What’s wrong with the housing market?

Indications exist that important tops in price and bottom in rates have been established

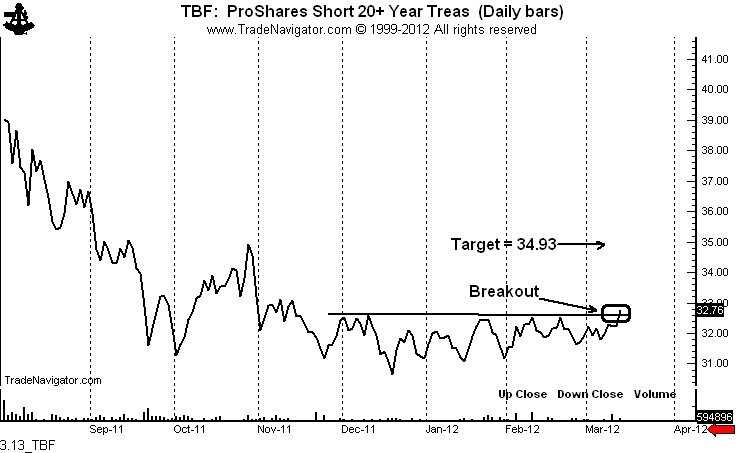

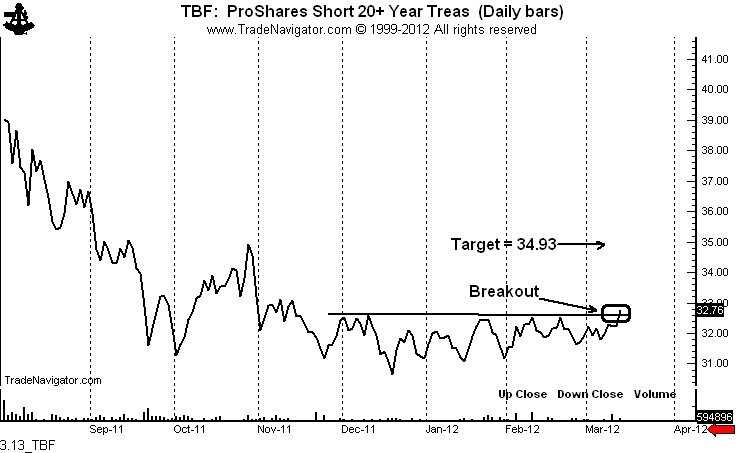

The decline today in T-Bond and T-Note futures contracts violated significant support lines. Accordingly, the rally in rates violated important resistance lines. The evidence is in that an intermediate term decline in prices and increase in rates are upon us.

T-Bond and T-Notes yields should now head to the October lows, prices to the November highs.

The following charts are given as evidence:

The decline today in T-Bond and T-Note futures contracts violated significant support lines. Accordingly, the rally in rates violated important resistance lines. The evidence is in that an intermediate term decline in prices and increase in rates are upon us.

T-Bond and T-Notes yields should now head to the October lows, prices to the November highs.

The following charts are given as evidence:

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.