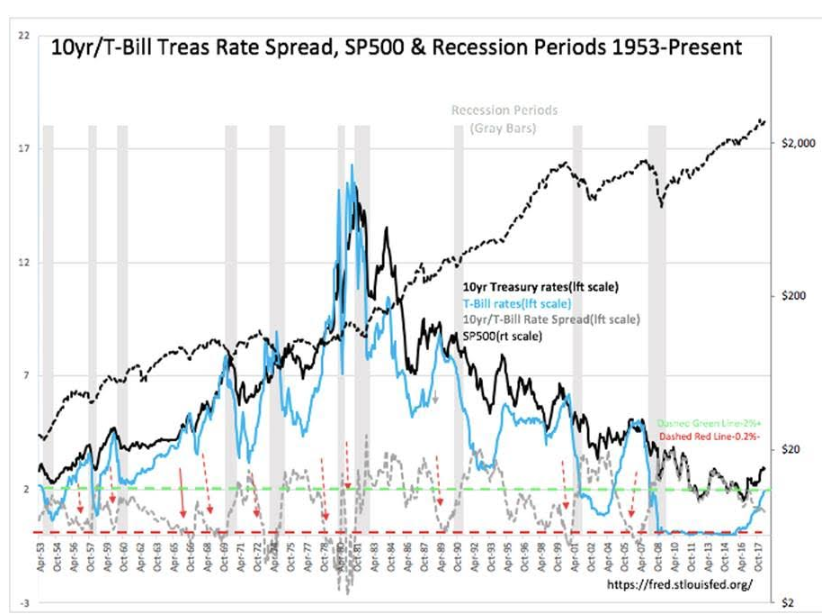

I consider the T-Bill/10yr Treas to be a proxy for market psychology. You could call it ‘Behavioral Finance’.

There is a lot of talk of ‘market tops’ and pending ‘collapses’. This talk has been with us since this investment cycle began in Spring 2009. It is market psychology based on recent market prices.

That many fear a top or collapse comes from the focus on market prices as one’s primary information. This is what most people do. Focusing on economic facts and the history of these facts to economic events is what I do and provides a clearer picture. Most investors are short-term and miss entirely how there are long-term correlations between economic measures and markets. In doing my own research, market prices are set by market psychology after financial results enter media headlines.

First comes Economics/Financials, which in turn become Headlines, which in turn drive Market Psychology, which in turn drives Market Prices.

Once you know this and how to monitor what the likely next set of economic headlines, you make better economic decisions. As I did my own research, it became obvious the T-Bill/10yr Treas Rate Spread was very, very good at identifying major market tops and bottoms. The reason for why this works is based on bank lending margins which rely on short-term vs. longer-term rates the basis of bank profits. When investors become more confident, they sell Fixed Income to buy Equities. This drives rates generally higher. But, when they become euphoric they sell T-Bills more than 10yr Treas which drives T-Bill rates so high that the spread between T-Bill/10yr Treas Rates falls enough to choke bank lending. The level at which this occurred historically is 0.2%. I use this information to warn me when to anticipate an end of cycle correction and exit equity markets. Today’s level is ~1% which is mid-range of 0.2%-2.0% since 1953. The history of this has been 100% correct and I assume it is likely to remain that way this cycle.

Current Administration policies to lower global tariffs and easing policies regarding small and regional bank lending is likely to accelerate US economic activity the next few years. Nonetheless, markets are unpredictable. Should investors suddenly become euphoric and drive T-Bill rates to the same levels as 10yr Treas then capital markets will dry up.

Make hay while you can!!