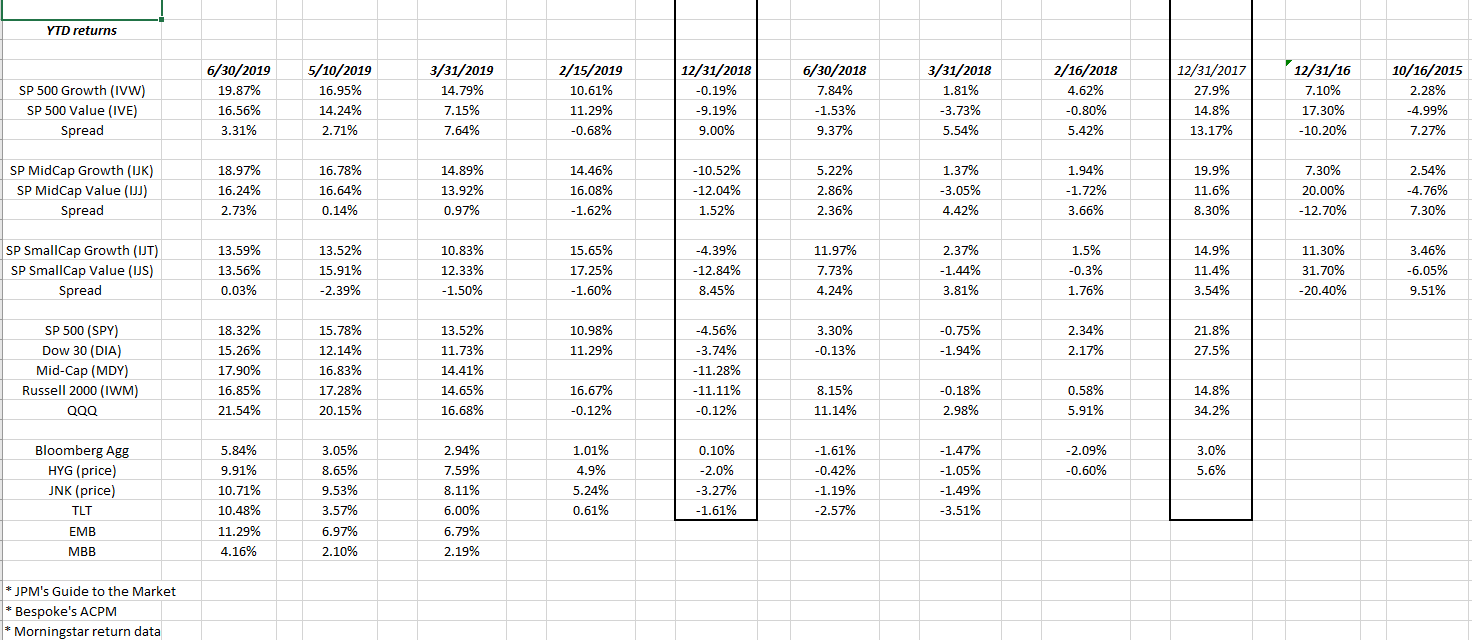

Because of the cacophony of “overvaluation” cries, it always pays to watch where the momentum is in the equity markets versus what is lagging.

This style-box analysis and rotation is another way to manage market risk.

Large-cap growth is still outperforming large-cap value and has been for a while, while mid-cap is closing the performance gap with large caps, but small-cap’s still lag.

“Growth” is still outperforming “value” across all the market-cap segments although small-cap value is also narrowing the performance gap.

Throwing this spreadsheet up every 6 weeks forces me to keep an eye on these asset classes that are outperforming and under-performing. There is a “reversion to the mean” aspect to this analysis.

Summary / Conclusion: I’ll never forget the late 1990’s and the “one-way” direction of large-cap growth and Tech which left everything behind after the Long-Term Capital Management Crisis in the fall of 1998. Smallcaps starting to under-perform dramatically in 1997. Large-cap Growth and Tech became like a vortex that swept everything up in its path as “value” and everything besides the top 10% of the SP 500 by market cap lagged badly.

Gary Morrow, one of my favorite technicians, who posts his work on Twitter (@garysmorrow), LinkedI and This Week on Wall Street, noted recently how the IJS (small-cap value ETF) keeps getting rejected at resistance.

Wait for the breakout for IJS, and then it might be time to own the IJS relative to the large-cap universe.

It’s interesting that as the SP 500 has made a series of new all-time highs the last weeks, FAANG (Facebook, (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL) (GOOG/GOOGL) have not yet made all-time-highs, so we are starting to see the first part of under-performance of large-cap growth ? Let’s see what Q2 ’19 earnings look like for the subset.

Microsoft (NASDAQ:MSFT) – not part of FAANG – and client’s largest holding – has been keeping up with the all-time-highs in the SP 500.

It’s still a large-cap growth market but hopefully this update will keep you informed of when that changes.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI