Trump announces 50% tariff on copper, effective August 1

Target Corp (NYSE:TGT) Consumer Discretionary - Multiline Retail | Reports May 18, Before Market Opens

Key Takeaways

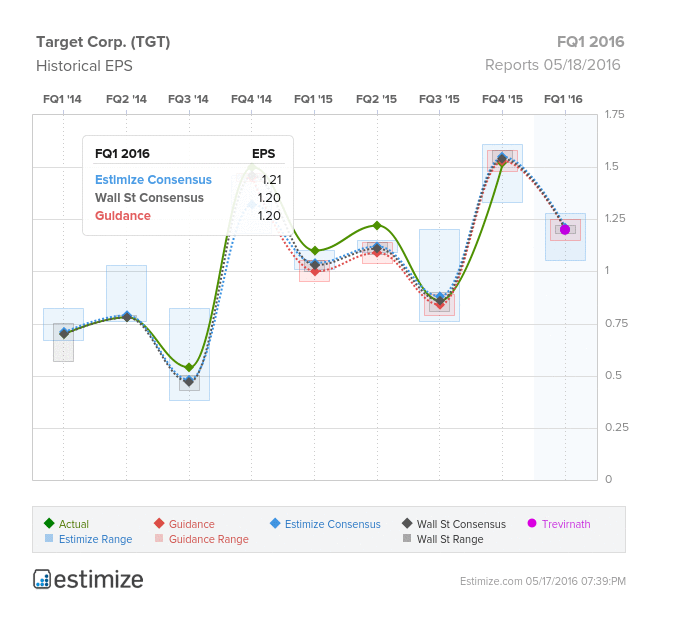

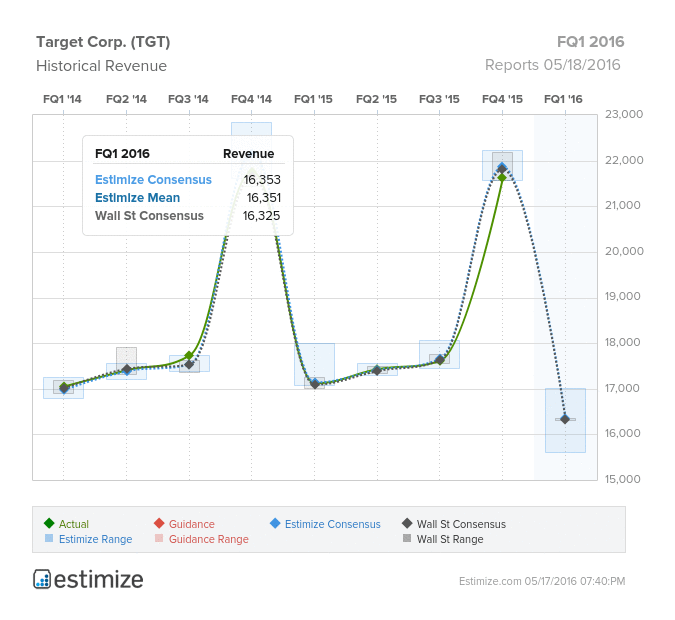

- The Estimize consensus is looking for earnings per share of $1.21 on $16.35 billion in revenue, 1 cent higher than Wall Street on the bottom line

- Digital sales continue to be a focus for Target (TGT), growing 34% last quarter alone

- The sales of its pharmacy business to CVS will alleviate some pressure on Target’s gross margins

Discount retailer, Target, is scheduled to report first quarter earnings this Wednesday, before the market opens.

Target’s widespread acceptance amongst millennials has kept the company competitive against the likes of Amazon (NASDAQ:AMZN) and Wal-Mart (NYSE:WMT). Even so, TGT has had trouble growing revenues in the past 2 fiscal years, with last quarter posting a sales decline of 0.6%, and this quarter looking even worse.

The Estimize consensus is looking for earnings per share of $1.21 on $16.36 billion in revenue, 1 cent higher than Wall Street on the bottom line. Compared to a year earlier profits are projected to increase 9%, while sales are predicted to fall 4%.

Despite negative revenue growth, the stock is up 7.5% in the past 3 months and historically increases 3% in the 30 days following its earnings report.

Like most retailers, Target has been focused on expanding its omnichannel capabilities to compete with the slew of online retailers. In the fourth quarter, digital channel sales increased by 34%, contributing 1.3% to comp sales growth. Overall, comparable sales increased 1.9% driven by a fifth consecutive quarter of increased traffic.

Target’s focus on well-performing categories coupled with its expanding food category has transformed the company into a one stop shop for everyday needs. Moreover, the sale of its pharmacy business to CVS will alleviate some pressure on gross margins.

As consumers turn their focus to value, the discounters may be one segment in the retail industry to benefit. On the downside, Target will have to continue fending off competition from Amazon while they bring their online experience up to speed.

Do you think TGT can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.