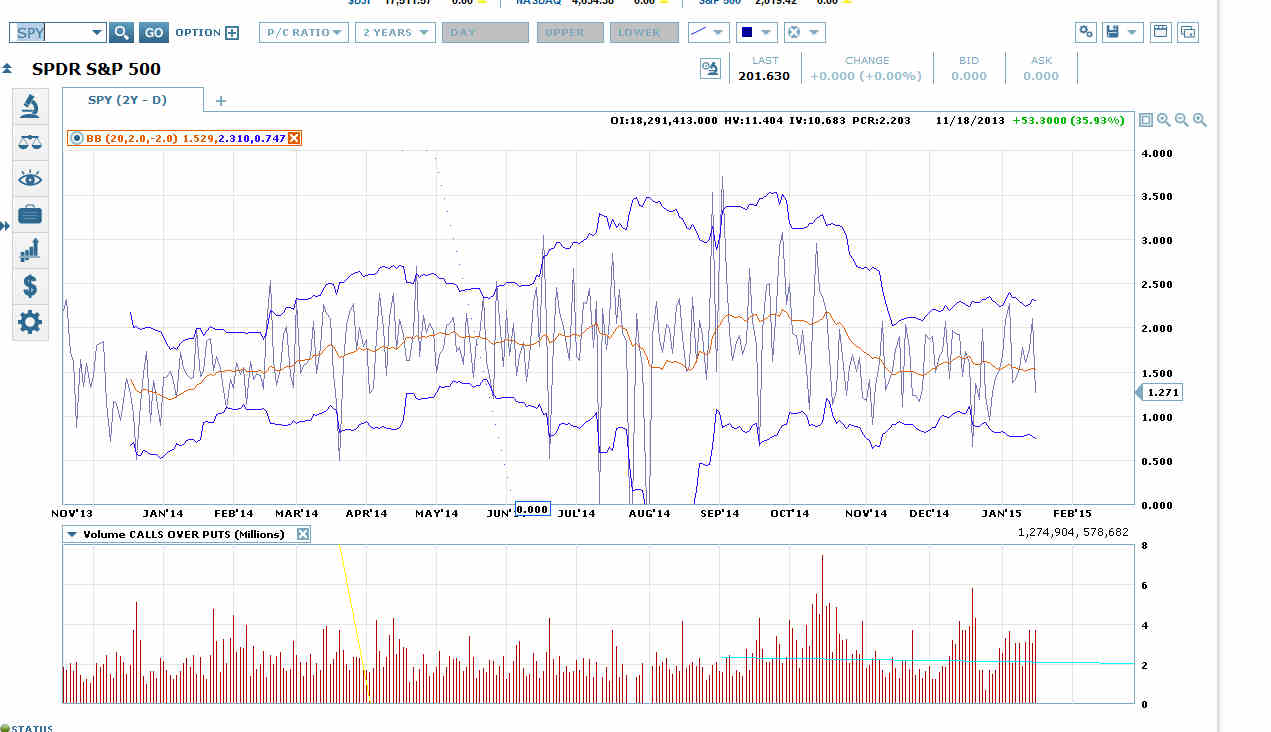

The SPY put-call ratio closed Friday at 1.27. That’s unusually low for an opex Friday.

During opex week that would be bearish for the next day. Outside of opex week, the ratio can get more extreme before you see the effect.

For example, we would often see the ratio get close to its lower Bollinger Band® before the SPY price moved down.

The ratio dropped on a solid rise in open interest. SPY put volume was almost changed, at a high level. But SPY call volume rose by 66%. That jump makes some kind of down move more likely.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.