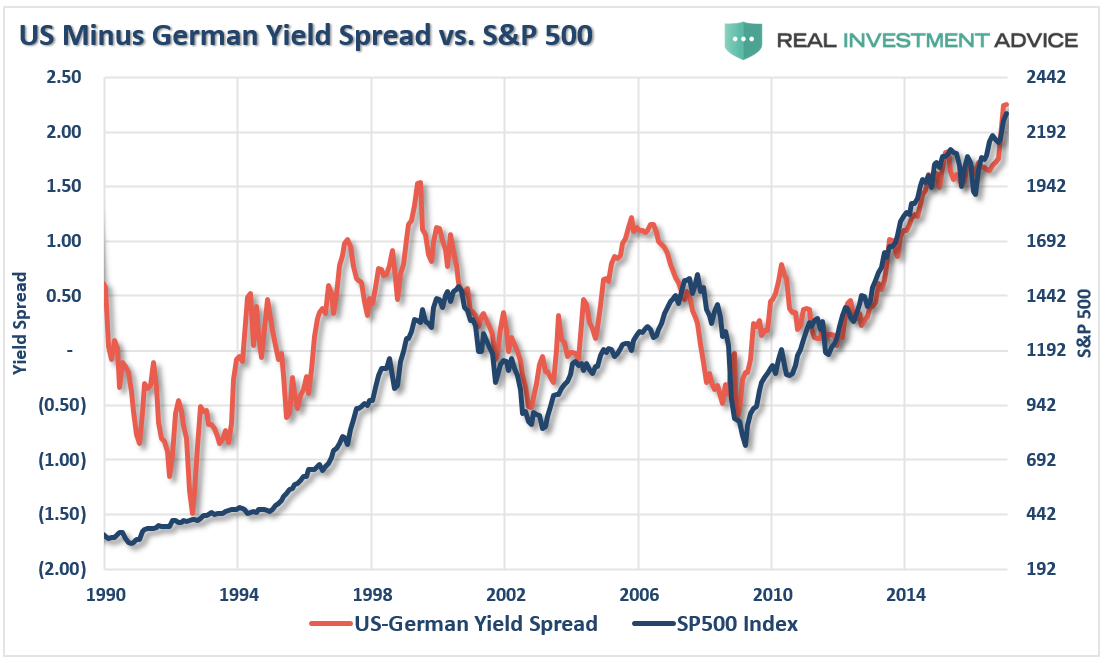

Among key indicators, Gundlach pointed to German Bunds and especially Schatz (2Yr), noting that ‘German bond yields are leading the way down and Gold is rising.’ He also warned that ‘speculators remain massively short bonds and the market is going to squeeze them out.'

He is absolutely correct, and both of these are points I have made previously.

Here is the most important point to remember. Just two months ago, we were told that U.S. equities should rise because bond yields would be low forever, discount rates should trend toward 0%, and therefore equity valuations should trend toward infinity over time.

Now, we’re told that despite bond yields surging we can still count on U.S. equities trending toward infinity because they’re better positioned to absorb higher rates than emerging markets.

It can’t be both.

The chart [above] shows the 10-year Treasury rate and the German Bund rate. Not surprisingly, since rate spreads directly impact economic activity, trade, and currency flows, whenever spreads widen to such a degree, bad things have tended to happen.

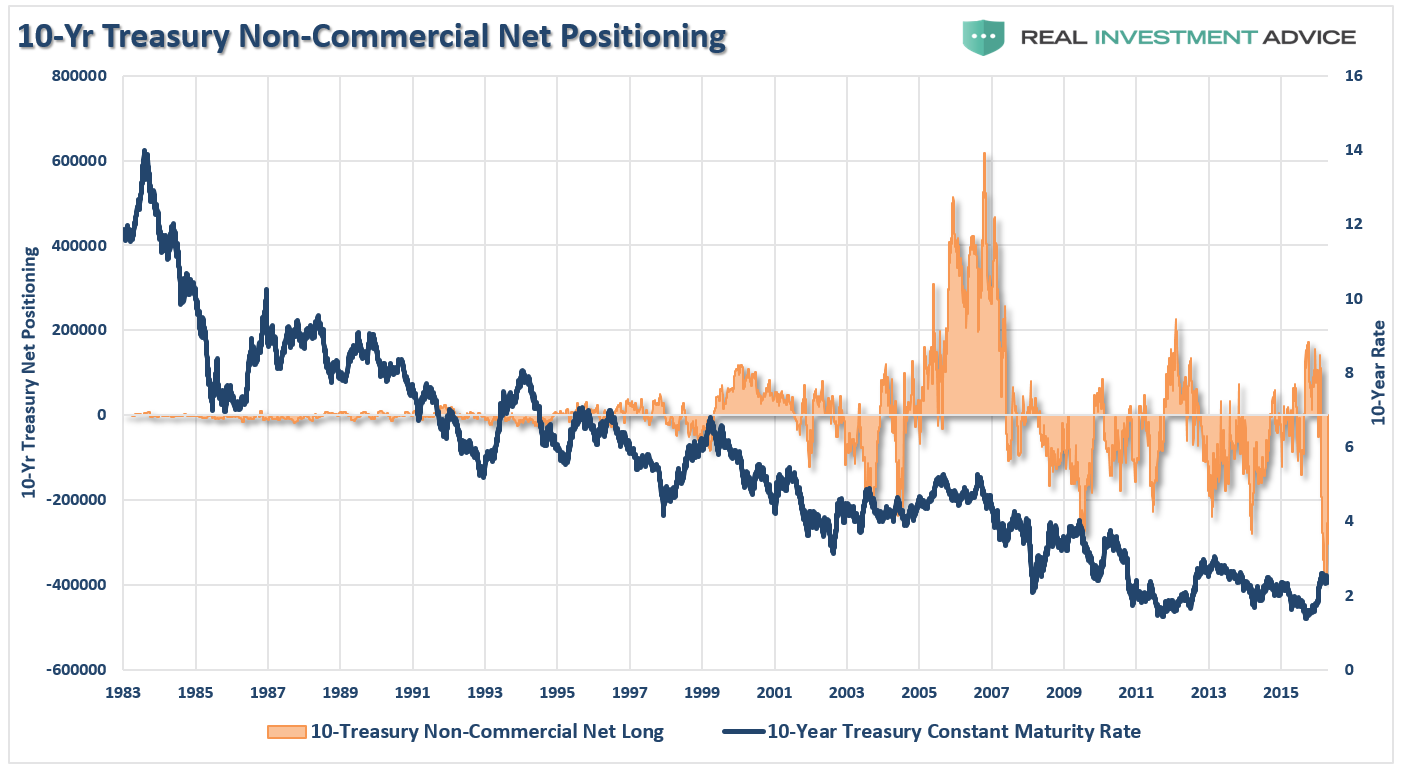

The most interesting setup currently for investors, is the massive net-short position on US Treasury Bonds. Given the aggressive leveraging in the markets above, a reversal in the S&P 500 will likely send money rushing into bonds for “safety.” That rush will fuel a short-covering spree in bonds forcing yields towards 1.5% or lower.

Virtually everywhere you look there are signs the rally seen on the surface of the major indices is far different than what is happening beneath. You can see it most clearly in the chart below, which shows where the sector rotation was at the beginning of January and the end of February.

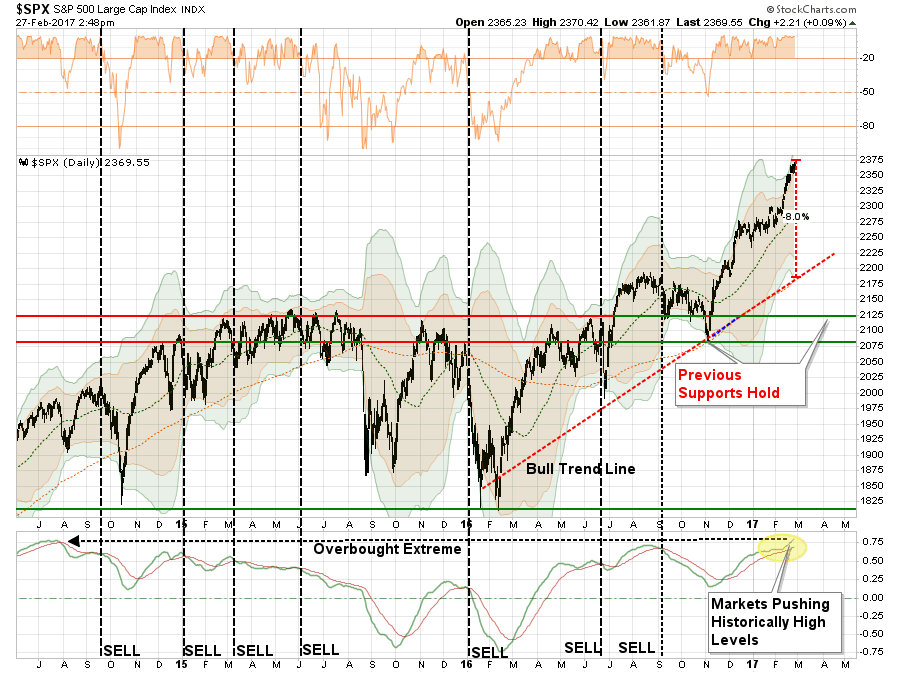

Yet, despite this underlying rotation, the markets have been clinging near all-time highs, with a very sharp deviation of 8% above the 200-day moving average with extreme overbought short-term conditions.

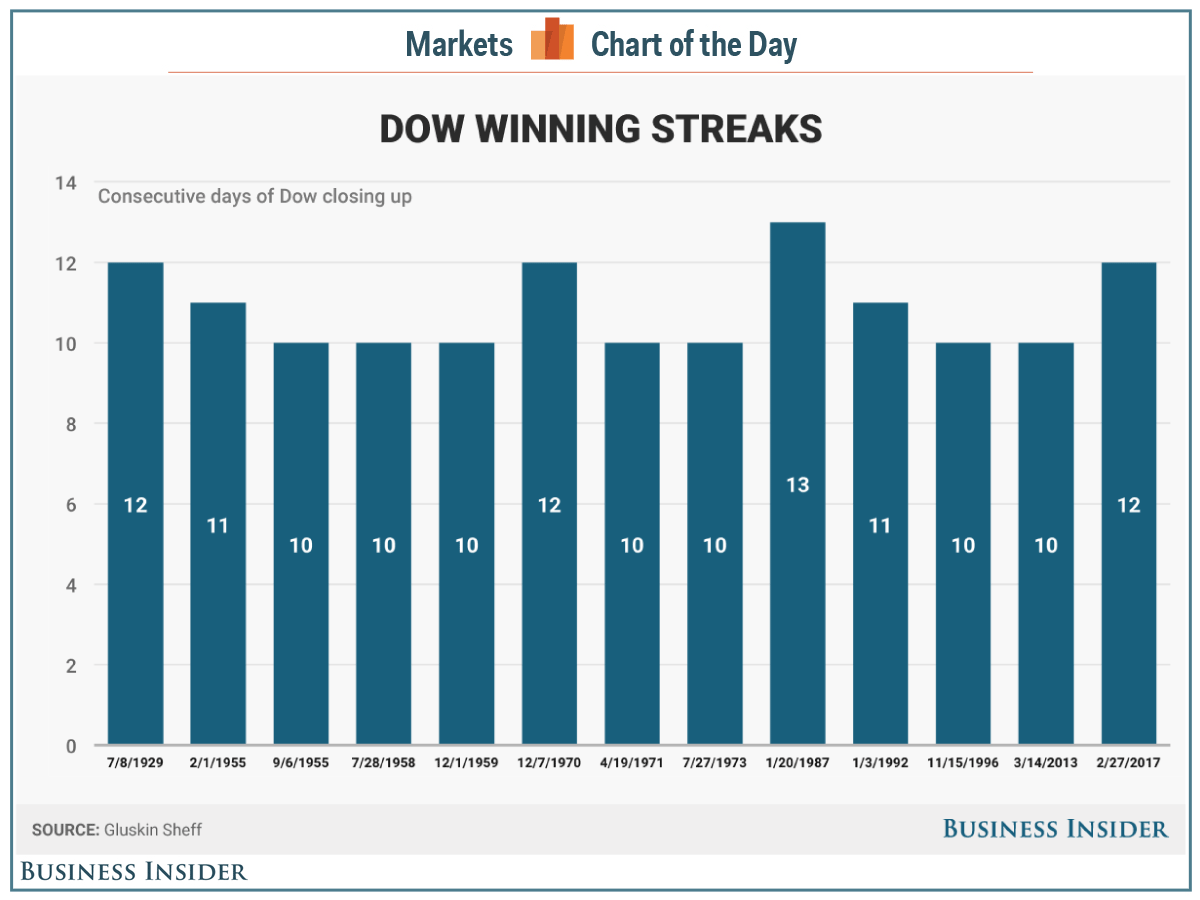

And just look at the Dow Jones:

- Yesterday, February 27, the index closed at 20,837.44

- It is higher for 12-straight days.

- It is up 14% since the election.

- The Dow has not fallen by more than 1% or more for 94 straight trading days, the longest stretch since November 2016.

Chart courtesy of BI:

While none of this suggests we are about to experience a “massive mean reverting event” in the short-term, it does suggest that some actions be taken to shore up risk in portfolios from a pullback to support. Such a pullback could be as much as 8% from current levels. While a correction of that magnitude doesn’t seem like much, it will “feel” much worse given the current level of complacency in the markets.

The Search For A Reason

As human beings, we always need a “reason” for actions. It is just how we are wired. If we stare at a series of random dots long enough, our brain will begin to find patterns and shapes in the randomness. The same is true for the market. News headlines are used by our brains to attach a reason to the randomness of market actions. However, turn-off the media and look at price action itself and a clearer picture emerges.

As shown in the chart above, the recent market “Trump Bump” has exhausted “buyers” in the market on a very short-term basis. This “overbought” condition (as discussed above) provides the fuel necessary for a sell-off in the market. Like an open container of gasoline, there is “no risk” as long as there is “no spark.”

Betting there will never be a “spark” is a dangerous game.

With that warning issued, and while many will just simply assume I am “bearish,” I want to remind you that the trend of the market is still “bullish.” This is why our portfolios still remain primarily fully exposed to the market with respect to equity-related risk.

However, being exposed to the market also means we are:

- Hedging much of our exposure,

- Maintaining trailing stop-loss levels; and

- Are taking profits by reducing overweight allocations back to portfolio weights.

It also does not mean our allocations will not be aggressively adjusted downward at some point; it is just not needed as of yet.

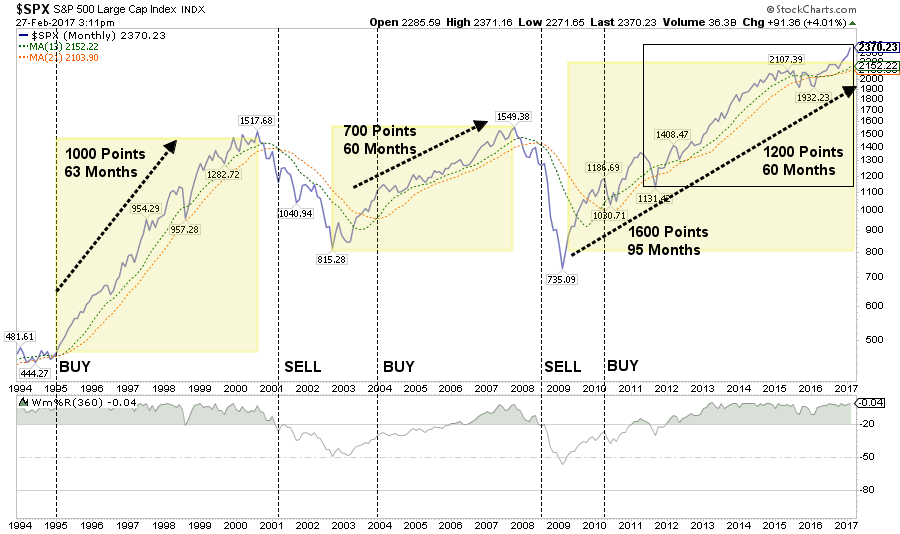

As noted in the final chart below, the bullish trends of the previous two bear markets were violated relatively early in the reversion process. For those paying attention, there was plenty of opportunities to exit the markets while retaining a bulk of the previous gains. As noted, the current bullish trend has not been violated as of yet which keeps portfolios currently allocated toward risk.

As I have repeatedly discussed over the last several weeks, prudent portfolio management practices reduce inherent portfolio risk thereby increasing the odds of long-term success. Any rally that occurs over the next few days from the current levels should be used as a “sellable rally” to rebalance portfolios and related risk. These practices align with the most basic investment rules/philosophies that have been followed by every great investor/trader in history. To wit:

- Sell positions that simply are not working. If they are not working in a strongly rising market, they will hurt you more when the market falls. Investment Rule: Cut losers short.

- Trim winning positions back to original portfolio weightings. This allows you to harvest profits but remain invested in positions that are working. Investment Rule: Let winners run.

- Retain cash raised from sales for opportunities to purchase investments later at a better price. Investment Rule: Sell High, Buy Low

There is no magic formula for long-term investment success. It has always been achieved by following simple processes and disciplines that have managed investment risk thereby reducing emotionally driven decisions during times of increased volatility.

As Warren Buffett once quipped:

There are two rules to investment success 1) Never lose money; 2) Refer to rule #1.

It really doesn’t get much simpler than that.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI