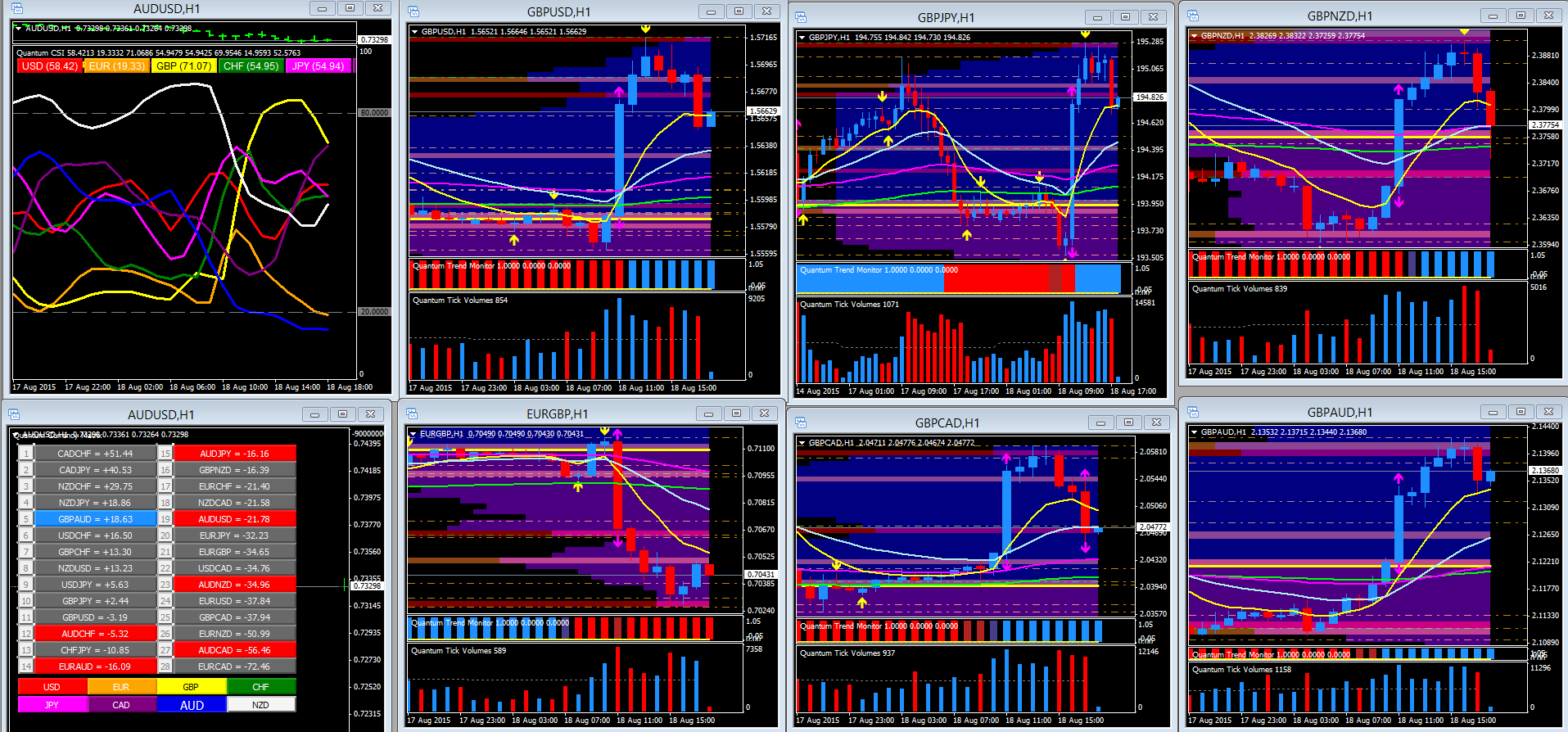

This morning’s inflation data most definitely put the spring back into cable bulls with the pair launching itself off the VPOC (volume point of control) and overnight lows in the 1.5570 and 1.5560 regions respectively. Indeed the pair and pierced through the strong resistance at 1.5689 and even managed to pierce through the psychological 1.57 price point.

Sterling’s performance this morning has indeed been ‘sterling’ across its matrix, with strong moves higher against all its principal counterparts, namely the Japanese yen, CAD, AUD, CHF, NZD, USD and EUR. The market’s weight of money this morning has definitely been flowing into the British pound with the candles on the hourly charts all closing above their average true range. However, whether the British pound is able to hold onto this morning’s gains remains to be seen, not least given the fall away in volume since the initial spike higher. Of course, liquidity in August is generally much lower than usual and the market is notorious for over reacting to a single item of news.

For Cable 1.5716 has proved a price level too far with the pair subsequently drifting lower as the NY session got underway. Indeed, all our GBP crosses have pulled back to some degree, with the GBP/NZD and GBP/AUD moving the most to the downside at time of writing.

Whether this pullback for the British pound continues now depends on a number of factors, not least tomorrow’s releases from the US, namely the Core CPI, CPI and, of course, the FOMC minutes. However, for sterling a further test of market sentiment awaits on Thursday with the release of the retail sales figures, where the consensus is for a positive number.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.