Analyst flags 9 bargain stocks in a ‘Black Friday’-style dip

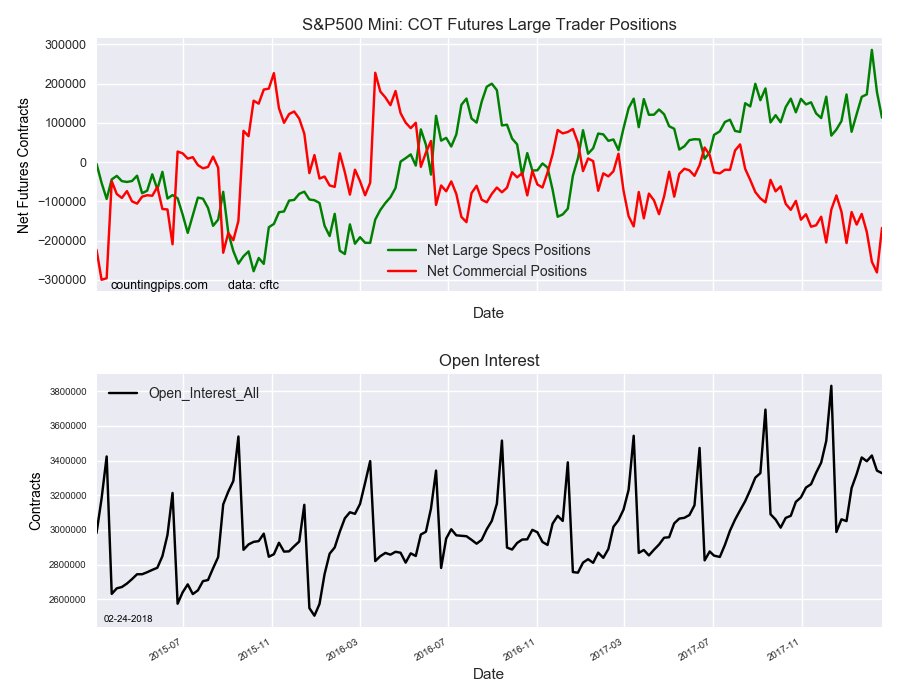

S&P 500 Mini Non-Commercial Speculator Positions:

Large stock market speculators cut back on their bullish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P 500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 113,331 contracts in the data reported through Tuesday February 20th. This was a weekly lowering of -65,669 contracts from the previous week which had a total of 179,000 net contracts.

Speculative positions have now declined sharply for two straight weeks and by a total of -172,883 contracts following the large jump in bullish positions on February 6th. Despite the two weekly declines, the overall bullish level remains above the +100,000 contract level for a sixth straight week.

S&P 500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -167,811 contracts on the week. This was a weekly rise of 113,512 contracts from the total net of -281,323 contracts reported the previous week.

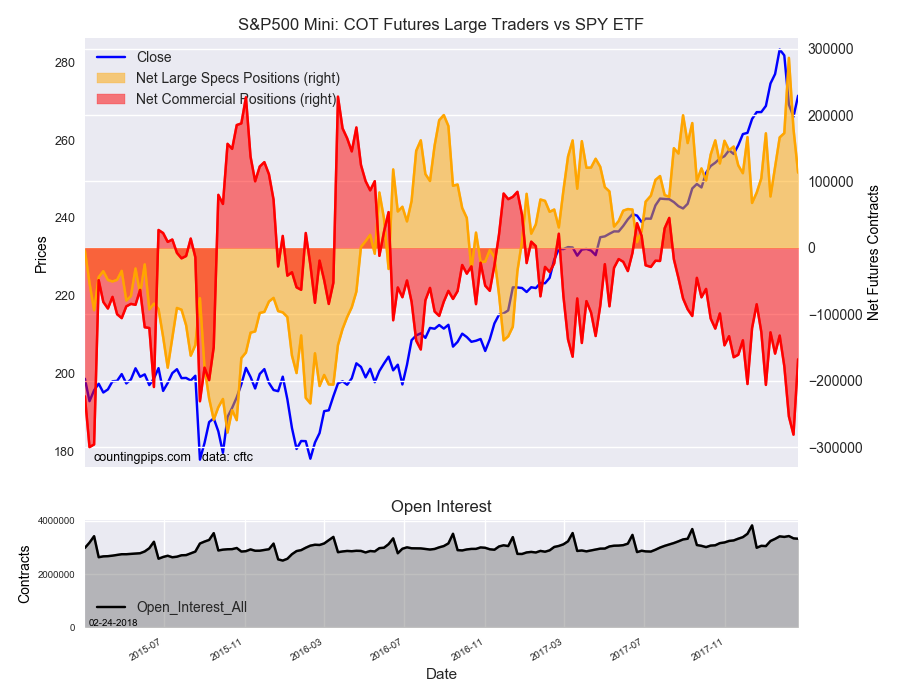

SPY ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P 500 Index, closed at approximately $271.4 which was a gain of $5.4 from the previous close of $266.0, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 2 out of 3 global portfolios are beating their benchmark indexes, with 88% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?