Are DOGE layoffs set to resume?

Supermarket Income REIT (LON:SUPR)) recently delivered its first set of annual results since listing in July 2017. Capital was deployed rapidly, in a disciplined manner that targets flexible, future-proof assets (all with online fulfilment capability), let on long leases with upwards-only, RPI-linked rent reviews. The 5.5p DPS target was achieved, with income earnings fully covering dividend payments. A full-year contribution from the assets acquired, and indexation of rents, should drive significant progress in the current year.

IPO targets met and solid base for growth

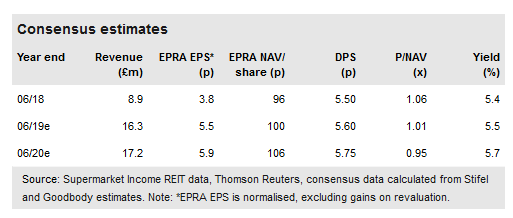

SUPR acquired five assets during the year, and a sixth acquisition completed post-year-end takes the total invested to £317m (before acquisition costs), with an annualised rent roll of £16.3m. The proceeds from equity issuance, including £100m from the IPO and £85m from the two follow-on equity raises, were invested rapidly, allowing SUPR to meet its full-year DPS target of 5.5p while fully covering dividends paid in the year. Valuations increased by 4.1% (5.5p per share), primarily reflecting 3.6% average rent indexation, and partly offset portfolio acquisition and IPO costs. Year-end EPRA NAV was 96p. Rent indexation should support income growth and, assuming no change in yields, valuations further in the current year. SUPR is targeting a 3.2% increase in the quarterly dividend from January 2019.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.