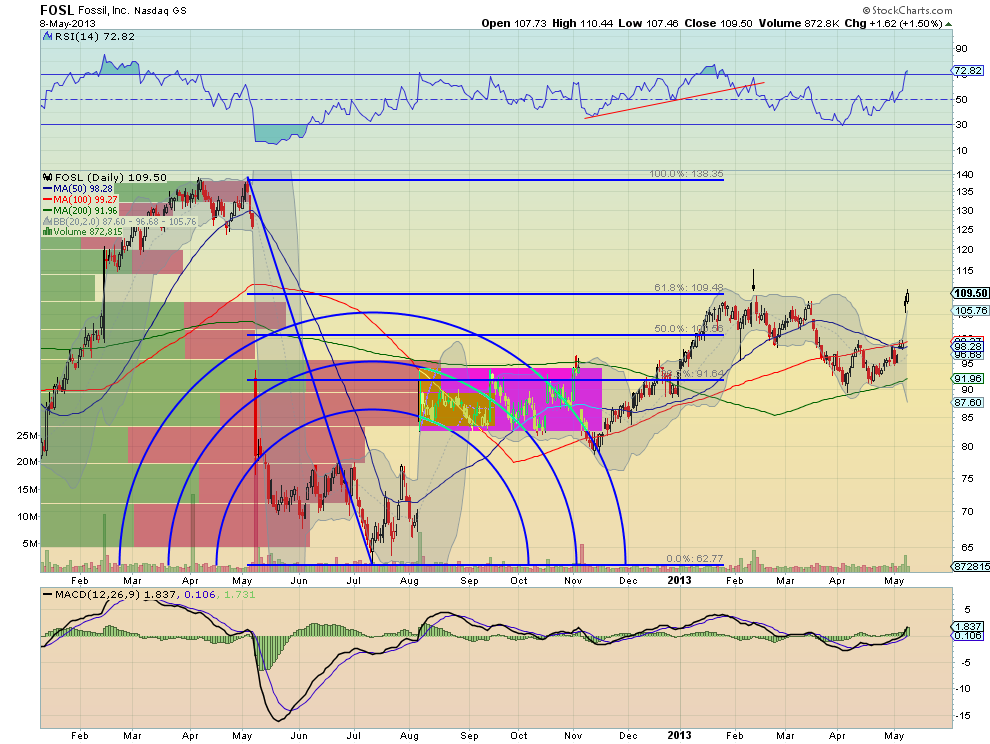

Fossil, (FOSL), reported earnings on Tuesday morning and the stock immediately moved higher. It now sits back at resistance at 109.50, the 61.8% Fibonacci level and where it failed the last attempt. The Relative Strength Index (RSI) is now moving into technically overbought territory, but the Moving Average Convergence Divergence indicator (MACD) is turning up, supporting more upside. If you are holding the stock, this is a time to tighten your stop and look for more upside. But what to do if you missed this?

Fossil, (FOSL)

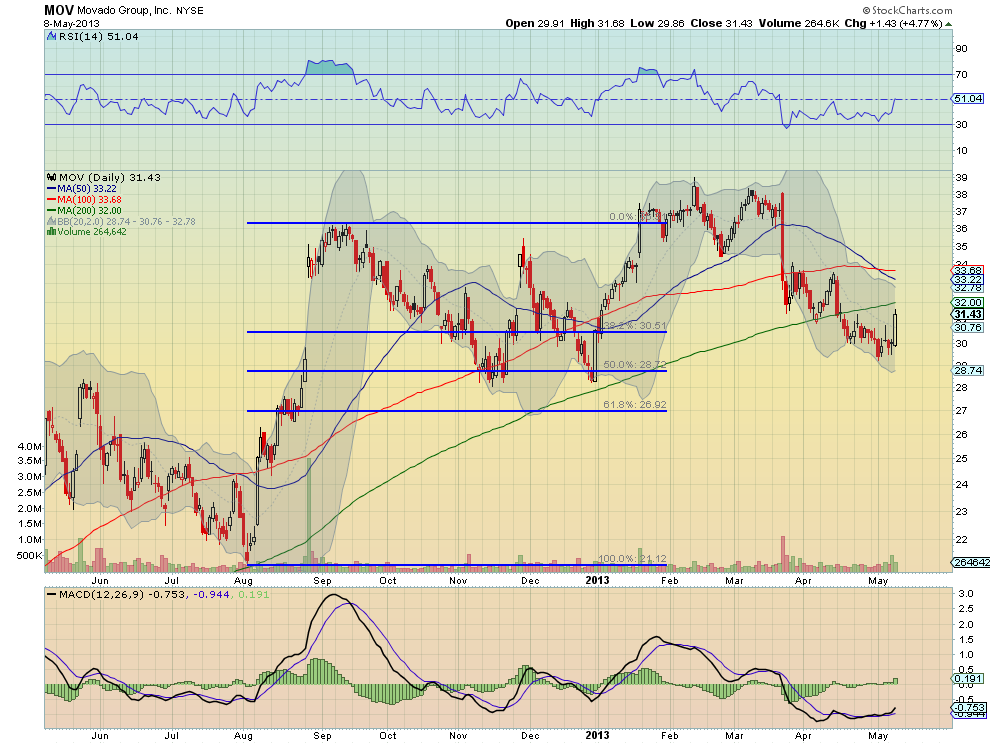

You can set an alert for an entry on a pullback and hold at 100. Or you can look at another name that happens too sell watches that is reversing and about to move higher. I am talking about Movado (MOV). The chart for Movado below shows the bottoming process at 30 with a RSI that is moving back higher and about to cross the mid line while the MACD signal line turns back higher. Using a move over 32 as an entry with a stop at 30.75 could be a good way to play this.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI