T2108 Status: 58.5%

VIX Status: 14.2

General (Short-term) Trading Call: Hold (bullish bias)

Active T2108 periods: Day #125 over 20%, Day #8 over 50% (overperiod), Day #1 under 60% (underperiod), Day #41 under 70%

Commentary

So much for a redux of the start of previous years. Instead of soaring into overbought territory, T2108 plunged to 58.2% as the S&P 500 (SPY) lost 0.89% (which qualifies as a large one-day sell-off these days). This negative start to the year breaks a string of five straight years of positive gains to celebrate the start of the new year. Some extremely strong starts occurred in that streak. Before that? 2007 and 2008 delivered two years in a row of negative tidings to start the year (gulp).

I am sticking to the bullish bias with the S&P 500 still well above the 1800 pivot. The VIX popped again – perhaps the surprise pop to end the year was indeed some kind of signal. This time I reached for puts again on ProShares Ultra VIX Short-Term Futures ETF (UVXY). The VIX stopped cold at its 200DMA. If it rises to the 15.35 pivot, I will likely double down.

Standing heads above the selling today was Twitter (TWTR) with a gain of 6.1% on strong volume. The plunge from its crescendo lasted all of two days. Presumed resistance is at $69, the low of the crescendo day. If TWTR closes above that, bearish bets are off. I am not placing any further trades until I get a confirmation move (up or down). I go short/puts below today’s low of $64.40. TWTR is not bullish again until it manages a close for a new (all-time) high.

Be careful out there!

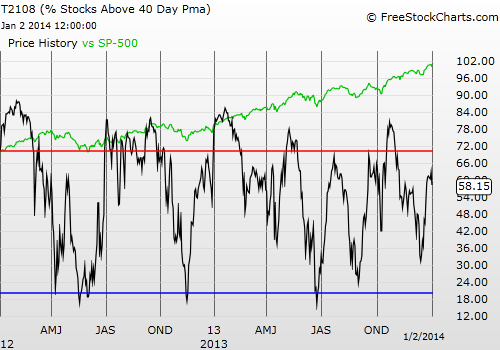

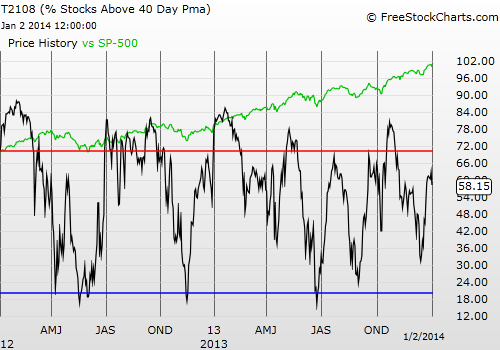

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SPHB and SPLV and SSO puts (pairs trade); long UVXY puts

VIX Status: 14.2

General (Short-term) Trading Call: Hold (bullish bias)

Active T2108 periods: Day #125 over 20%, Day #8 over 50% (overperiod), Day #1 under 60% (underperiod), Day #41 under 70%

Commentary

So much for a redux of the start of previous years. Instead of soaring into overbought territory, T2108 plunged to 58.2% as the S&P 500 (SPY) lost 0.89% (which qualifies as a large one-day sell-off these days). This negative start to the year breaks a string of five straight years of positive gains to celebrate the start of the new year. Some extremely strong starts occurred in that streak. Before that? 2007 and 2008 delivered two years in a row of negative tidings to start the year (gulp).

I am sticking to the bullish bias with the S&P 500 still well above the 1800 pivot. The VIX popped again – perhaps the surprise pop to end the year was indeed some kind of signal. This time I reached for puts again on ProShares Ultra VIX Short-Term Futures ETF (UVXY). The VIX stopped cold at its 200DMA. If it rises to the 15.35 pivot, I will likely double down.

Standing heads above the selling today was Twitter (TWTR) with a gain of 6.1% on strong volume. The plunge from its crescendo lasted all of two days. Presumed resistance is at $69, the low of the crescendo day. If TWTR closes above that, bearish bets are off. I am not placing any further trades until I get a confirmation move (up or down). I go short/puts below today’s low of $64.40. TWTR is not bullish again until it manages a close for a new (all-time) high.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Be careful out there!

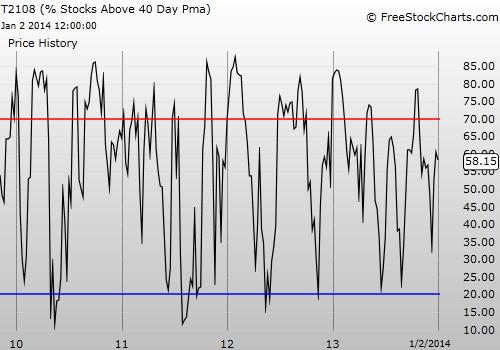

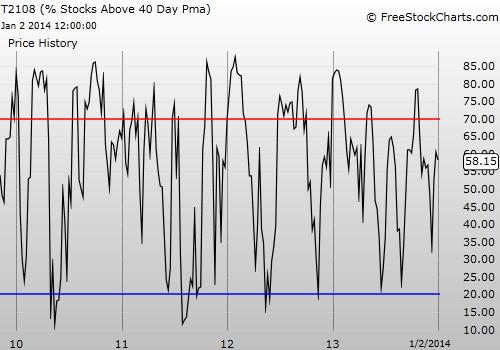

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SPHB and SPLV and SSO puts (pairs trade); long UVXY puts

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.