Bank of Japan keeps interest rates unchanged; outlines ETF sale plans

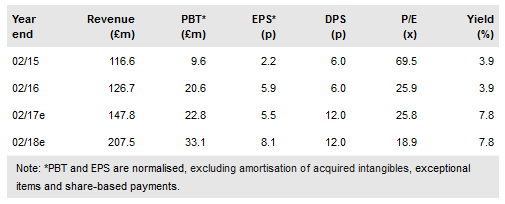

We were, on balance, reassured by Stobart Group (LON:STOB) interim results. The 7.8% yield, supported by the continuing disposal plan, gives equity holders more than enough compensation before operations in Energy and Aviation fully ramp up to their FY19e/CY18 objectives. We adjust our near-term forecasts upwards slightly to reflect the observed H117 margin expansion, but leave our FY19 target year estimates largely unchanged. We believe in the deliverability of Stobart’s FY19e growth targets but, in the case of the Aviation business, we would be further reassured by concrete evidence of passenger growth.

Core: Better profitability, but Aviation not ‘in the bag’

We increase our core EBITDA forecasts by 0.5% and 2.6% for FY17 and FY18 to reflect better than forecast profitability in Energy and Aviation. We are encouraged in particular by the outlook in both the Rail and Energy businesses. However, in Aviation, while we welcome the addition of CityJet as a partner at Southend Airport, we believe management has yet to demonstrate the concrete progress in passenger growth to reassure the market on its FY19e targets.

To read the entire report Please click on the pdf File Below

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!