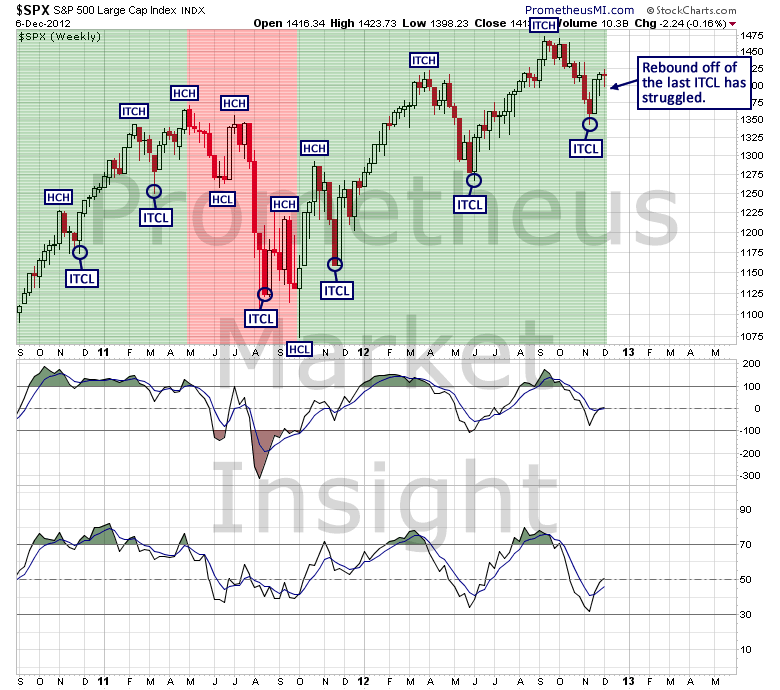

In mid-November, our cycle analysis predicted the formation of a meaningful low in the stock market. The intermediate-term cycle low (ITCL) developed as expected during the week ending November 16 and the rebound off of the low has struggled during the last two weeks, also as forecast.

The character of the rebound off of the latest ITCL will provide the next signal with respect to long-term direction, so it will be important to monitor market behavior closely during the next several weeks.

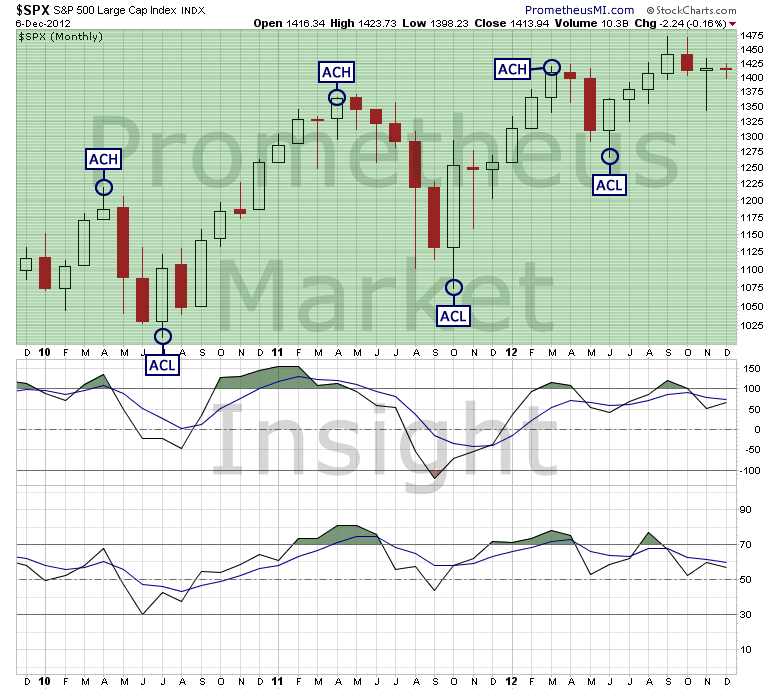

Additionally, as noted last weekend, the annual cycle from June is on the verge of a meaningful development and a long-term signal could occur as soon as the end of December.

With the intermediate-term cycle and the annual cycle both on the verge of significant developments with respect to long-term direction, it will be important to monitor market behavior closely during the remainder of December.

As we often note, charts do not always have a meaningful message to convey, but it is important to listen to them carefully when they do.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.