Bitcoin price today: up to $109k but tariff woes, Trump’s new deadline limit gains

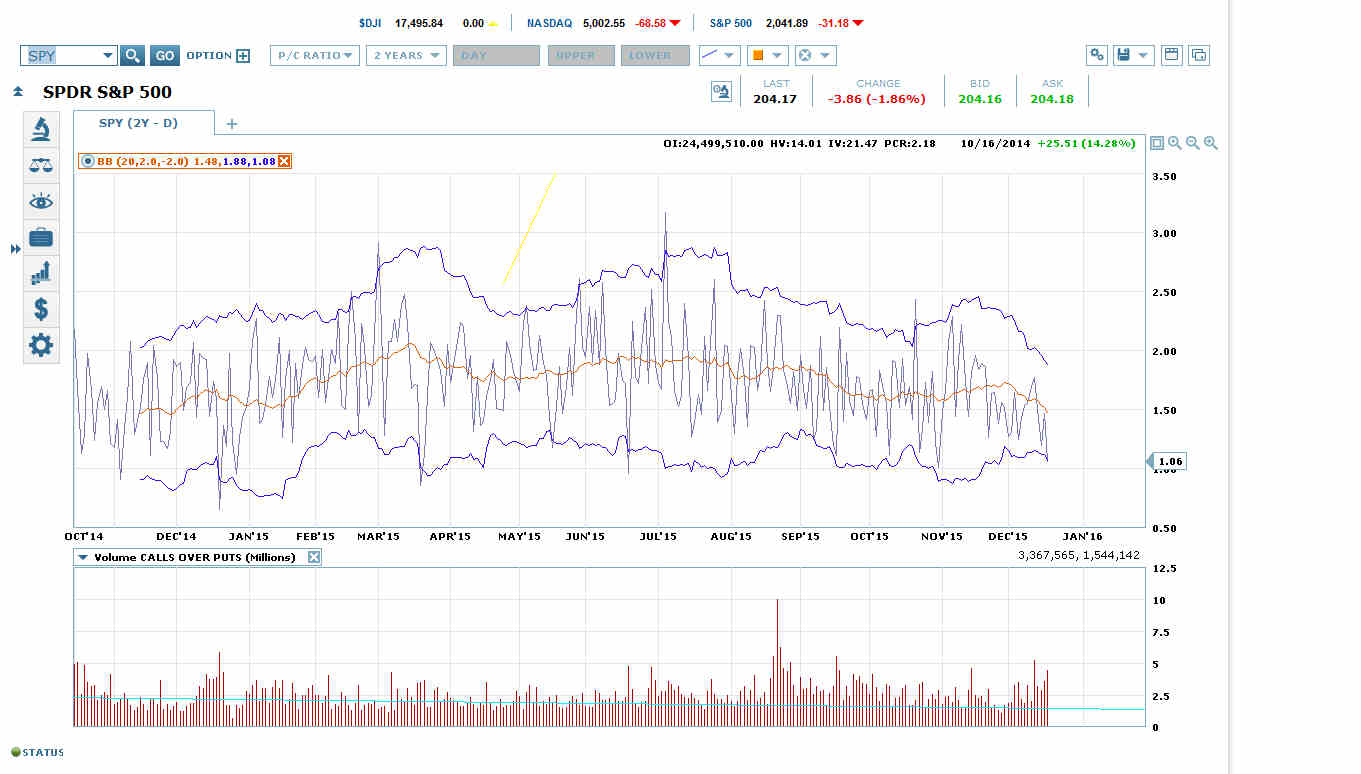

N:SPY Put-Call Ratio Collapses on a Surge in Calls

The SPY put-call ratio collapsed to 1.06, piercing the ratio’s bottom Bollinger Band, on almost a 50% surge in call volume. SPY put volume was up by less than a percent. There was a good-sized jump in open interest.

This is a classic pattern on triple witching Thursdays.

If you look at past collapses in the ratio on triple witching Thursdays, you will find that all of them are characterized by big jumps in call volume on rising open interest. The collapse in the ratio tends to be followed either by an immediate collapse in prices, a sideways move for one to a few days followed by a price collapse, or a small price rise that lasts up to a few days, followed by a price collapse.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.