What’s wrong with the housing market?

Following eight years of development, Statpro Group (LON:SOG) is beginning to see the benefits of its cloud strategy, as it reported a 19% growth in H1 adjusted EBITDA (13% at constant currencies). This included initial contributions from Investor Analytics and InfoVest Consulting, which were acquired early in the period. StatPro has its strongest ever pipeline of new business and the final piece in the cloud strategy – Revolution Performance – is scheduled for commercial launch next month. Hence, with StatPro’s US-based financial software peers and SaaS companies trading on lofty multiples, we continue to believe there is significant upside in the shares.

Interim results: Recurring revenue book up 26%

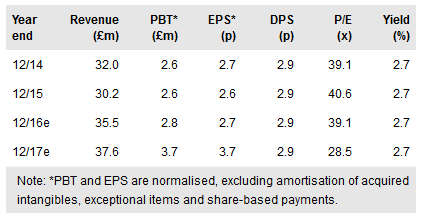

Group revenue grew by 14%, or 11% at constant currencies, to £17.6m. This included 64% growth in StatPro Revolution, the group’s cloud services platform, to £4.02m. The traditional StatPro Seven product line slipped by 12% to £8.99m. Annualised recurring revenue (ARR) jumped by 26% to £36.2m, including £4.0m from acquisitions and £3.0m from currency movements, including the impact from the sharp fall in the British pound late in the period. The group ARR provides a strong guide to future performance as 93% of group revenues are recurring, with the balance from professional services. StatPro is set to launch Revolution Performance – its transaction-based performance analytics solution – next month. Revolution Performance could provide significant upside to the numbers, as it provides an opportunity for customers to simplify their IT functions and hence reduce their total cost of ownership. Further, it processes data much faster than traditional solutions by drawing on computing power over the internet.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.