We’re heading into the Wednesday before a triple witching opex week and an FOMC meeting.

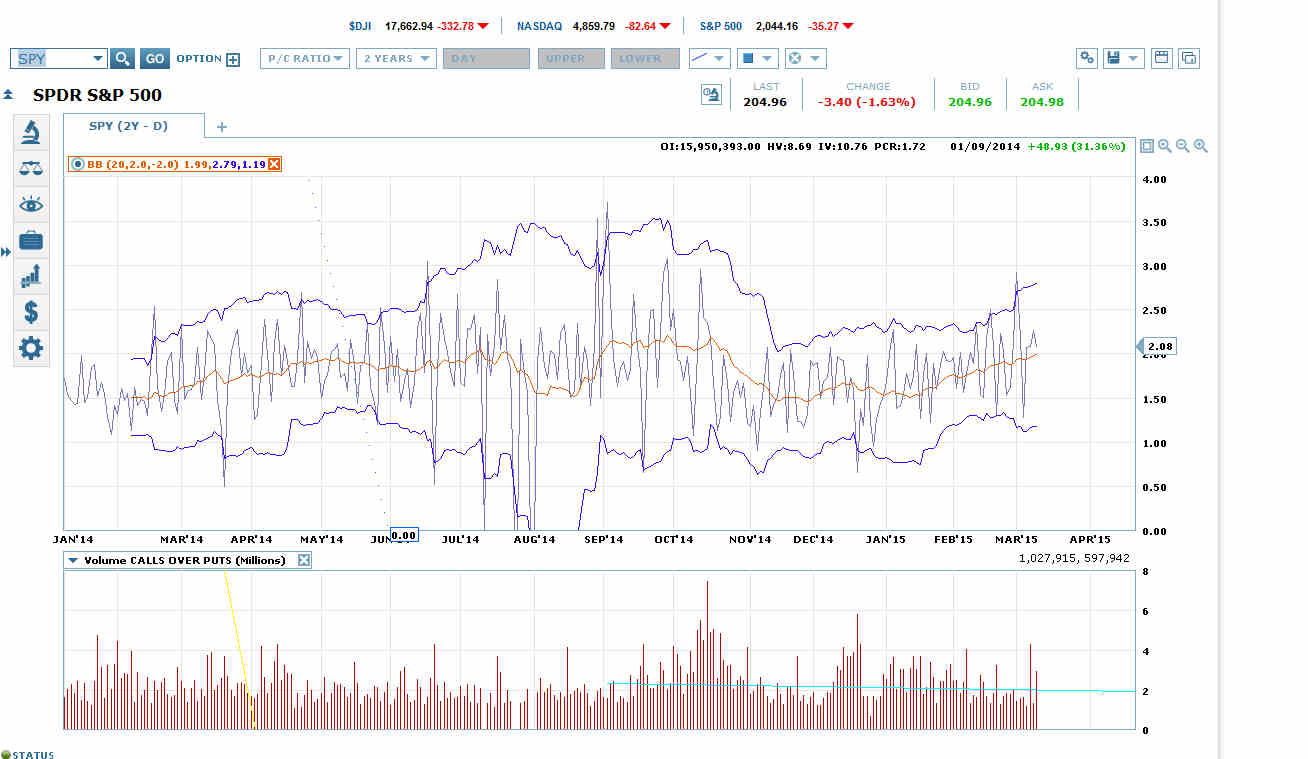

On the Thursday of triple witching options expiration weeks, the SPY put-call ratio reaches or goes through its lower Bollinger Band. If there has been a steady creep upwards in the 20 dma of the ratio, triple witching tends to start the 20 dma moving back down to its long-term average of 1.50.

The nadir of the SPDR S&P 500 (ARCA:SPY) put-call ratio on Thursday of triple witching typically occurs near the top of a strong market rally before a post-opex dip.

During triple witching weeks the SPY put-call ratio tends to hit its lower Bollinger Band 2-5 days after the SPY price has started rising out of a pre-opex dip.

To repeat: Directly before triple witching weeks you tend to see market dips that bottom 2 to 5 trading days before the Thursday of triple witching week. After that bottom, the market tends to put in a rally roughly the same size of the dip it’s coming out of. By the time of the SPY put-call ratio triple witching nadir, the market is very close to the top of that rally. Then the market tends to drop into another dip.

The pre-opex dip and opex/triple-witching rally tend to be roughly the same size. The post opex dip can be of a similar size or bigger. If it’s of a similar size, you’ll often get a bigger dip from a higher high a short-time (roughly a few weeks) later.

The regularity of these patterns suggests that they are an artifact of the expiration and rollover of trading instruments, rather than something fundamental happening in the market.

Today the SPY put-call ratio moved down to 2.08 on a surge in open interest, but the surge was only big enough to get open interest back to the low end of the normal range. SPY put volume surged by 116%. SPY call volume rose by 134%.

It’s a little early for the pre-triple-witching rally to start. I expect we see the price goofing around down here another day or two, putting in slightly lower lows, before a melt-up.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.