Tech ETF QQQ is testing a key Fibonacci level that dates all the way back to its lows back in 2003. If it succeeds in breaking above this Fibonacci level, will it send a positive message to Tech and the broad markets? I think it will.

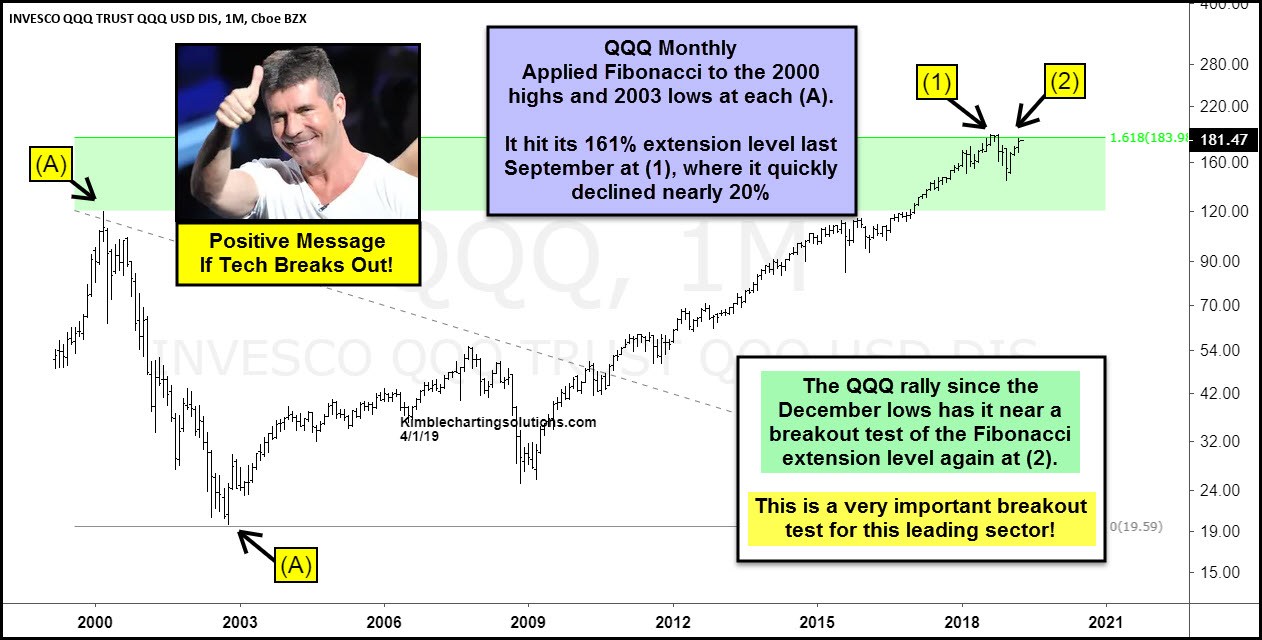

Fibonacci was applied to the 2000 highs and 2003 lows at each (A). The 161% Fibonacci extension level off these key price points comes into play around the 184 level. QQQ closed a couple of points above this key level in September, then selling pressure took over, erasing nearly 20% of its value.

The rally off the lows in December now has QQQ a couple of percent below the Fibonacci extension level and last year's highs at (2).

Is a breakout about to take place or is Tech going to Double-Top at the Fibonacci 161% extension level?

In my humble opinion, one should keep a close eye on QQQ at this price level because what it does from here most likely will send a very important intermediate message to the broad markets going forward.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.