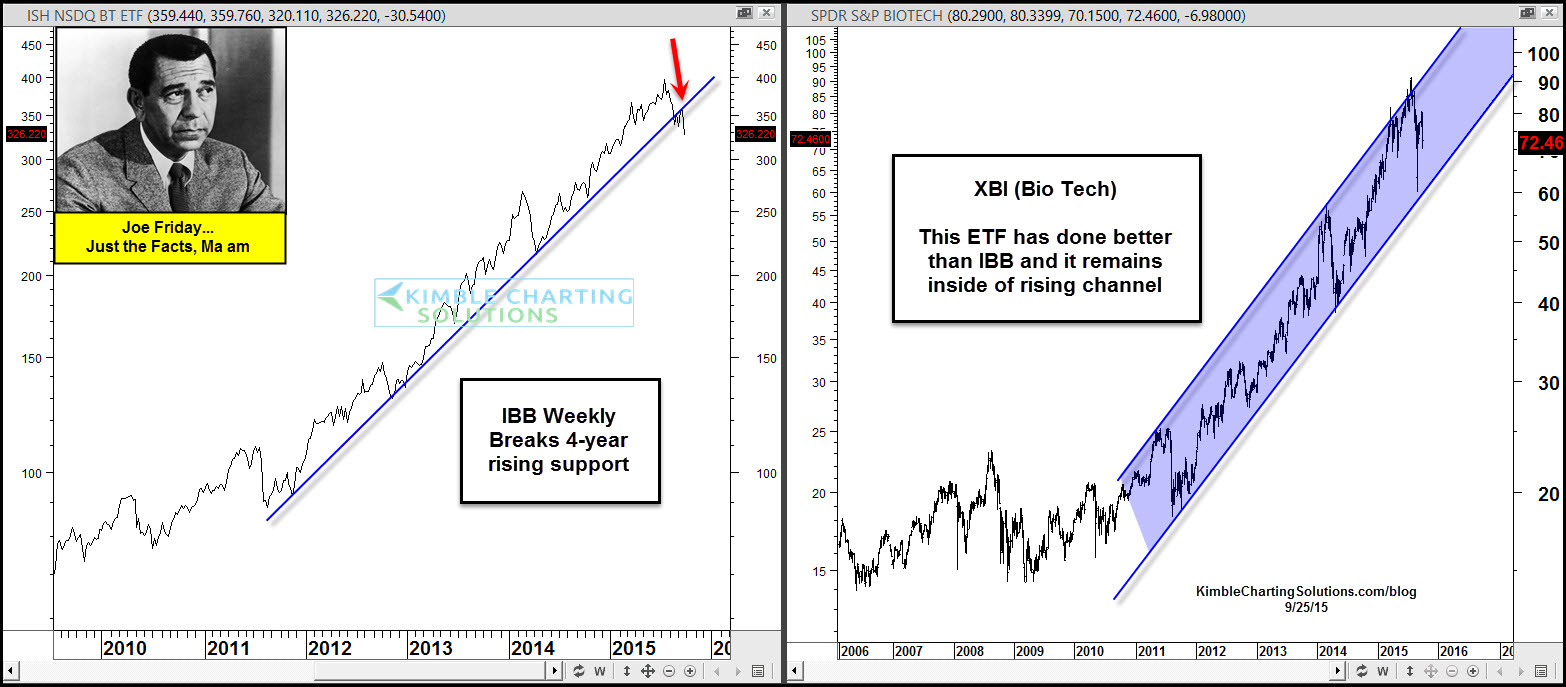

When it comes to Bio Tech ETFs, performance over the past year has varied greatly. The chart below looks at iShares Nasdaq Biotechnology (NASDAQ:IBB) and SPDR S&P Biotech (NYSE:XBI), both Biotech ETF’s. As you can see, XBI is doing much better in 2015 than IBB, up almost 100% more.

Below looks at the patterns in IBB and XBI, which do have different patterns to say the least!

The chart of IBB on the left reflects a 4-year rising support line was broken and kissed as resistance at the red arrow above.

XBI on the other had, remains well inside of a 4-year rising channel.

These Biotech ETF’s are not built the same and the leading performer of the two remains inside of this rising channel. I will be concerned for this sector and the broad markets if XBI breaks below support.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.