The news headlines out of Europe continue to surprise to the downside. As growth in most countries stagnates, the euro area is struggling across the board.

Econoday: Amongst the larger economies, Germany managed a disappointingly small 0.1 percent quarterly advance but there were fresh falls in France (0.2 percent), Italy (0.5 percent) and Spain (0.5 percent). Neither the Italian nor Spanish economy has seen any growth since the second quarter of 2011.

Elsewhere, performances were poor with quarterly expansion amongst those members supplying the data restricted to just Belgium (0.1 percent) and Slovakia (0.3 percent). There is little surprise that Cyprus (minus 1.3 percent) was at the bottom of the growth table, and there was renewed weakness in the Netherlands (minus 0.1 percent), Portugal (minus 0.3 percent) and Finland (minus 0.1 percent). Estonia's good run also came to an abrupt halt (minus 1.0 percent), while Austrian activity remains unchanged from the fourth quarter.

Some had hoped that as periphery nations begin to show trade surplus (due to declining domestic demand and lower labor costs), their economies may stabilize. But with global demand remaining weak in the first quarter and unemployment reaching new highs, that stabilization did not materialize. For now the periphery can not export its way out of recession.

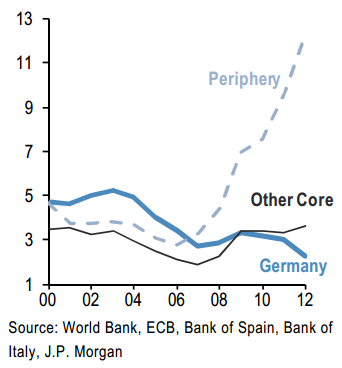

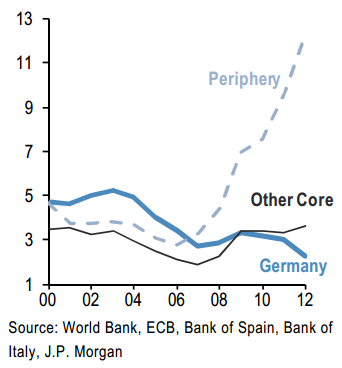

Furthermore, the Eurozone periphery nations continue to struggle with what amounts to a paralyzed banking system with limited credit expansion capabilities. One key reason for this paralysis is a large (and growing) book of non-performing loans held by these nations' banks (unemployed borrowers and broke housing developers tend to have trouble making payments on their loans).

And just like in Japan in the 90s, not addressing the bad loan problem quickly generates prolonged periods of contraction.

Econoday: Amongst the larger economies, Germany managed a disappointingly small 0.1 percent quarterly advance but there were fresh falls in France (0.2 percent), Italy (0.5 percent) and Spain (0.5 percent). Neither the Italian nor Spanish economy has seen any growth since the second quarter of 2011.

Elsewhere, performances were poor with quarterly expansion amongst those members supplying the data restricted to just Belgium (0.1 percent) and Slovakia (0.3 percent). There is little surprise that Cyprus (minus 1.3 percent) was at the bottom of the growth table, and there was renewed weakness in the Netherlands (minus 0.1 percent), Portugal (minus 0.3 percent) and Finland (minus 0.1 percent). Estonia's good run also came to an abrupt halt (minus 1.0 percent), while Austrian activity remains unchanged from the fourth quarter.

Some had hoped that as periphery nations begin to show trade surplus (due to declining domestic demand and lower labor costs), their economies may stabilize. But with global demand remaining weak in the first quarter and unemployment reaching new highs, that stabilization did not materialize. For now the periphery can not export its way out of recession.

Furthermore, the Eurozone periphery nations continue to struggle with what amounts to a paralyzed banking system with limited credit expansion capabilities. One key reason for this paralysis is a large (and growing) book of non-performing loans held by these nations' banks (unemployed borrowers and broke housing developers tend to have trouble making payments on their loans).

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

And just like in Japan in the 90s, not addressing the bad loan problem quickly generates prolonged periods of contraction.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI