Street Calls of the Week

As expected, the violent price swings that have characterized market behavior since the sharp decline in May continue to drive extreme daily moves in stocks. The S&P 500 index closed sharply higher Friday, reacting off of support at the lower boundary of the oversold reaction from early June.

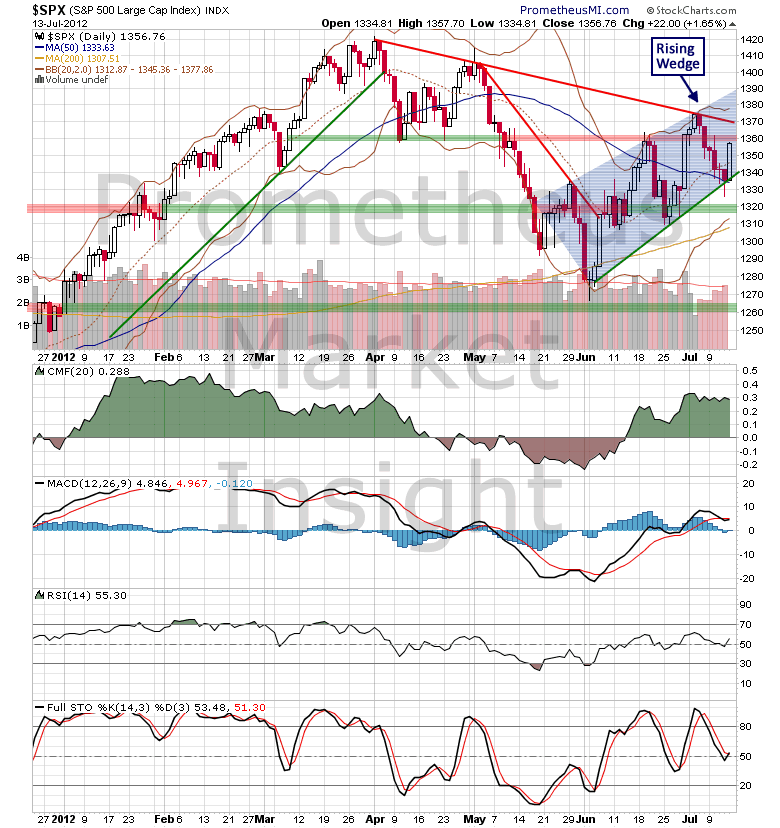

The rebound has developed into a rising wedge, which is a bearish technical formation that usually terminates with a break below uptrend support. Technical indicators are slightly bullish overall on the daily chart, tentatively favoring a continuation of the advance.

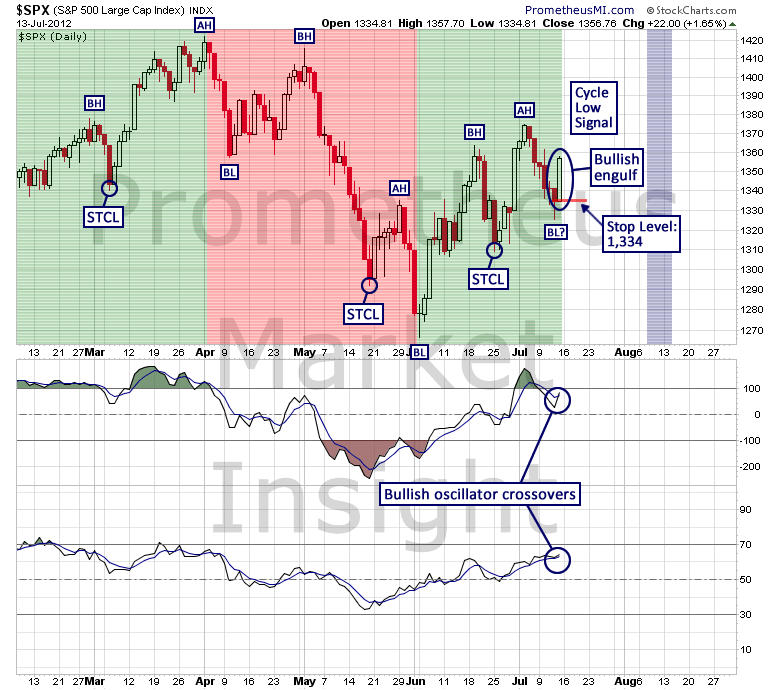

A cycle low signal was generated Friday, indicating that the beta low (BL) of the current short-term cycle may have formed on July 12, although we would need to see additional strength during the next session to confirm that development. A quick reversal and move below the stop level at 1,334 would invalidate the signal and suggest that the alpha phase decline is still in progress.

The stock market continues to exhibit behavior consistent with the formation of a cyclical top and the character of the developing beta phase will likely provide the next signal with respect to long-term direction, so it will be important to monitor price behavior closely during the remainder of July.

The rebound has developed into a rising wedge, which is a bearish technical formation that usually terminates with a break below uptrend support. Technical indicators are slightly bullish overall on the daily chart, tentatively favoring a continuation of the advance.

A cycle low signal was generated Friday, indicating that the beta low (BL) of the current short-term cycle may have formed on July 12, although we would need to see additional strength during the next session to confirm that development. A quick reversal and move below the stop level at 1,334 would invalidate the signal and suggest that the alpha phase decline is still in progress.

The stock market continues to exhibit behavior consistent with the formation of a cyclical top and the character of the developing beta phase will likely provide the next signal with respect to long-term direction, so it will be important to monitor price behavior closely during the remainder of July.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI