Risk-off has taken centre stage again this week, yet the U-turn reversal on yields suggests a corrective bounce could be due and provide a sympathy bounce for markets.

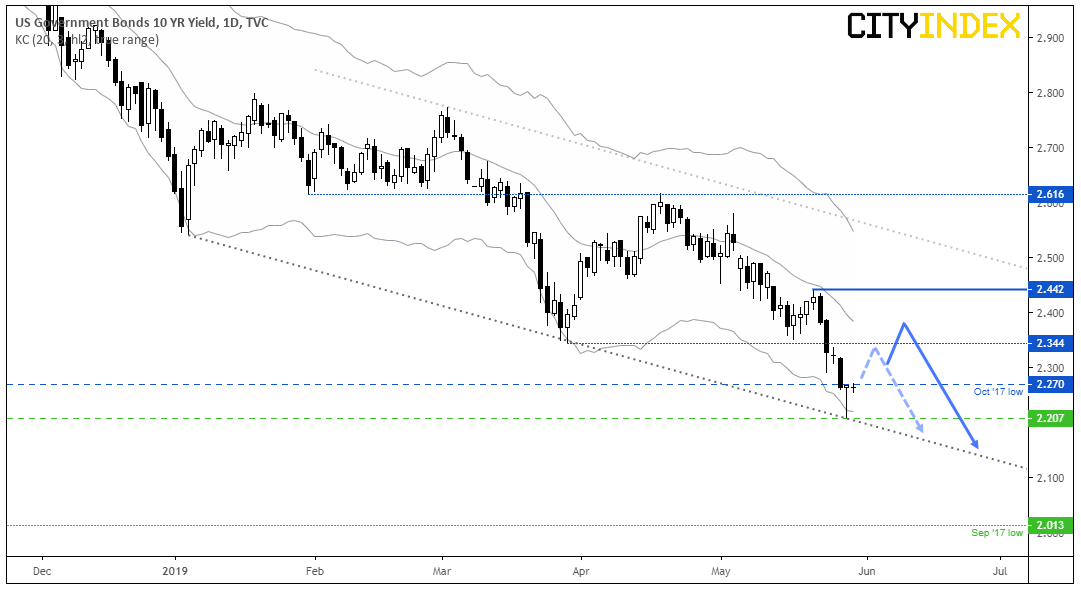

By yesterday’s low, the U.S. 10-Year had fallen to its lowest level since September 2017 whilst global equity markets fell in tandem and demand for safe-haven assets were on the rise. However, given the U-turn recovery late session there is clearly support at 2.2%. Furthermore, a bullish pinbar tested the lower bound of a bearish channel and has reversed back inside its lower Keltner band (3x ATR width) to suggest the US10Y could be in for a near-term technical bounce, before losses resume. Of course, we need to see prices confirm this, but if soured sentiment takes a breather there’s a couple of markets worth watching.

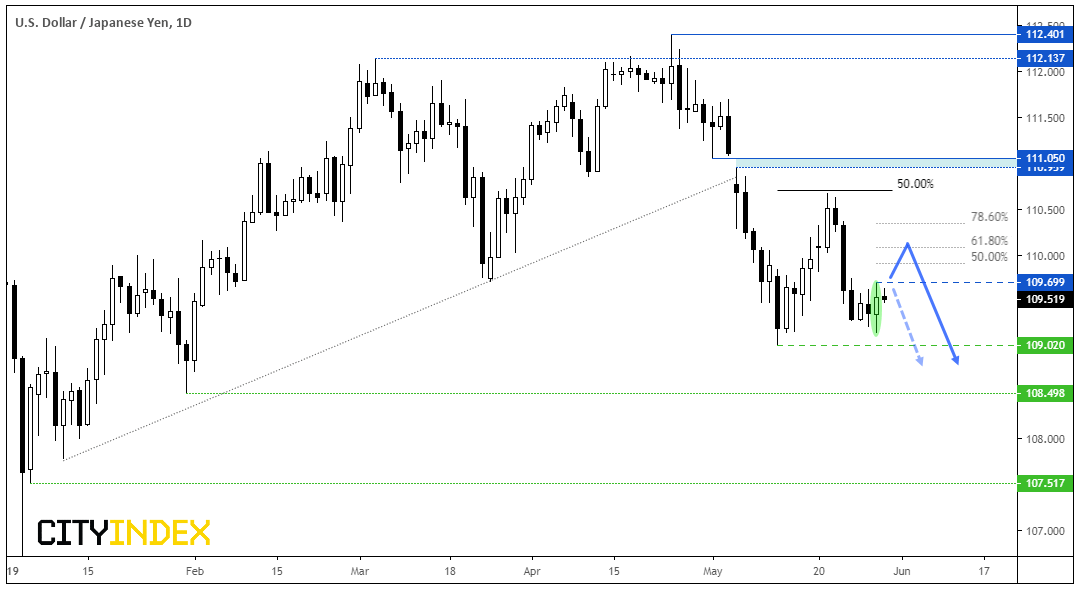

AUD/JPY and USD/JPY are the only two yen pairs that didn’t break to new lows this past week, which makes them both ripe for a bounce if yields rise.

- Of the two, USD/JPY appears the more technically compelling, given it failed to retest 109.02 and printed a bullish outside candle yesterday.

- Intraday traders could consider bullish setups with a break above 109.70 and consider Fibonacci retracement levels as targets.

- However, given bearish momentum remains dominant from the 112.40 high, bears could seek to fade into weakness below Fibonacci levels.

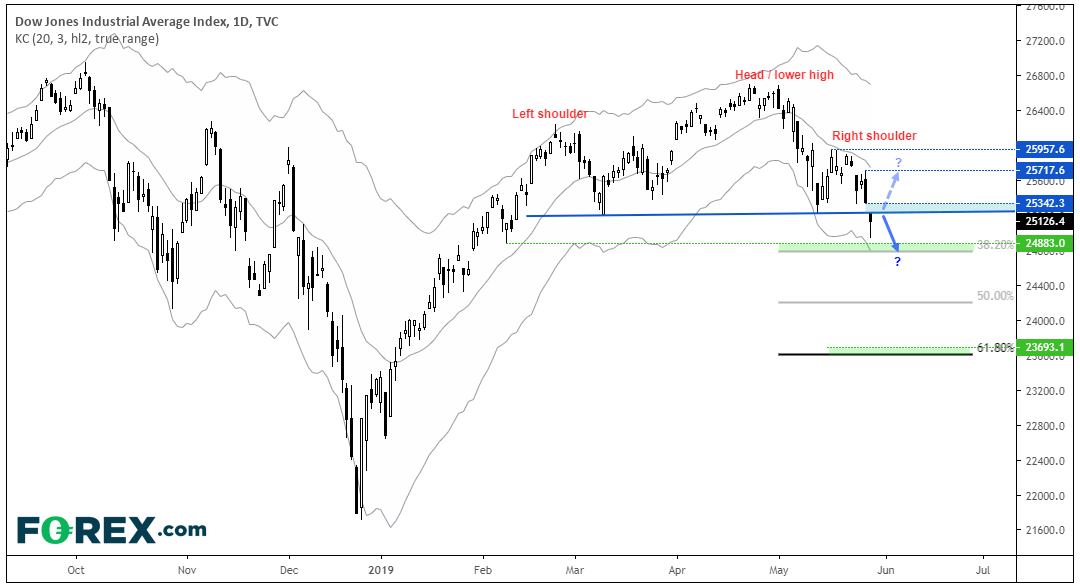

Yesterday,DJIA broken beneath its necklineto confirm a bearish head and shoulders reversal. Naturally, a bounce in yields could be supportive of stocks, so we should keep a close eye on how prices reaction around the neckline.

- If the neckline holds as resistance, bears could look to fade into moves below the neckline for a swing trade short. Bearish targets can be found near the Fibonacci levels, and the head and shoulders target is just above the 61.8% level.

- However, if we see prices break the neckline and trade above the gap, it warns to a fakeout and prices could rebound quite strongly. Bullish targets include the 25,718 and 29,958 highs.

- Obviously, for the bullish scenario to work we’d need to see some solid news surrounding the trade war along with domestic data (keep an eye on US GDP tonight).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.