Nvidia to resume H20 chip sales in China, announces new processor

Finally some spice has been added to the election cycle, but it took a poor GDP number to get it going. The UK economy grew in the first three months of this year by 0.3%, lower than the consensus estimates of 0.5% and half of what the economy managed to churn out in the last quarter of 2014. To put that all into perspective, Q1 2015 was the slowest three month period of growth in the UK since the last quarter of 2012. Industrial and manufacturing numbers from the UK economy through January and February have been poor and for once, the services sector has not been able to make up that deficit. That in itself is worrying.

Households not helping

Q1 should have seen stronger household consumption, with lower energy and fuel bills helping the pockets of average consumers. Wages are rising in real terms and unemployment is falling. To have the slowest level of service sector growth in over 2.5 years is quite confusing.

We have to bear in mind that preliminary releases are normally revised and I am hoping that this is revised higher through the forthcoming iterations. We have seen survey data recover between January and March and those later surveys reaching the ONS should bring that reading higher. David Cameron and George Osborne will also be hoping that number comes higher although with now only 8 days to go the election, dust will have settled before they get a chance to say I told you so.

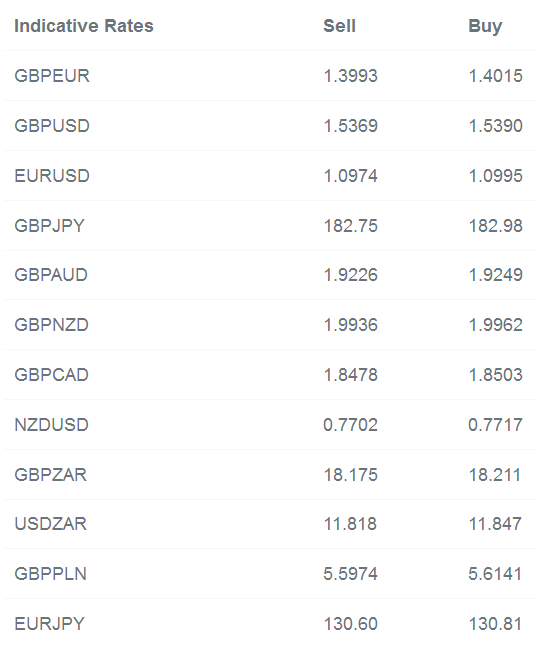

Despite the poor number, GBP recovered its losses, especially against the dollar, in short order. After an initial 70 pip fall, the pair finished a cent higher on the session and is currently in the mid-1.53s. The reason is not a strong pound, however, but a weak USD.

Fed to keep on a hawkish course

Today’s Federal Reserve meeting is hard to get excited about. Last month’s meeting seemed to suggest that today’s announcement was a dead rubber. With no meeting in May, everyone’s focus has shifted on to what happens in June. With the signals we are getting from the US economy at the moment, however, it seems nothing will be happening in June having been heavily backed at the beginning of the year as the month when rate rises may finally come about.

Yesterday’s US consumer confidence numbers were a mess. March typically sees lower spending as consumers wait on tax repayments that are due in April so we can take a slight slip in confidence there. Secondly, we must look at the payrolls announcement released on Good Friday. Was the miss down to simply fewer jobs being offered or is it showing something more, some tightness in the labour market as there are no more jobs to fill? One is temporary and easy to overcome. The other is neither of those things.

Despite this I think that the Federal Reserve sticks to its guns talking about higher inflation and the transitory nature of this quarter’s poor data. An acknowledgment of the recent wobble is likely but I suspect fully priced into the USD and I would be looking for an end to this USD slump.

EUR/USD looking like Lazarus

The euro is not slumping this morning and is focused on 1.10 in EUR/USD having touched 1.0990 overnight. Encouraging noises from Greece keep coming with Prime Minister Tsipras hinting at a referendum within the country on a Greek exit from the Eurozone. Sound scary? Fear not, as recent polls suggest that over 70% of the Greek electorate want to stay within the single currency.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.