Foreign interest in U.S. securities has been sparse and sporadic since mid-2011, as shown on the graph below. Data released Friday shows another monthly drop in foreign purchase of U.S. securities.

Inasmuch as "demand for domestic securities and currency demand are directly linked because foreigners must buy the domestic currency to purchase the nation's securities," one has to wonder how much longer the U.S. economy can continue to "recover" and at what pace without increased foreign interest...particularly as the SPX faces this potential scenario.

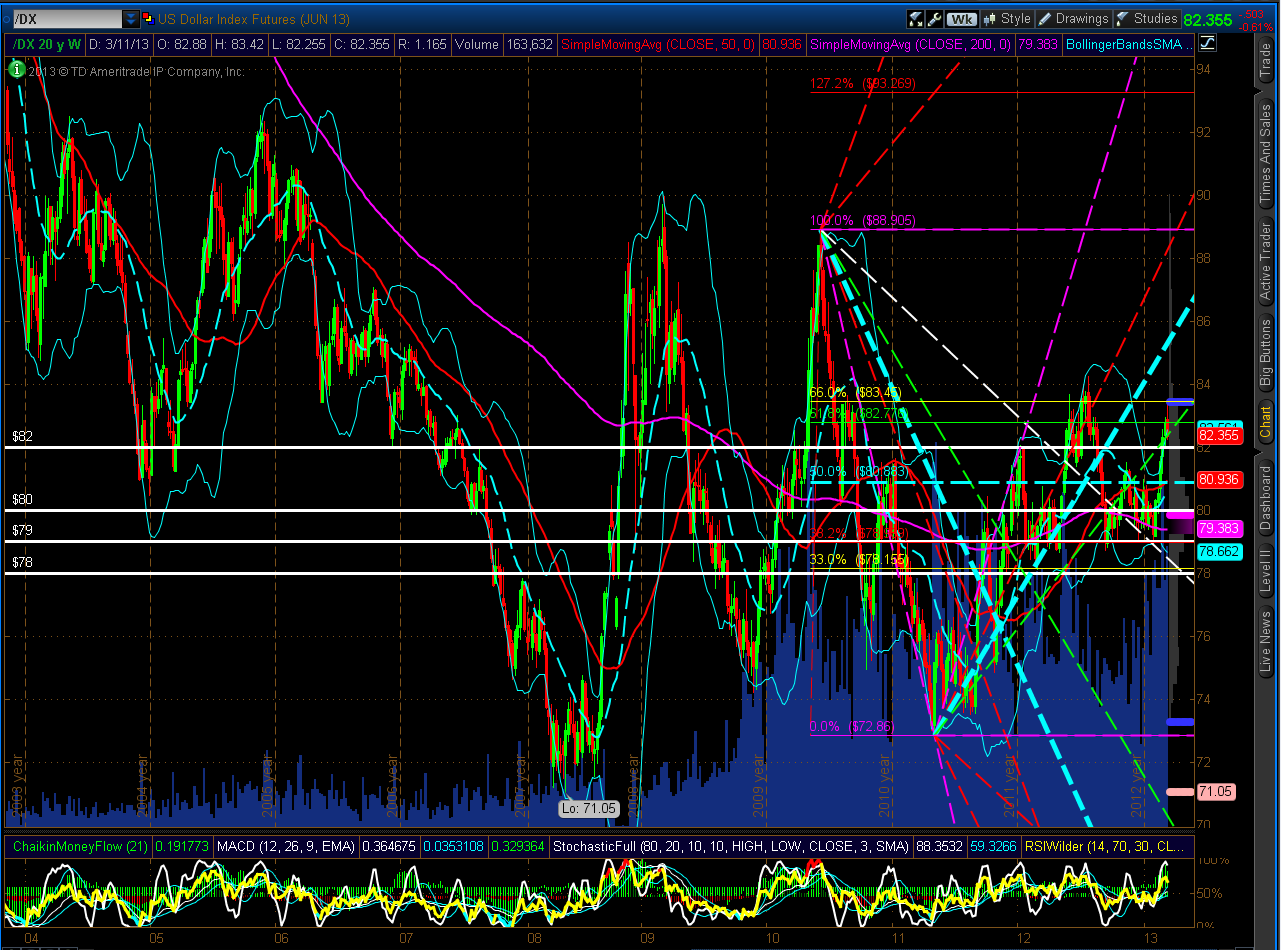

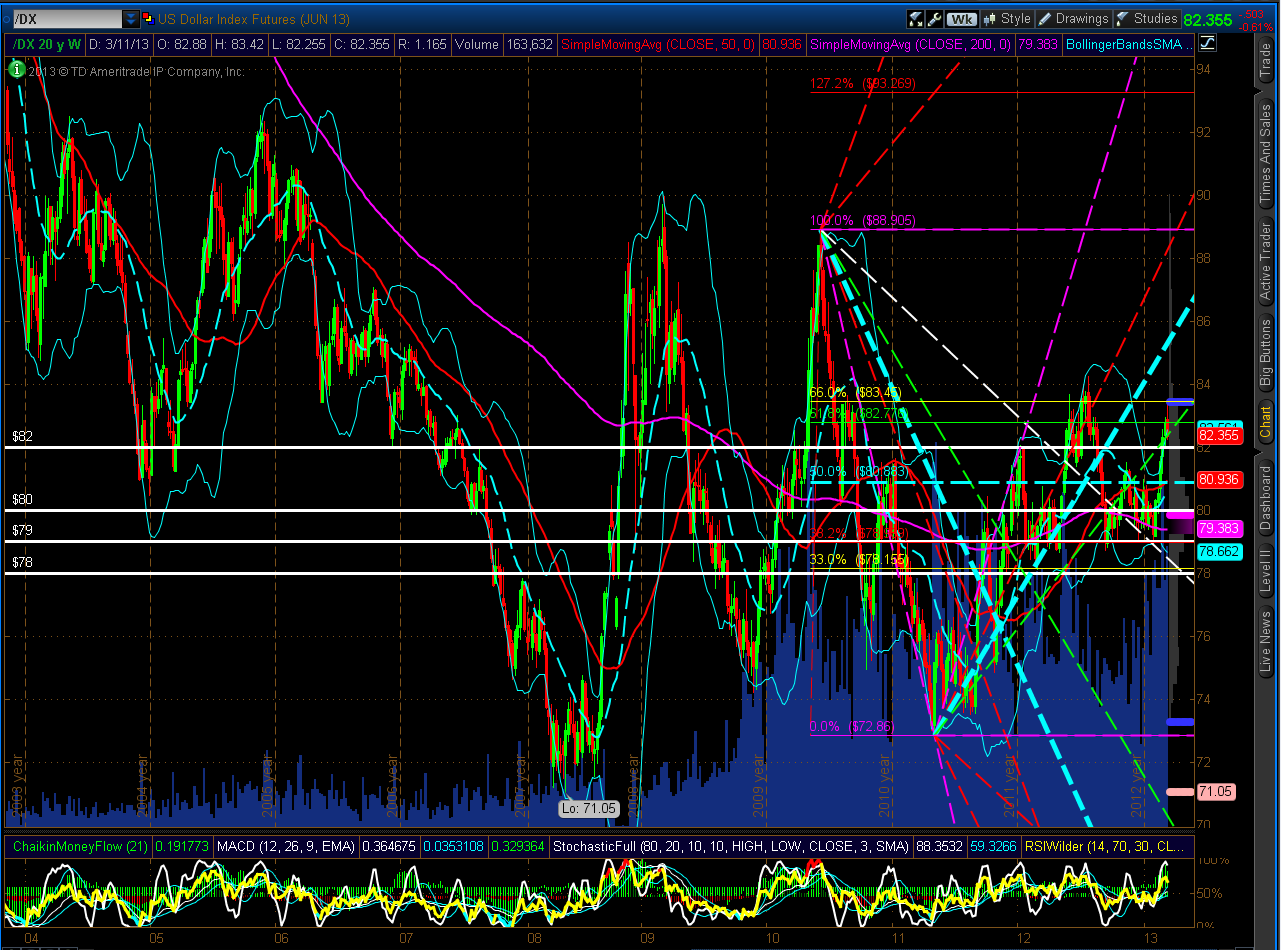

Meanwhile, the U.S. dollar dropped a bit on Friday and is trading around a confluence of 60% Golden Fibonacci ratios, as shown on the Weekly chart below...one to watch for either a resumption of strength, or for further weakness...major support lies at 82.00.

Inasmuch as "demand for domestic securities and currency demand are directly linked because foreigners must buy the domestic currency to purchase the nation's securities," one has to wonder how much longer the U.S. economy can continue to "recover" and at what pace without increased foreign interest...particularly as the SPX faces this potential scenario.

Meanwhile, the U.S. dollar dropped a bit on Friday and is trading around a confluence of 60% Golden Fibonacci ratios, as shown on the Weekly chart below...one to watch for either a resumption of strength, or for further weakness...major support lies at 82.00.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI