UnitedHealth shares surge as Buffett’s Berkshire shows new stake

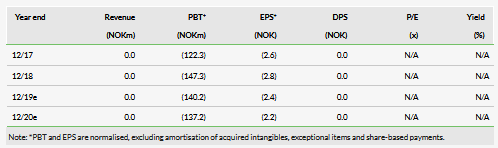

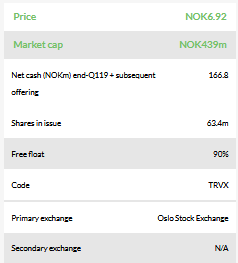

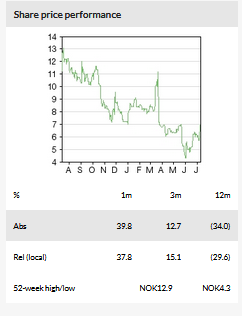

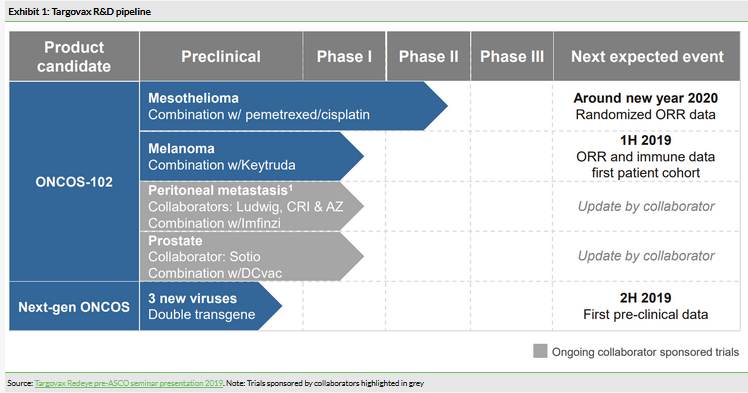

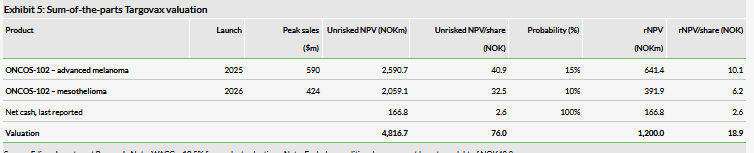

Targovax (LON:0RIS) recently announced a strategic decision to focus on the clinical development of its ONCOS programmes and to discontinue clinical development of its TG platform, citing the need to reallocate resources as the main reason. The news was followed by the release of interim data from the Phase I melanoma study, which was encouraging. After the latest events we have removed TG02 colorectal cancer asset from our model, although out-licensing is still a possibility, and increased the likelihood of success from ONCOS-102 in melanoma. Our Targovax valuation is lower at NOK1.2bn or NOK18.9/share, vs NOK1.46bn or NOK27.7/share before. Our new, more detailed look into the investigator-led trials with ONCOS-102 reveals the potential for oncolytic virus platform expansion not yet reflected in our rNPV model.

Exclusively focusing on ONCOS development

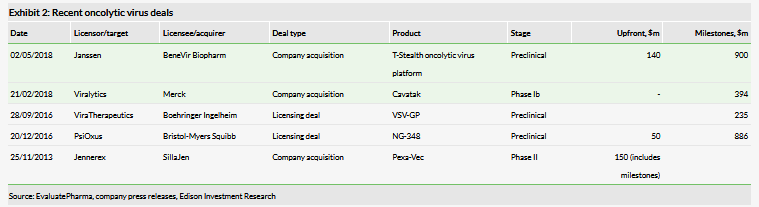

The company has announced that clinical development of the TG platform is being halted, including TG02 development in colorectal cancer. The company believes that despite the positive final three-year overall survival results from the Phase I/II study with TG01 in pancreatic cancer, the next step in this programme would be a large randomised; however, this is too costly for a small biotech company. Instead, Targovax will focus on its oncolytic virus platform, which it perceives to be in a leading position within mesothelioma and, overall, a programme with interesting data readouts in the near future. Recent M&A activity in the oncolytic virus space (Exhibit 2) suggests this could be the more attractive technology for partners.

Data from Part 1 Phase I melanoma study

Targovax announced ORR and immune activation data from the Part 1 of the ONCOS-102 Phase I study with patients with advanced, unresectable melanoma, who progressed on anti-PD1 treatment. Patients received ONCOS-102 injections and were again treated with the anti-PD1 Keytruda. Three of nine patients demonstrated an ORR of 33%, while immunogenicity and tumour biopsy results showed that ONCOS-102 was capable of inducing a cancer-specific response and that the intratumoural injection can translate into a systemic response.

Valuation: NOK1.20bn or NOK18.9/share

Our Targovax valuation is NOK1.20bn or NOK18.9/share compared to NOK1.46bn or NOK27.7/share. This was mainly the result of removing the TG02 colorectal cancer asset from our model, which was partially offset by the increased ONCOS-102 success probability in melanoma. The dilution from the recent fundraise results in a relatively larger decrease in our valuation per share.

Business description

Targovax is an immuno-oncology company headquartered in Oslo, Norway, with an oncolytic virus platform ONCOS. ONCOS-102 is currently prioritised in several indications including mesothelioma and melanoma. Targovax is also working on next-generation oncolytic viruses in its preclinical R&D pipeline.

Targeting collaborations for TG platform with promising final Phase I/II data in pancreatic cancer

Three-year data from the TG01 Phase I/II trial in resected pancreatic cancer (n=32) was recently announced, showing a median overall survival of 33.3 months and a three-year survival rate of 38%. Two-year data was released on 24 May 2018 (see our note), and showed a two-year overall survival rate of 68.4% in the first cohort (13/19), and 77% in the second cohort (10/13).

As we described, these results compare well with historical comparisons. However, citing the fact that further development of the TG platform would be too costly, Targovax has decided to fully focus on its oncolytic virus platform. Management still expects to extract some value from the TG platform, for example out-licensing the technology. Targovax has already done this to some extent; for example, it has set up a collaboration with the Parker Institute for Cancer Immunotherapy and the Cancer Research Institute relating to the TG platform, and Zelluna Immunotherapy acquired a freedom-to-operate licence to Targovax’s mutant RAS T cell receptor technology. The potential value of the deal with Zelluna is NOK100m in milestones and annual fees, in addition to royalties and sub-licensing revenues.

Several readouts in the near term with ONCOS

Targovax has focused its resources on clinical development of ONCOS-102 in mesothelioma and melanoma, as well as the preclinical ONCOS assets. There are now four ongoing clinical trials with ONCOS (including collaborator sponsored trials).

Fresh data from the Phase I melanoma study (Part 1)

As expected, Targovax has announced the overall response rate and immune activation data from the Part 1 of the Phase I study with patients with advanced, unresectable, anti-PD1 refractory melanoma (n=9). The trial is testing ONCOS-102 in combination with checkpoint inhibitor (CPI) pembrolizumab (Keytruda, Merck & Co). The patients, who were treated with CPIs before and then relapsed, were given three intratumoural injections of ONCOS-102 and then received up to eight infusions of Keytruda. The results include:

- The treatment was reported as well tolerated.

- 3/9 patients demonstrated clinical response, ie a 33% overall response rate (RECIST1.1 and irRECIST):

- one patient had a completed response; two patients had partial responses.

- Immunogenicity data showed that ONCOS-102 induces a cancer-specific response with systemic increases in pro-inflammatory cytokines observed in all nine patients.

- Tumour biopsies showed increased infiltration of CD8+ T-cells in eight of nine patients.

Cases of increased T-cell infiltration into lesions not injected with ONCOS-102 were also observed indicating an abscopal effect. In addition, T-cells recognising specific tumour antigens were found in circulation in four patients. Together these findings suggest that the intratumoural injection of ONCOS-102 can cause systemic anti-tumour immune responses.

The rationale of the study was to prime the immune system with a virus to generate a cancer-specific response and then ‘release the brakes’ with checkpoint inhibitors. The initial data look promising, in our view, and support the hypothesis of the trial. In total, 33% of patients (3/9) who relapsed after checkpoint inhibitor treatment responded to it again after being treated with ONCOS-102. These were a hard-to-treat patient population and, if such results were confirmed in a large randomised trial, it would be perceived as very strong.

In our initiation report, we described Australian biotech Viralytics as peer to Targovax. Viralytics developed Cavatak, a wild-type oncolytic coxsackievirus A21. In February 2018, Merck & Co acquired Viralytics for A$502m. Before that the company published interim results from several Phase I trials. Interim data from one Phase Ib study where melanoma patients were treated with Cavatak and Yervoy (ipilimumab, anti- CTLA-4, Bristol-Myers Squibb (NYSE:BMY)) showed that ORR was 29% (2/7) in patients who had failed prior single line anti-PD1/L1 checkpoint therapy. The comparison is somewhat limited by the fact that Yervoy is an anti-CTLA-4 antibody, however, still same class of immunotherapy. Another biotech company Checkmate Pharmaceuticals is developing TLR-9 agonist, which is a class of immunotherapy drugs that are also being tested in combinations with CPIs. Toll-like receptors or TLRs are activated downstream upon infection of tumour cells with oncolytic viruses. Checkmate Pharmaceuticals is conducting a Phase Ib study of intratumoral administration of their lead product CMP-001 in combination with pembrolizumab in patients with advanced melanoma who are anti-PD1 refractory. Interim data (not complete) published include an ORR rate of 22% (15/69).

Due to the small number of patients, definitive conclusions or comparisons between the ONCOS and other trials cannot be made as this time, but the Targovax data seems encouraging at the moment. Part 2 of the trial is currently enrolling patients, where the safety and efficacy of a prolonged, more intensive treatment regimen of 12 ONCOS-102 injections will be evaluated.

Phase Ib/II mesothelioma study

The ONCOS-102 Phase Ib/II mesothelioma study is now fully enrolled (n=31) with results expected in around new year 2020. This is the most advanced indication currently and a significant catalyst for the share price. The results from the safety part of the Phase Ib were already reported, as described in our June 2018 note, which also included initial efficacy results. The randomised Phase II part of the trial finished enrolling all patients and the goal is to assess safety and tolerability, immunological activation and the six-month overall response rate (ORR) of the combination of ONCOS-102 and standard of care chemotherapy (pemetrexed and cisplatin) compared to standard of care chemotherapy alone.

Preclinical study shows ONCOS abscopal effect

Recently Targovax published results from a preclinical study that demonstrated an abscopal effect (reducing the size of tumours situated away from the injected site) with an ONCOS-102 and Keytruda combination in a humanised mouse melanoma model. The significance of these findings comes from the fact that oncolytic viruses are not suitable for systemic administration. If an abscopal effect is proven in humans, even non-injected tumour lesions can be expected to be controlled (for example if they are inaccessible for injection).

M&A activity in the oncolytic virus space

In general, oncolytic viruses are generating more interest in treating cancers and, as immune primers, are increasingly being explored as compatible combination partners for immunotherapies such as checkpoint inhibitors (priming the immune system with a cancer-specific response using the virus, and then ‘releasing the brakes’ from the T-cells to attack the tumour). The field of oncolytic viruses saw an uptick in M&A activity in 2018. In May 2018, Janssen agreed to pay $140m upfront to acquire private company BeneVir Biopharm, which is developing oncolytic viruses to treat solid tumours based on its T-Stealth platform, currently in preclinical stage. In February 2018, Merck & Co announced its acquisition of Viralytics with the lead product, Cavatak. Merck & Co agreed to pay A$502m, which was in line with our valuation of Viralytics of A$469m (published in December 2017) plus a A$29.6m placement by Viralytics (in January 2018). This represented a 178% premium to Viralytics’ prior-day closing share price. In our view, these deals confirm interest in the technology field, and in the application to solid tumour therapy.

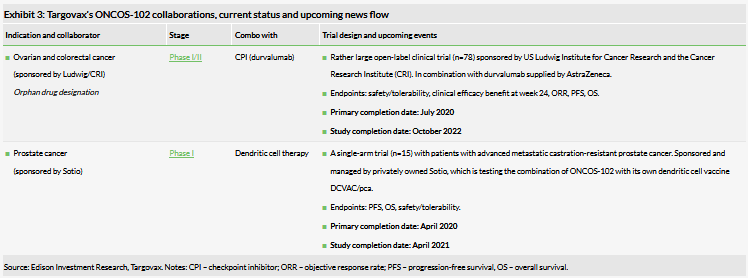

Investigator-led trial outcomes could translate into new commercial opportunities

In light of the recent move to focus on ONCOS, we have re-examined the collaborator trials (summarised in Exhibit 3) in more detail to evaluate the potential in these indications.

The Phase I/II trial in collaboration with the Ludwig Institute for Cancer Research and the Cancer Research Institute is being conducted in patients with peritoneal disease who have failed prior standard chemotherapy and have histologic confirmation of epithelial ovarian cancer or metastatic colorectal cancer (CRC). ONCOS-102 is being studied in combination with MedImmune’s checkpoint inhibitor durvalumab. In our view, this collaboration is the most likely of the two ONCOS-102 collaborations to translate into a commercial opportunity in the near term for several reasons:

- Area of unmet need: these patients have a poor prognosis and are very difficult to treat.

- It is a fairly large trial for Phase I/II (n=78).

- The study is being conducted by high-profile research institutions in the US.

- There is a strong scientific rationale for combining an oncolytic virus eg ONCOS-102 and a checkpoint inhibitor eg durvalumab (as discussed in our initiation report), and Targovax is already exploring this combination in its Phase I melanoma study + Keytruda.

- The ONCOS-102 administration route is intraperitoneal. Patients with peritoneal metastasis can be uniquely treated with peritoneal chemotherapy and since ONCOS-102 is administered locally, there is a strong rationale for intraperitoneal administration.

The peritoneum is a tissue (membrane) that lines organs in the abdominal cavity. Due to its proximity to several other organs, a primary tumour in these organs can easily metastasise to the peritoneum. Primary tumours can also originate in the peritoneum, but this is very rare. Colorectal cancer and ovarian cancer are common primary tumours that are known to metastasise to the peritoneum. Although survival rates have improved somewhat with the introduction of new treatments, the prognosis of these patients is still very poor due to the advanced stage. Specific treatments for peritoneal metastases are cytoreductive surgery and hyperthermic intraperitoneal chemotherapy, but patients will likely be receiving additional treatments for their primary tumours.

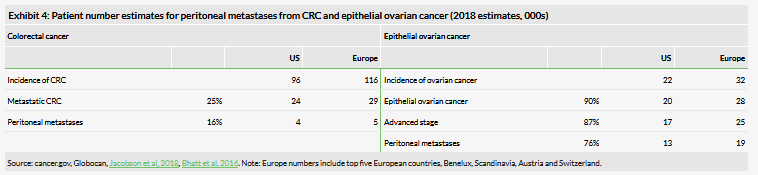

Potentially large patient population

Epithelial ovarian cancer is the most common type of ovarian cancer, making up around 90% of cases (cancer.org). The majority of patients who are diagnosed have advanced disease (around 87%; Narod, 2016), where the tumour has spread beyond the pelvic tissues, for example to the lymph nodes or peritoneum (stage III), or further to liver or spleen parenchyma (stage IV). Most patients with advanced disease have peritoneal metastases (one study found this to be 76% of patients), and it is ultimately regarded as part of the disease.

Colorectal peritoneal metastases are not as common as in ovarian cancer. Around 16% of metastatic colorectal cancer cases have peritoneal metastases. Treatment with cytoreductive surgery and hyperthermic intraperitoneal chemotherapy can improve survival from around five months (untreated) to 12–18 months (Koumpa et al, 2019).

Given the early stage of the study, it is too early to estimate the potential precise positioning of ONCOS-102 for treatment of patients with peritoneal metastasis, but our initial evaluation reveals a relatively large accessible patient population given the rather specific peritoneal chemotherapy approach (Exhibit 4). We estimate that the number of patients with advanced ovarian cancer having peritoneal metastases to be around 13k in US and 19k in Europe. Applying the same pricing as we have done for ONCOS-102 in other indications ($75k in US and €52.5k in Europe) would indicate a potential market of $1bn in the US and the same in Europe (assuming 100% penetration). We estimate the number of patients with colorectal peritoneal metastases to be lower, around 4k in the US and 5k in Europe, which would translate into an addressable market of around $300m in US and the same in Europe.

Collaborator Medimmune (AstraZeneca) is already active in the ovarian cancer space with its marketed PARP inhibitor Lynparza, but is not currently in the colorectal cancer space. Durvalumab (Imfinzi) is not yet approved in ovarian cancer or colorectal cancer but is approved in several other cancers (including bladder cancer, head and neck, liver cancer, melanoma, non-small cell lung and small cell lung cancers).

Valuation

Our updated valuation is NOK1.20bn or NOK18.9/share, compared to NOK1.46bn or NOK27.7/share previously, which is based on a risk-adjusted NPV analysis using a 12.5% discount rate, including NOK166.8m net cash. The dilution from the recent fundraise was the main reason for the relatively larger decrease in our valuation per share. We now include NOK6.0m in financial leases as required under IFRS 16. We continue to exclude from our valuation other long-term debt of NOK53.1m in Finnish government grants, as repayment is needed only if the products are sold or launched.

We have previously removed the pancreatic cancer indication. Now we have also removed the TG02 colorectal cancer asset from our model, as a result of the recent strategic decision regarding the TG platform. TG02 was being explored in a Phase Ib trial where colorectal patients received TG02 in combination with a checkpoint inhibitor. Targovax stopped the trial without waiting for the data, but as this was mainly a safety and immunogenicity study, the immediate termination of the trial is rational, in our view, from an R&D portfolio management perspective. In our last report, this indication had a value of NOK9.2/share (out of the total rNPV of NOK27.7/share). This removal was partially offset by the increase in success probability of ONCOS-102 in melanoma from 10% to 15% following the interim data announcement.

We keep other assumptions relating to the clinical trials in our rNPV model unchanged (described in our initiation report). For the time being we do not include in our valuation the potential of ONCOS-102 in the indications being explored by the partners (peritoneal metastasis or prostate cancer). This is mainly because these trials are still being led by the partners and Targovax cannot control the trial design. Depending on the results, multiple outcomes are possible, such as advanced stage trials, which could lead to a formal licensing deal or Targovax itself could decide to invest in these indications. We will revisit these programs once more details are revealed.

Upcoming near-term catalysts are:

- Preclinical data on new ONCOS oncolytic viruses expected H219; and

- ONCOS-102 mesothelioma Phase I interim data expected in Q120.

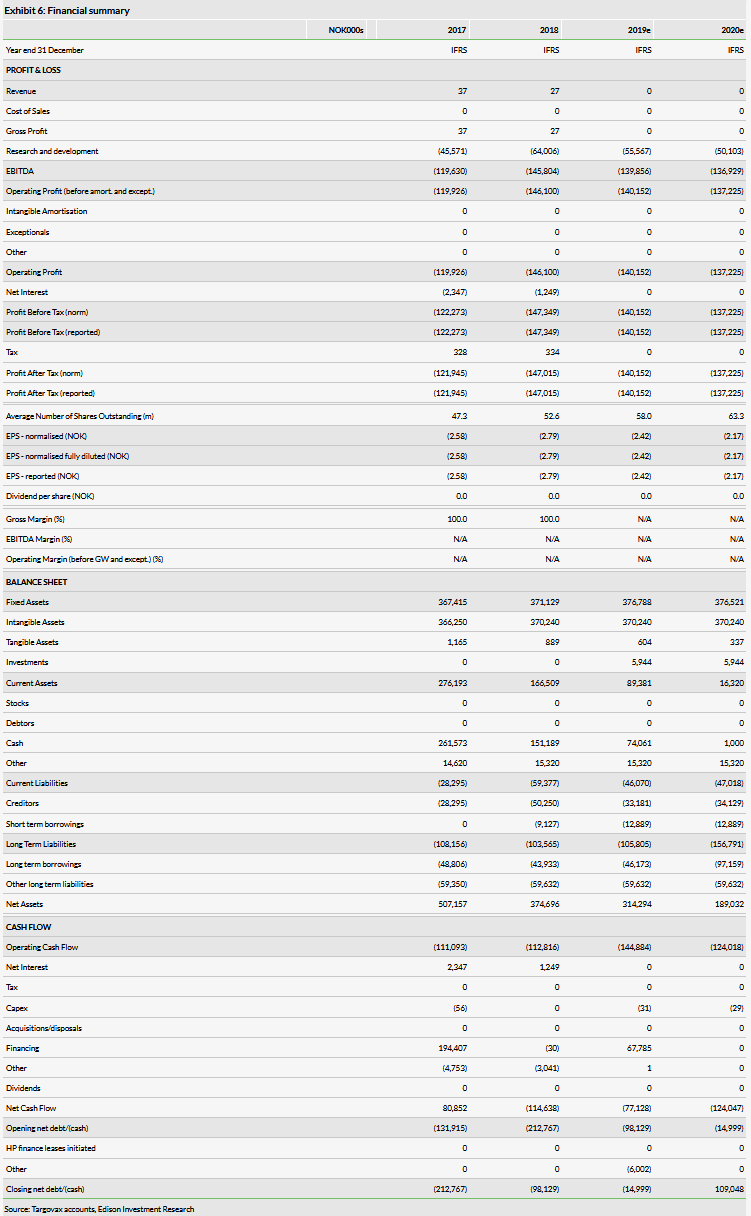

Financials

As Targovax’s Q119 results were in line with our expectations, and we made no major changes to our estimates. The Q119 operating loss was NOK39.6m with external R&D expenses accounting for NOK19.4m. The company is stopping all clinical R&D activities for its TG platform, but we expect it will increase clinical activities for ONCOS so we leave the total operating loss estimate for 2019 unchanged at NOK140m.

The cash position of NOK172m gross at end-Q119 plus NOK1.0m gross from a subsequent repair offering should reach well into 2020, which is in line with Targovax’s guidance (Q320). According to management, there was strong interest from existing shareholders and new institutional investors (in Norway and the US) in the private placement that Targovax undertook in March 2019.

As the R&D pipeline matures, several projects should reach mid-stage around 2021, which is when we expect another substantial increase in R&D spend. The required additional funding for 2020 is reflected in our model as a long-term debt of NOK51m, as per our research principles.

Targovax has changed the way it accounts for leases under the new IFRS 16 rules. It now records remaining financial leases (excluding short-term leases of less than 12 months and low-value leases) in the balance sheet as long-term liabilities (SEK5.9m as of end Q119). This was balanced with a corresponding increase in long-term assets. The net effect on the P&L was minor.