Bitcoin price today: retreats to $118k from record peak; June inflation rises

It’s been quite a decade for the world of cryptocurrencies. We’ve traveled from humble beginnings to see Bitcoin conquer the world, momentarily - before giving way to the more volatile form we see today.

There is, however, a new blockchain-driven digital currency that could well stake a claim in becoming the biggest alternative place to store our money as we continue to transition into becoming a cashless society.

The stablecoin is a relatively new entity on the crypto-market. They’re very similar to the likes of Bitcoin and Ethereum in that they’re also blockchain-powered, decentralised and heavily secure. However, while Bitcoin is capable of experiencing dizzying highs of achieving values upwards of $20,000 and heavy price drops overnight, the stablecoin is designed to be more, well, stable - meaning users will have less reason to fear these particular cryptocurrencies.

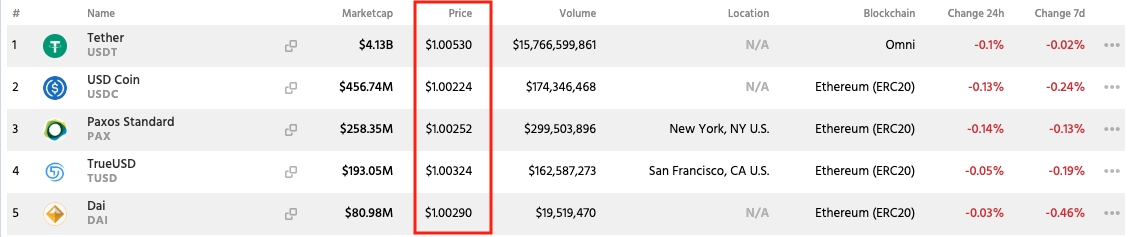

Image Source: Investing.com

Stablecoins at a glance

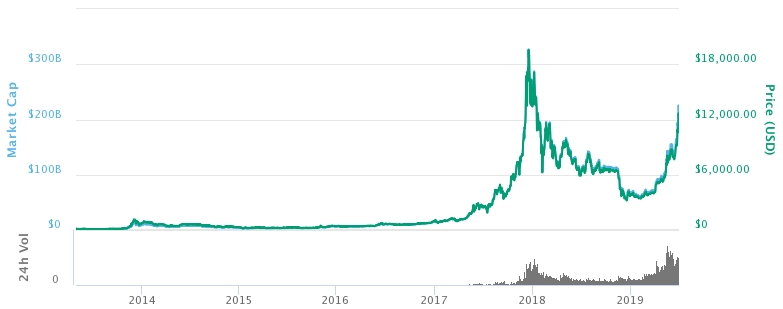

When we think of cryptocurrencies, it’s hard to look beyond the omnipresence of Bitcoin. On most days, the digital currency looks more like a rollercoaster ride than a unit of finance - with wild highs followed by aggressive drops. There’s a reason why Bitcoin has been compared to the Netherlands’ ‘tulip mania’ of the early 17th Century - recognised as the world’s first large-scale economic bubble. Bitcoin investors typically invest with the aim of selling their share on for a fortune. Stablecoins, on the other hand, are considerably better anchored in reality. Their values are typically pegged to other tangible assets like the US Dollar or gold. This means that by investing in stablecoin, you won’t become a millionaire overnight - but there’s also very little chance of you waking up to the loss of your share values either.Moreover, often a stablecoin would be more or less equivalent to the USD. As illustrated below, the top five stablecoins are priced at a similar rate to the dollar.Defying volatility

Because stablecoins defy the uncapped Wild West of many cryptocurrencies today, the fact that they’re hard-wired to physical currency helps to keep the digital payment method free from volatility.

At a time when Bitcoin and Ethereum are struggling to follow-up on their respective successes towards the end of 2017, the prospect of dependable currency is building in popularity.

(Bitcoin’s price history over the past five years: Stablecoins steer clear of volatility by tying themselves to real-world assets, like USD or gold. Image: Bitcoinwiki)

In fact, such is the popularity of stablecoins that Facebook has announced that it’s looking to get into the act - having forecast their own stablecoin, Libra, for release in 2020. While other big-name currencies like USD Coin and Tether are already available worldwide, new exciting stablecoins are entering the market. For example, EOSDT - an EOS-based cryptocurrency that leverages underlying assets to add extra liquidity to the market and Timvi (TMV) - a stablecoin secured by the ETH-deposits of the ecosystem’s participants.

Reliability in blockchain

The jewel in the crown of stablecoins is their blockchain-based framework. Not only could they make for a truly borderless means of payment, with significantly lower processing fees attached, but stablecoins could enable the seamless payment of blockchain-based assets. Their open architecture means they can be embedded into numerous digital applications where the proprietary legacy systems of banks can be much more prohibitive.

When Bitcoin was launched, over ten years ago - it was done so with a keen eye on creating a more appealing alternative to the restrictive and insecure confines of the currencies of the time. But alongside other forms of digital finance, Bitcoin was overrun by investors keen on turning their assets into profit.

To say Bitcoin hasn’t been a success would be to miss the point. Its popularity has brought significant viability to the realm of cryptocurrencies as a whole. But it is fair to say that most crypto assets aren’t the sort of thing you’d use to buy milk on a Friday morning.

That’s where stablecoin may enter the fray. Free of volatility and with the potential to be used anywhere in the world, 2020 could be a breakthrough year for the refreshing new take on the brave new world of crypto. With digital behemoths, Facebook getting in on the act, anything’s possible in the steady waters of stablecoin.

Author's Disclosure: Trading cryptocurrencies or investing in ICOs or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.