Dollar in demand, euro slumps after U.S.-EU trade agreement

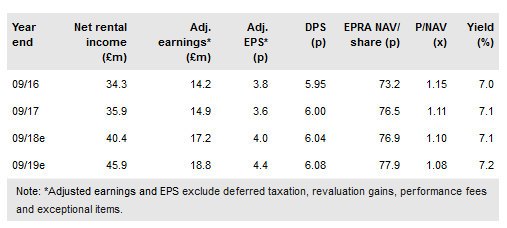

FY17 saw steady underlying growth in the investment portfolio and recurring earnings. Overall returns were further enhanced by positive revaluation movements reflecting continued tightening in market yields. Investment in development schemes had a limited impact on earnings in FY17 but completions and continuing acquisitions from a strong pipeline offer good growth prospects. The dividend has been increased and Medicx Fund Ltd (LON:MXF) expects to pay 6.04p in respect of FY18, a yield of 7.1%, supported by growing highly secure, long-term income derived mainly from government sources.

Continued growth in recurring earnings in FY17

The portfolio rose to £680m with £49.4m committed to new investment during the year. Net rental income and adjusted earnings (recurring “income earnings”) both rose c 5%, but did not fully benefit from investment in properties under construction, particularly in the Republic of Ireland (RoI). As a result, with the share count increased by c 14% to part fund investment and meet scrip dividend demand, adjusted EPS at 3.6p was lower than in FY16 (3.8p).Including £18.7m of revaluation gains, a £5.3m deferred tax add-back resulting from REIT conversion, and £240k in REIT conversion costs, IFRS net earnings grew 45% to £38.6m. EPRA NAV per share rose 5% to 76.5p and including dividends paid, NAV total return was 12.7%.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.