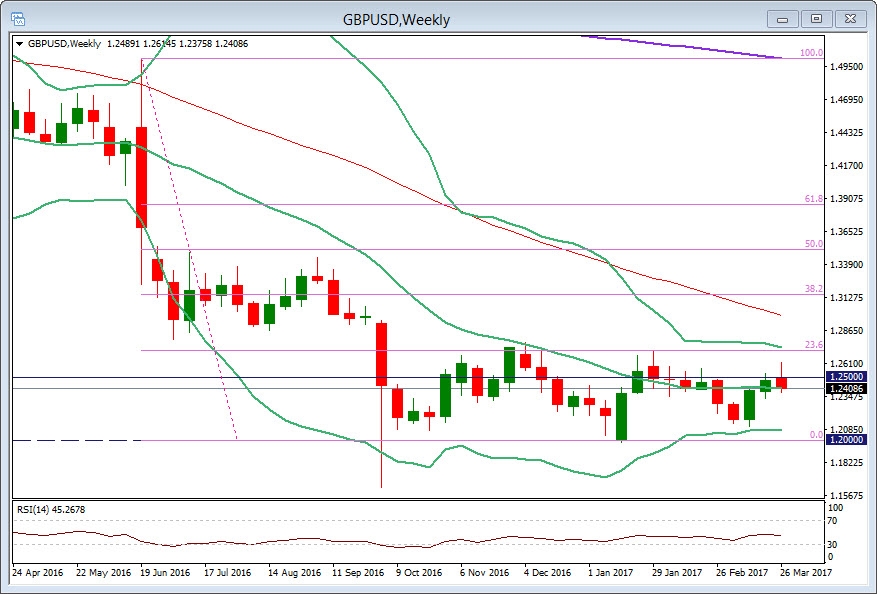

GBP/USD, Weekly

11:30 GMT March 29 2017; a significant and historic time and day for the UK and sterling. It is also significant for the wider European Union and the euro. The UK Prime Minister Theresa May has signed the letter that will trigger Article 50 of the Lisbon treaty and start the process of the UK’s departure from the EU. The letter will be officially handed to the EU at 11:30 GMT. However, it will be at least one month before an official response from the EU is forth coming following the EU Summit on April 29. 23 months will remain for a “deal or no deal” outcome.

So what are both side’s options and the likely time frame and impact on their respective currencies? Although it is impossible to answer any question precisely as neither party has entered into such an arrangement before some things are clear.

The two year countdown starts TODAY – the UK will no longer be a member of the European Union in 2019. As I've said many times, markets go up, down and sideways, they overreact both positively and negatively BUT the one thing they REALLY hate is UNCERTAINITY. History shows us that they tend to stay away from countries and currencies where there are unpredictable events. Following the June 23 2016 referendum, sterling lost close to 20% of it value.

Much has been discussed about what sort of deal the UK will get, or if indeed any deal will be agreed on within two years and the implications of both. Talk has surrounded a “Norway or Iceland” type arrangement, a Canadian deal or indeed an arrangement similar to that enjoyed by Switzerland. The key deliverable for Mrs. May and her team will be for the UK to have access to the Single Market / Customs Union if this fails then its back to the World Trade Organization (WTO) rules. This will mean tariffs and customs checks on both sides of the English Channel, something neither side will be keen on. No deal would mean that these WTO tariffs remain in place until the UK can negotiate better deals. This will take years and even decades. (The recently agreed EU/ Canada deal took 8 years to negotiate).

2017 is also the year of key elections throughout Europe with France going to the polls in April and May and Germany in September. The populist vote although stalled in the Netherlands, is a real force in France with Mrs. Le Pen and in Germany represented by the AfD. Uncertainty also swirls around the Italian banking system, the stubbornly high rate of non-performing loans throughout the European banking system and the ever present unsustainable Greek debt. Marine Le Pen has promised a French referendum on leaving the EU should she become president. An interesting 2017 lies ahead for the UK and Euro land and it all starts today.