13 people have been killed in a tragic and cowardly act in Barcelona. Hours later Spanish police shot and killed five more terror suspects, some of which may have been wearing explosive vests.

More than 100 people have been killed in terror attacks over the past year in Europe and the United States and more than 1000 in the rest of the world. Every one of them is a tragedy and a sin, a harsh reminder that pointless hatred exists in a world which is otherwise very peaceful in many ways.

Most of these incidents have very little affect on financial markets. Institutional investors have grown callous as the real economic implications of such events has waned. Retail investors have all but forgotten that such events used to move markets and so have ceased to trade them.

This attack is somehow different. This attack was claimed directly by the Islamic State. After the West's numerous victories against ISIS many were starting to think it a thing of the past. The fact that they were able to coordinate this type of attempt, even if it did mostly fail, is a chilling sign that terrorism is probably not going away anytime soon.

Today's Highlights

Not Quitting Yet

Metals Thrive

That's a Good euro

Please note: All data, figures & graphs are valid as of August 18th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

Though the terror streak in Spain may have had something to do with the losses in the stock market most financial media is pointing to a rumour that was running around Wall Street yesterday that Trump's top economic advisor Gary Cohn quit his post.

Even though the myth was quickly debunked, it managed to ignite an inner fear on Wall Street. What if Trump's top advisers, the sane ones, all start walking out on him.

After all, most Americans who don't fully believe in the President's abilities at least believe that he will surround himself with good people. What if those good people, many of whom are currently cringing at Trump's comments over the past few days, started to disappear? Then what would we be left with? Steve Bannon, Kellyanne Conway, and Chris Christie.

This thought alone was enough to send the markets tanking on Thursday and send the VIX volatility index to close near it's highest levels of the year.

The Dow awoke from it's slumber and indeed a deep slumber it was in. This was the first session that the DJ30 has moved more than 1% in either direction in 63 trading sessions.

Metals Thrive

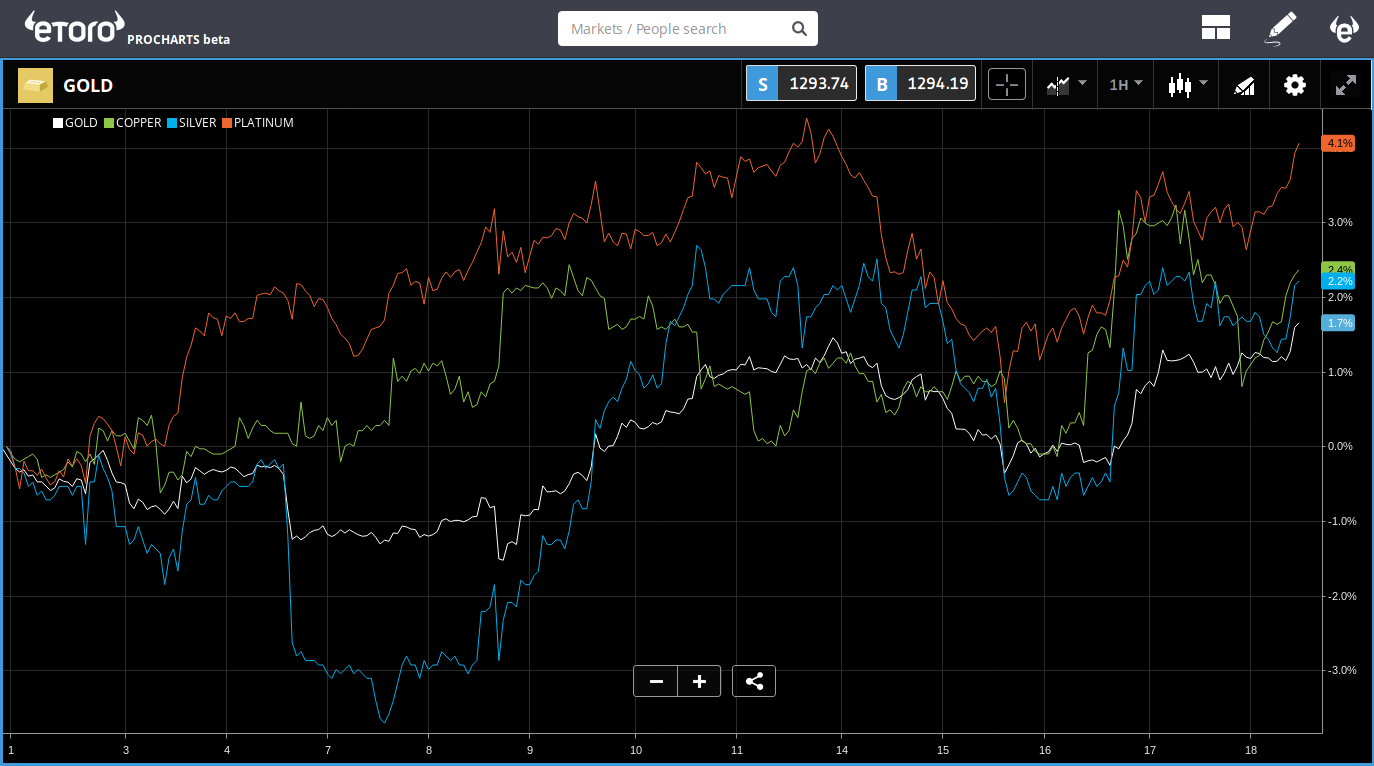

Perhaps due to all the market uncertainty and drive to safety or maybe for some other reason, the precious metals are moving forward, many of them coming close to the breakout zone.

The number one mover by far is Platinum, which has gained more than 4% since the start of the month. Here is a graph with several different important metals. Make of it what you will.

Gold has been trading cautiously around $1,300 for a while now. At the moment though, we're less than $6 short of that mark. After testing this psychological level in April, and in June, will it be able to break through in August?

European Minutes

The meeting minutes from the ECB yesterday revealed some rather large cracks in the "let's normalize monetary policy" push that was so apparent around the world last month.

Many central banks were saying that it's time to start tightening money by raising interest rates and reduce/reverse quantitative easing. Well, the United States seems divided on that front. Though the ECB doesn't seem divided just yet, they did express concern that the Euro is too high for it's own good.

The Euro very politely declined after these comments as many thought the ECB might now be inclined to do something about it.

Still, after the massive gains in the EUR/USD that we've seen so far this year, the pattern on the chart does seem to be a classic bullish shaped flag.

Wishing you a wonderful weekend.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.