Low-Inflation/Low-Rates/Improving-Economy Drive Stocks

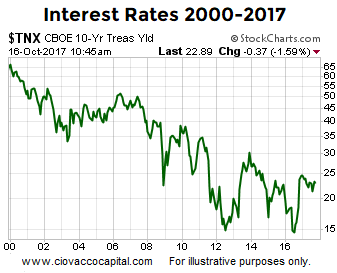

Lower Rates Longer

When interest rates are low and economic data is improving, stocks typically get an added opportunity-cost boost relative to bonds. From The Wall Street Journal:

Leaders of the world’s largest central banks indicated that weak inflation in advanced economies could prolong the post-crisis era of easy-money policies. Despite a broad-based improvement in the global economy, wages and consumer prices remain stubbornly low, making central bankers wary of removing their stimulus measures too quickly, they told a Group of 30 banking conference here on Sunday.

The Voice Of Experience

Given the favorable tailwinds for equities, this week’s video explores a prudent question:

What Advice Would Jesse Livermore Have For Investors In 2017?

Valuations Impacted By Low Rates

Even though the facts question the utility of valuations from a stock-market timing perspective, PE ratios are

still widely followed on Wall Street. It is difficult to get overly concerned about stock valuations when the world’s greatest value investor uses terms such as cheap. From Forbes:

In his characteristically unshakeable manner, Buffett opines on the elevated market with CNBC’s Becky Quick: “We’re not in a bubble territory or anything of the sort.” In fact, he argues, “measured against interest rates, stocks actually are on the cheap side compared to historic valuations.”