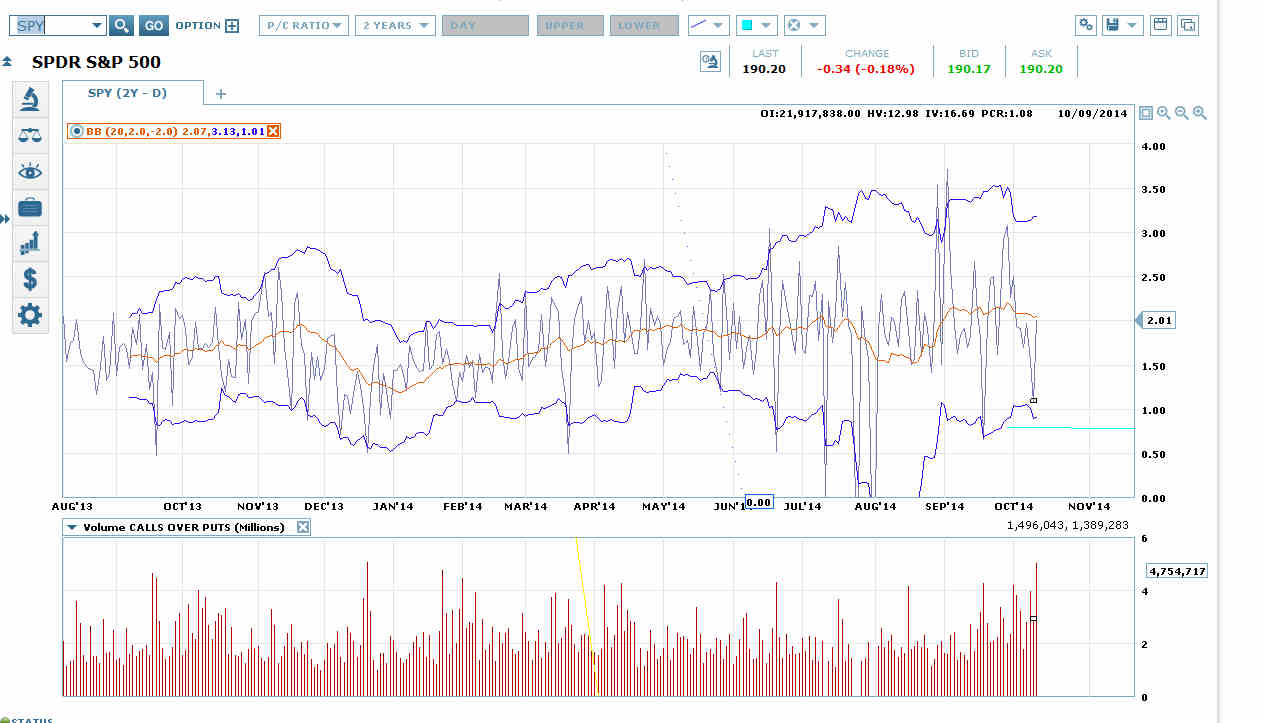

The SPDR S&P 500 (ARCA:SPY) Put-Call Ratio Rose to 2.01 on Friday

The SPY put-call ratio rose to 2.01 on Friday on another strong rise in open interest. That ratio would normally be high in terms of the long-term average for opex Fridays, but now it’s right at the ratio’s 20 dma.

SPY put volume rose today by 125%. SPY call volume rose by 20%. Neither bulls nor bears are backing down. That makes for perfect conditions for a megaphone.

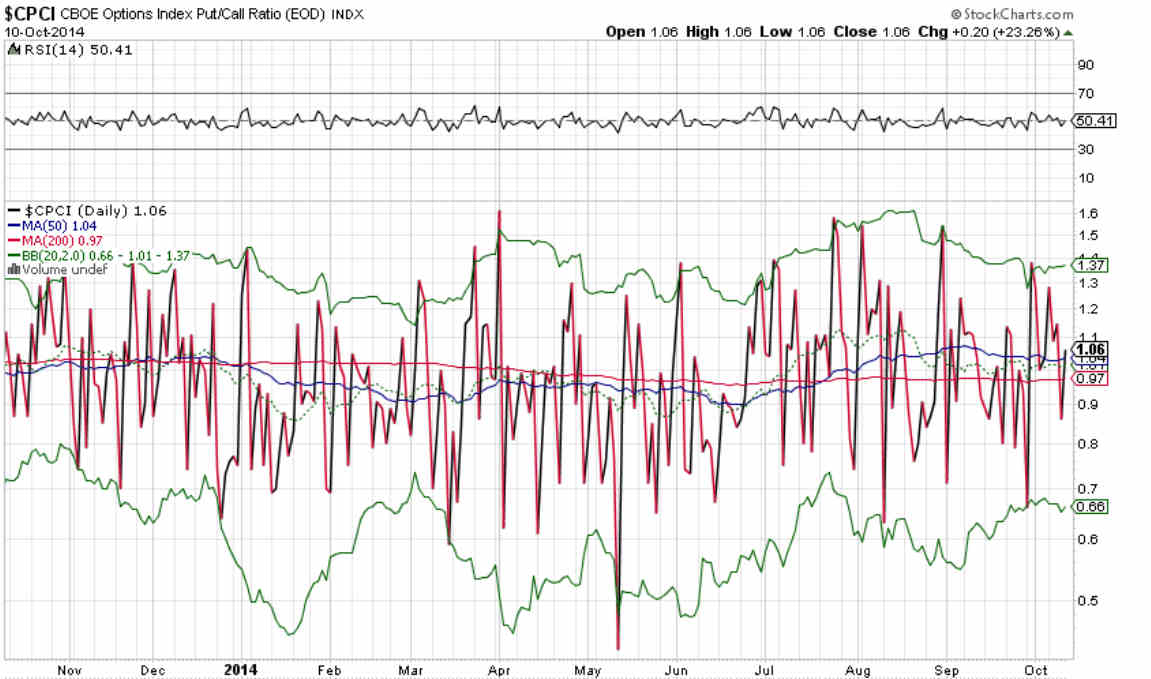

The CPCI went back up to neutral as well.

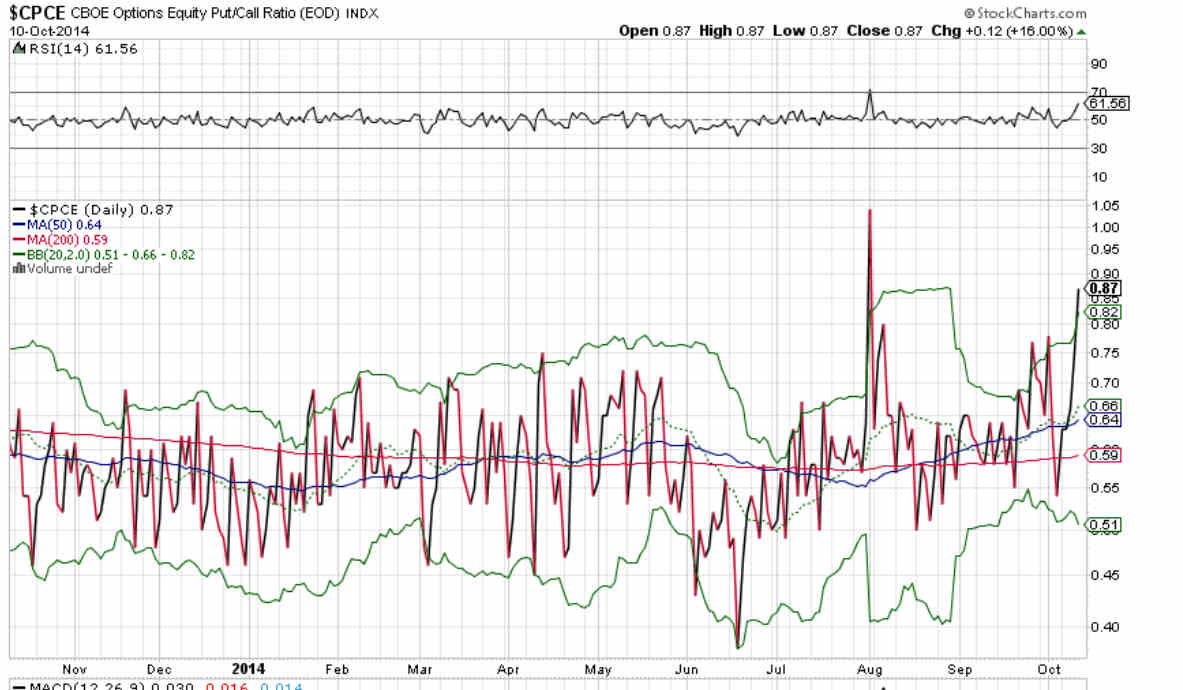

But the CPCE, which was already high from Thursday, soared through its upper Bollinger Bands®. With the other two ratios neutral, this would tend to be bullish for Monday.

ES started a new megaphone (likely a bottoming megaphone) after hours after breaking out downwards from today’s megaphone and an afternoon price channel. The SPX closed on its 200 dma looking like a head and shoulders that needs a right shoulder.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.