Solid State Plc (LON:SOLI) has announced that FY19 profit will be slightly ahead of the £3.5m in consensus estimates, as will revenue at c £56m. This is the result of continued strong demand in the Value Added Distribution division and the anticipated H2 recovery in the Manufacturing division materialising. Consensus FY19 and FY20 estimates are unchanged following the January upgrade, supported by an order book at end March 2019 that was 40% higher than a year previously. While the share price has responded positively to the news, the shares continue to trade at a substantial discount to peers with regards to prospective P/E.

FY19 performance slightly ahead of consensus

The strong growth in the Value Added Distribution division noted at the interims continued into H2 and was particularly notable in Q4. The anticipated H2 recovery in the Manufacturing division took place as the shift towards higher-margin work, which delivered a 70bp improvement in group gross margin at the interim stage, was maintained. The integration of Pacer Technologies, which was acquired in November 2018 and added optoelectronic components to the product offer, is progressing as planned. Management expects that about half of the 20%+ FY19 revenue growth will be attributable to this acquisition. Cash generation during Q419 was much stronger than management anticipated, enabling the group to make an early partial repayment of £2.0m on the loan taken out to acquire Pacer.

Strong order book underpins FY20 progress

The group starts FY20 in a good position, with an open order book at end March 2019 totalling £35.9m. This is 40% higher than a year previously (after restating to include Pacer). We note potential for incremental value-added sales arising from an enhanced optoelectronic components offer following commencement of production at Pacer’s ‘assembly-light’ capability in March 2019.

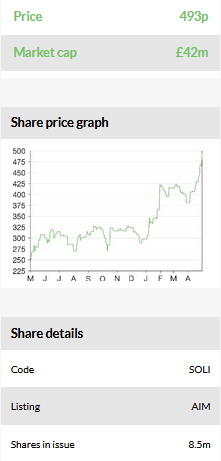

Valuation: Trading at a discount to peers

The share price has jumped by 6% on the trading update, which follows upgrades in October and January. Even so, the shares continue to trade on prospective consensus P/E multiples at a substantial discount to the mean for both our sample of specialist manufacturing companies (14.1x for Solid State vs 16.4x for peers) and our sample of value-added distributors (14.1x vs 20.0x). Moreover, there remains scope for FY20 upgrades depending on Pacer performance and margin contribution from individual manufacturing contracts.

Business description

Solid State is a high value-add manufacturer and specialist design-in distributor to the electronics industry. It has expertise in industrial/ruggedised computers, electronic components, antennas, microwave systems, secure communications systems and battery power solutions.

Bull

Added-value design capability supports long-term relationships with customers and supports higher margins.

Military and aerospace expertise helped win VPT power conversion solutions franchise.

Pacer acquisition adds to value-added distribution portfolio with little overlap.

Bear

Delays affecting high value-added manufacturing projects for government-funded and major Infrastructure programmes are commonplace.

Revenue development is dependent on OEM customers’ sales and marketing activity.

Interest on loan to fund Pacer transaction a drag on profits.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.