T2108 Status: 73.5% (8th overbought day)

VIX Status: 12.8

General (Short-term) Trading Call: Hold

Commentary

So much for a boring week. The last 4-days of lackluster trading had finally convinced me that this week would not provide the expected fireworks.

The S&P 500 (SPY) surged higher 1.0%. This ended my hope that a “do nothing” prediction from the T2108 Trading Model could represent an opportunity to fade the initial, opening direction of the S&P 500. On the positive side, at least the model did not scream “sell.” May’s month-to-date gain of 3.3% after two calendar weeks makes it all the more likely that May-sellers will be full of regret come June. As a reminder, I expected May to be just fine but offered up some “just-in-case” hedges; Caterpillar (CAT) triggered. The euro (FXE) also triggered with a break below its 50DMA.

You bulls who bought the breakout above 1600 (my advice to the particularly bullish out there) to new all-time highs are doing well. Keep holding but move the stops up to 1620. This level is just below the brief 4-day consolidation that preceded today’s rally. A close below this level finally gets me buying SSO puts as a play to fade the overbought period. My window for getting bearish is rapidly closing. As a reminder, after this week, I will be more focused on buying dips than on following a breakdown.

I do not have time to post charts, but I do want to note how heavily-shorted stocks have soared over the past month and in many cases all year. It seems that these stocks are getting targeted and providing fertile ground for traders playing catch-up with the overall stock market. You can click the links of these stocks for their 6-month charts on StockCharts.com. The percentages next to the stock ticker represent the shares shorts as a percentage of float:

ANGI: 21.9%

target=”_blank”>APOL: 20.8% (a relative latecomer to the campaign of short squeezes. The stock is lifting off a recent bottom and was up 9.1% today)

FSLR: 33.4%

GMCR: 37.9%

NFLX: 24.4%

SCTY: 16.6%

SODA: 43.7%

TSLA: 44.1% (stock went exponential post-earnings – this is a classic chart for the ages!)

All these stocks have gone “nuts” recently. This is clearly NOT a market for shorting, further validating my approach to avoid SSO puts until the market “proves” it is time to load them up.

Seeing this list makes Apple’s (AAPL) relative under-performance to the general stock market stick out even more. Today, AAPL dropped 2.4% “out of nowhere.” The $470 level turned out to be the stiff resistance I was afraid of. I had hoped that AAPL’s post-earnings momentum could soon enough break the March high and take AAPL to $500, but it seems that day will remain very elusive.

Finally, note that Worden has FINALLY introduced intraday quotes for T2108 (and other T2* indicators). This is a great advance because it now allows me to know when T2108 is flipping any thresholds BEFORE the closing bell. Once there are enough data, I will change the T2108 charts I post from line charts to candlestick.

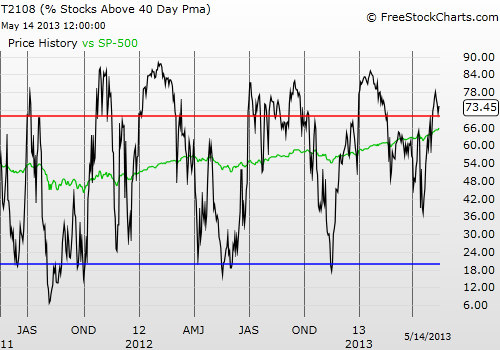

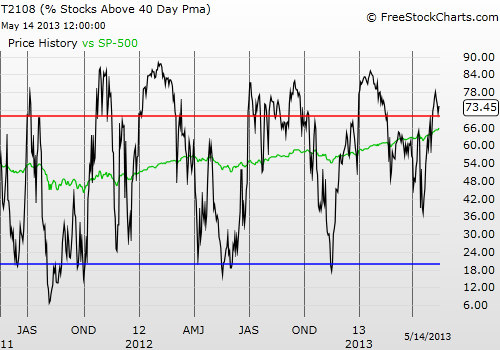

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: net short euro; long CAT shares and puts; long AAPL shares, calls, and puts; long TSLA calls (PURE speculation!), ANGI calls,

VIX Status: 12.8

General (Short-term) Trading Call: Hold

Commentary

So much for a boring week. The last 4-days of lackluster trading had finally convinced me that this week would not provide the expected fireworks.

The S&P 500 (SPY) surged higher 1.0%. This ended my hope that a “do nothing” prediction from the T2108 Trading Model could represent an opportunity to fade the initial, opening direction of the S&P 500. On the positive side, at least the model did not scream “sell.” May’s month-to-date gain of 3.3% after two calendar weeks makes it all the more likely that May-sellers will be full of regret come June. As a reminder, I expected May to be just fine but offered up some “just-in-case” hedges; Caterpillar (CAT) triggered. The euro (FXE) also triggered with a break below its 50DMA.

You bulls who bought the breakout above 1600 (my advice to the particularly bullish out there) to new all-time highs are doing well. Keep holding but move the stops up to 1620. This level is just below the brief 4-day consolidation that preceded today’s rally. A close below this level finally gets me buying SSO puts as a play to fade the overbought period. My window for getting bearish is rapidly closing. As a reminder, after this week, I will be more focused on buying dips than on following a breakdown.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

I do not have time to post charts, but I do want to note how heavily-shorted stocks have soared over the past month and in many cases all year. It seems that these stocks are getting targeted and providing fertile ground for traders playing catch-up with the overall stock market. You can click the links of these stocks for their 6-month charts on StockCharts.com. The percentages next to the stock ticker represent the shares shorts as a percentage of float:

ANGI: 21.9%

target=”_blank”>APOL: 20.8% (a relative latecomer to the campaign of short squeezes. The stock is lifting off a recent bottom and was up 9.1% today)

FSLR: 33.4%

GMCR: 37.9%

NFLX: 24.4%

SCTY: 16.6%

SODA: 43.7%

TSLA: 44.1% (stock went exponential post-earnings – this is a classic chart for the ages!)

All these stocks have gone “nuts” recently. This is clearly NOT a market for shorting, further validating my approach to avoid SSO puts until the market “proves” it is time to load them up.

Seeing this list makes Apple’s (AAPL) relative under-performance to the general stock market stick out even more. Today, AAPL dropped 2.4% “out of nowhere.” The $470 level turned out to be the stiff resistance I was afraid of. I had hoped that AAPL’s post-earnings momentum could soon enough break the March high and take AAPL to $500, but it seems that day will remain very elusive.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Finally, note that Worden has FINALLY introduced intraday quotes for T2108 (and other T2* indicators). This is a great advance because it now allows me to know when T2108 is flipping any thresholds BEFORE the closing bell. Once there are enough data, I will change the T2108 charts I post from line charts to candlestick.

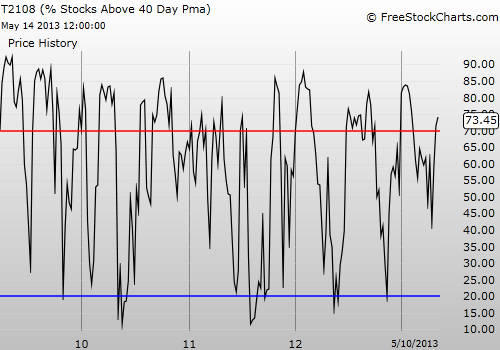

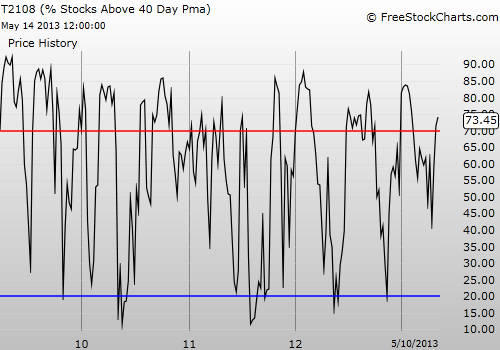

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: net short euro; long CAT shares and puts; long AAPL shares, calls, and puts; long TSLA calls (PURE speculation!), ANGI calls,

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.