A MarketWatch opinion piece published on 05/11/15 has the attention-grabbing headline “Countdown to the stock market Crash of 2016 is ticking louder”.

How often have calls for a crash been made in recent years? While we will not attempt to answer the question in a scientific manner, based primarily on curiosity, we searched the Google (NASDAQ:GOOGL) news archives for “stock market crash”. Below is a sample of what we found along with the dates of publication:

- “Warning: Crash dead ahead. Sell. Get liquid. Now” - 05/25/10

- “Stock Market Crash Alert, Market is Falling Like a Stone” - 05/26/12

- “Warning: Stock Market Likely to Crash From Here, 50% Drop!” - 02/28/13

- “The Bearish Call to End All Bearish Calls” - 01/03/14

- “Crash of 2014: Like 1929, you’ll never hear it coming” - 02/24/14

- “New doomsday poll: 99.9% risk of 2014 crash” - 03/17/14

- “10 peaking megabubbles signal impending stock crash” - 05/09/14

- “15 Big Oil sell signals that warn of a 50% stock crash” - 10/27/14

- “Five reasons why markets are heading for a crash” - 12/02/14

Easier To Pay Attention vs. Forecasting

Forecasting is difficult. Given the almost limitless number of variables, forecasting in the financial markets is very difficult. While anything is possible at any time, markets typically offer some advance warning before a crash. No one knows if a crash is coming, but we know with 100% certainty that another bear market is somewhere in our investing future -- it is only a matter of time. How does the big picture look now? This week’s stock market video can help us address that question using probabilities rather than fear.

Investment Implications - The Weight Of The Evidence

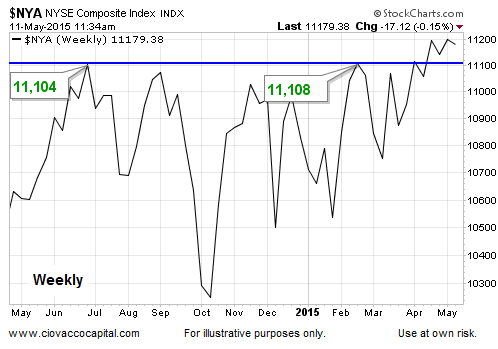

The concept of monitoring hard data is expanded a bit in this 2014 article. Given what we know today, the hard data continues to favor an equity-heavy allocation. The longer the broader NYSE Composite Stock Index can hold above 11,104, the better for the bullish case (see chart below). A move below 11,104 puts us back into the “low conviction” trading range that has bounded stocks for over ten months.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI