Technical trading means being able to let different views wash over your back, like water flowing by. Many don't believe that technical analysis (TA) actually works. “It's a self-fulfilling prophesy...shapes and patterns...baloney, horse feathers, hogwash”. Perhaps they don't get the concepts.

But even those that embrace TA in their short-run trading decisions tend to toss it out the window when it comes to long-run implications. Why? Do the behavioral aspects of supply and demand not hold in the long run? Are there magic powers that exist on a smaller timescale, like the subatomic forces at work in the universe that don't impact the larger day-to-day world? Those that embrace technical analysis for the long run are a much smaller bunch.

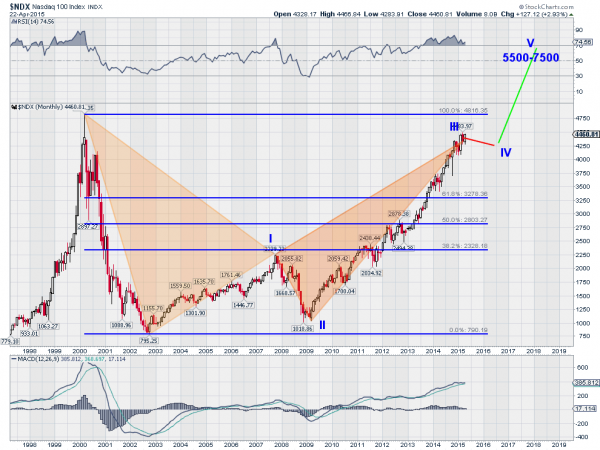

Despite that bias, there continue to be long-term charts of price action that defy that logic. The Nasdaq's 20-year chart is one of them. On a long-term basis, it seems perfectly happy to let the TAs have their technical way with it. The bearish Bat harmonic has been playing out and may be completing; the Elliott Wave pattern fitting in as well with a Wave IV due -- and expected to be a more flat corrective wave -- before another push higher. But I guess there's nothing to see here.

Yes, those that embrace technical analysis for the long run are a much smaller bunch.

I'm proud to be one of them.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI