Sterling retreating after doubts for a rate hike in May

- The pound retreated yesterday after BoE governor Mark Carney shed doubts about a much-anticipated rate hike in May. Carney’s comment that there are also “other meetings” this year, completed the puzzle of unfavourable UK financial data releases over the past three days relating to inflation, employment and retail sales. The market reacted negatively to the comments and cable dropped by some 100 pips. Please be advised that GBP OIS currently imply a probability of 67.11%, for a 25 basis points rate hike on the 10th of May by BoE. On other news, the EU seems to be rejecting a possible UK solution to the Irish border issue and the UK government auditor predicted that the Brexit bill could be exceeded by some 35-39 Billion pounds, both deepening political uncertainty. It could be the case that the Irish border issue is strengthening the arguments for the UK to remain in the EU customs union after Brexit, especially after the recent House of Lords defeat for Theresa May recently. Should there be further negative headlines about the BoE May rate hike or Brexit we could see the pound weakening even further.

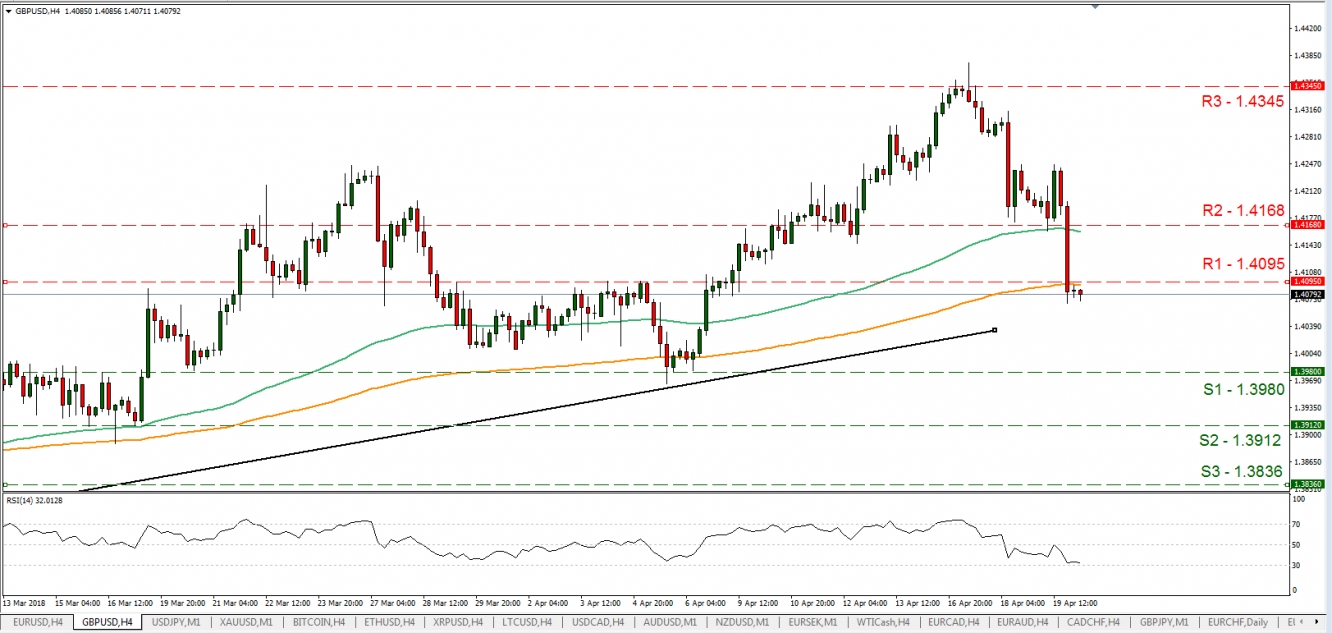

- Cable dropped considerably yesterday breaking consecutively the 1.4168 (R2) and the 1.4095 (R1) support levels (now turned to resistance). We see the case for the pair to continue to trade in a rather bearish market albeit in a slower pace, especially should it break clearly the upward trend line incepted since the 13th of November and as fundamentals seem to favour the bears currently. Should the bears continue to have the upper hand on the market we could see the pair reaching or even breaking the 1.3980 (S1) support line. Should the bulls take the reins we could see the pair breaking the 1.4095 (R1) resistance line and aim for the 1.4168 (R2) resistance hurdle.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Progress for NAFTA

- Canadian foreign minister stated that there was good progress on NAFTA key issues. The progress seems to be related to the issue of car making and what constitutes an American car. All sides seem to push for a new NAFTA agreement before July 1st in order to avoid clashing with Mexican elections, and timeframes such as mid to end May for an acceptable agreement could be feasible. Any further positive headlines regarding NAFTA could support CAD.

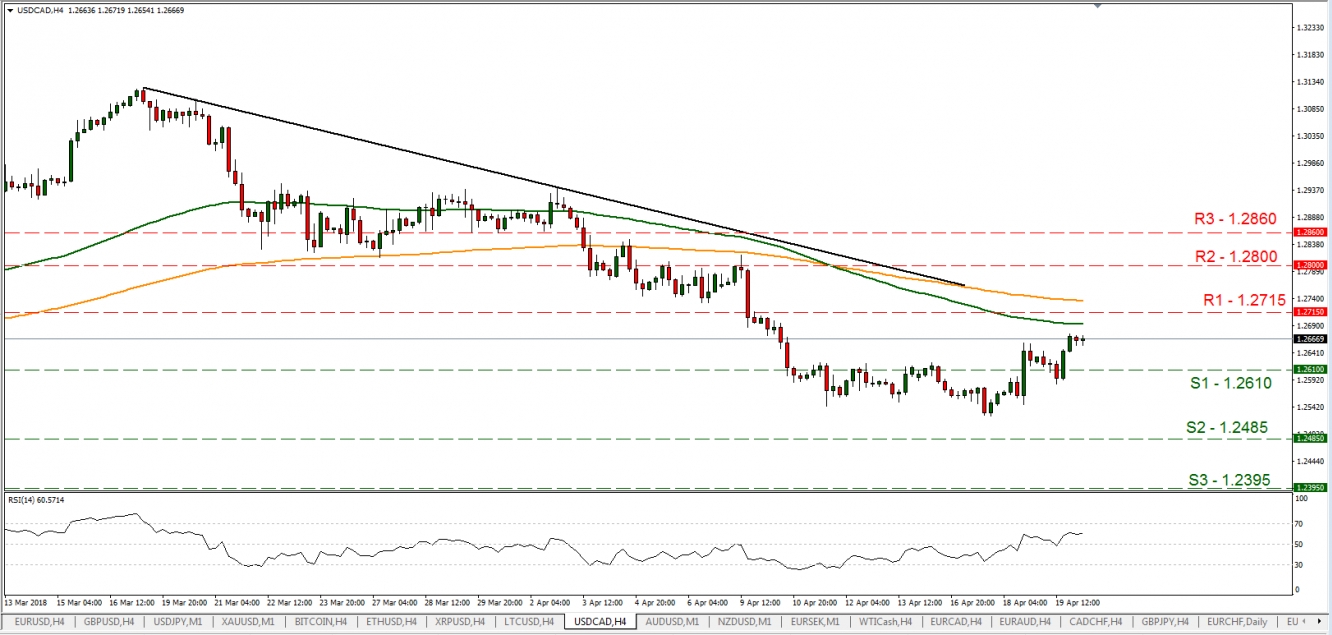

- USD/CAD traded in a sideways manner yesterday, breaking the 1.2610 (S1) support line twice (↓↑) in the 4-hour chart. We see the case for the pair to drop somewhat today as the financial data due out, later on, could favour the CAD side. Should the pair come under selling interest it could break the 1.2610 (S1) support level again and aim for the 1.2485 (S2) support barrier. Should it find fresh buying orders along its path we could see it breaking the 1.2715 (R1) resistance level and aim for the 1.2800 (R2) resistance zone.

In today’s other economic highlights:

- During today’s European session we get Germany’s PPI for March, while in the American session we get Canada’s inflation data, retail sales growth rate as well as Eurozone’s preliminary consumer confidence indicator and the US Baker Hughes oil rig count. As for speakers BoE MPC member Michael Saunders, German BuBa President Jens Weidmann, Chicago Fed President Charles Evans, Riksbank Governor Stefan Ingves and FOMC member John Williams speak.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

USD/CAD

·Support: 1.2610 (S1), 1.2485 (S2), 1.2395 (S3)

·Resistance: 1.2715 (R1), 1.2800 (R2), 1.2860 (R3)

·Support: 1.3980(S1), 1.3912(S2), 1.3836(S3)

·Resistance: 1.4095(R1), 1.4168(R2), 1.4345(R3)