Is the bull market getting long in the tooth?

Could the S&P 500 Index rally be nearing an end?

Okay now that we have the bears attention, let’s face the facts: This is a bull market (until proven otherwise). And the bull market isn’t going anywhere until we see trend lines break down.

With that being said, the stock market rally is nearing an important price juncture.

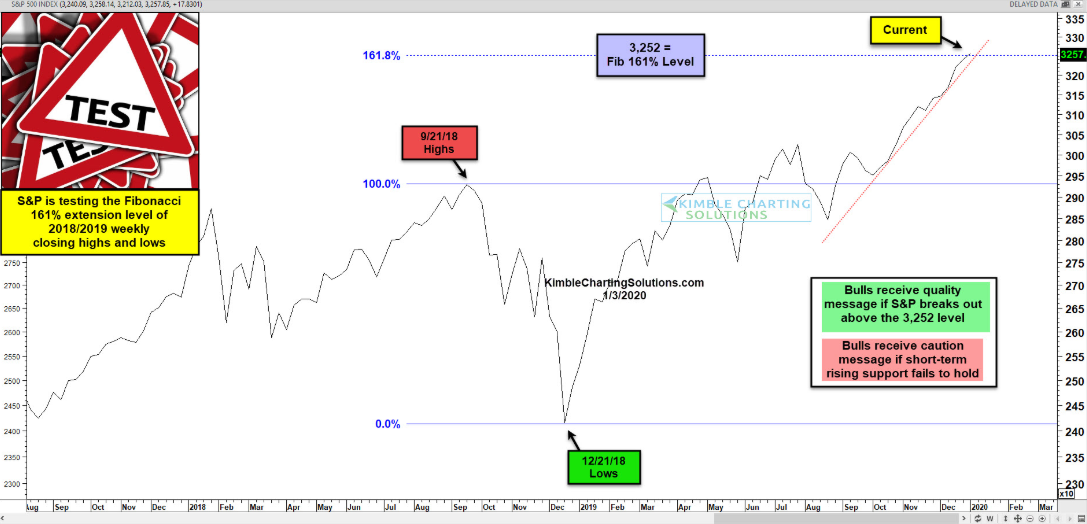

The S&P 500 is testing a key Fibonacci extension price level at 3252.

This Fibonacci extension level comes from the 2018/2019 weekly closing highs and lows. A breakout above this level on a weekly basis will send a bullish message to the market, while a stalling out near this level will signal that this bull is taking a rest. Only a break down below the up-trend line will signal caution.

Stay tuned.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI