On Monday, we highlighted an important price pattern in the chart of the Thomson Reuters Equal-Weighted Commodities index. Today, we’ll stick with that theme and look at two soft commodities and their trading setups: Coffee and Sugar (futures).

In both cases, we have charts that followed downtrends into key, long-term support then bounced. However, the current stage of each bounce is different.

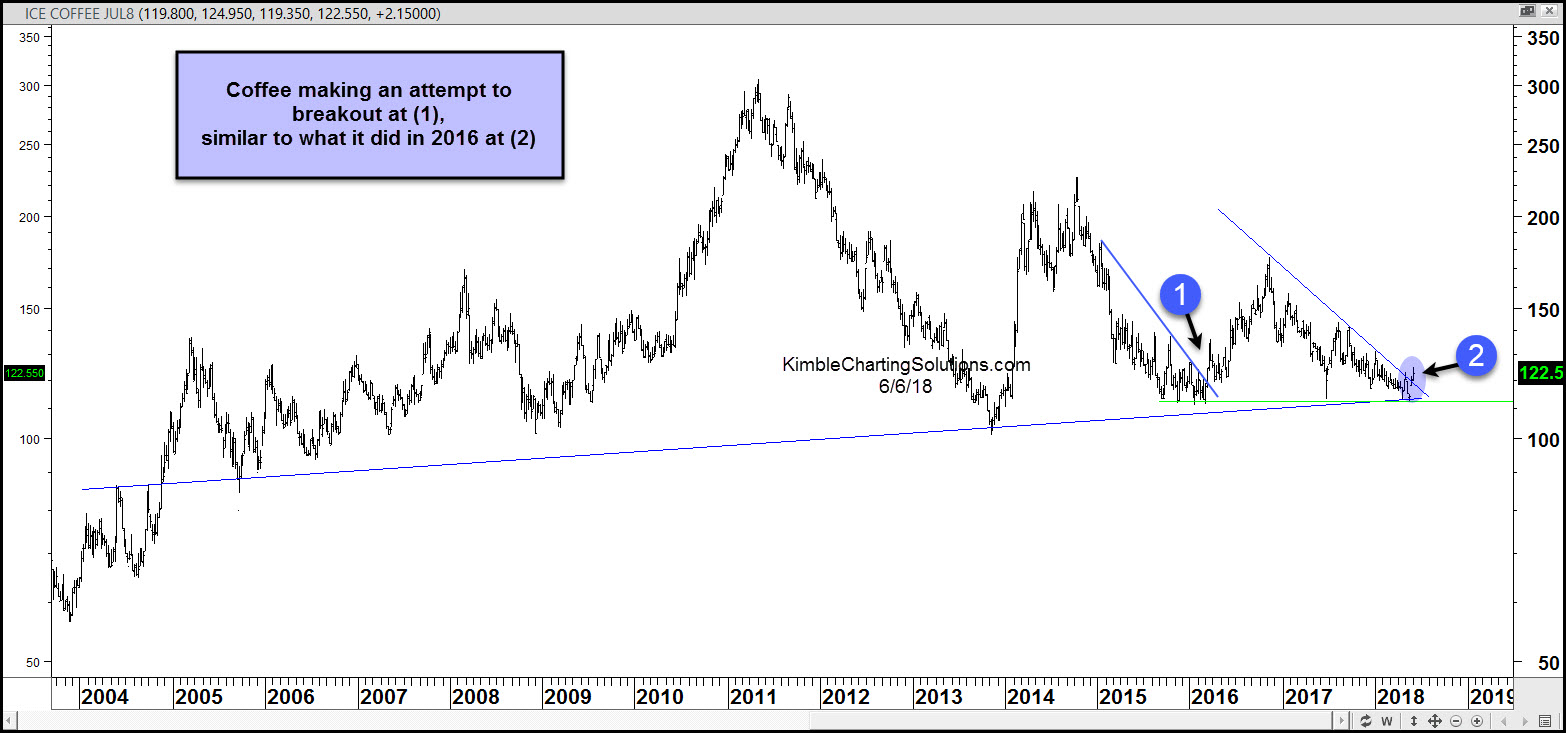

Coffee

This chart shows a nice bullish intermediate-term setup. Similar to 2016 (1), coffee bounced off long-term support before testing and breaking out above its falling downtrend line (2). Will this breakout pattern produce another rally? The first pullback will be important to watch.

Sugar

This one has a short-term rally out of a deeply oversold state. The trend is still down, as sugar has yet to break out. However, that may change soon. It is currently testing its falling downtrend resistance line (1) and could attract some buyers IF it's able to break out above point (1).

Stay tuned.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI