- SNB’s Jordan gets rid of EUR/CHF floor

- Swiss Negative Deposit rates effective immediately

- CHF cannot shake safe haven appeal easily

- Last EUR buyer has no interest

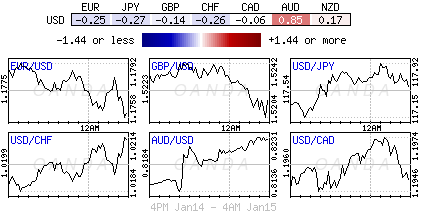

What a mess! At least Investors cannot complain, volatility continues to tick over and remains very healthy so far in 2015, and this despite investors not knowing if the ECB’s QE program will be tabled in a matter of days or whether Greece wants to stay with the ‘family. This morning it’s like trying to survive in the Wild West in the Swiss currency markets, and it used to be so cordial.

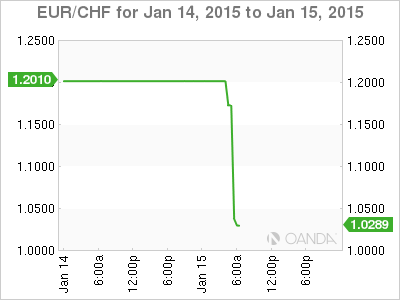

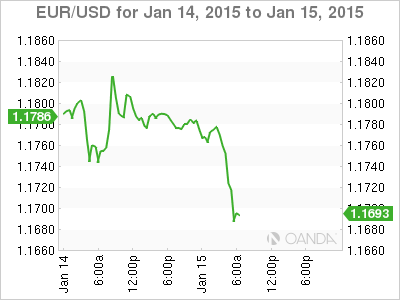

In the grand scheme of things, watching the EUR/CHF graphs “flatline” for so long was never going to work. At one point it felt like the SNB were the only buyers of EUR’s in the market. Swiss policy makers aim was to keep the psychological EUR/CHF floor in check at €1.2000 and were to defend this level at all cost, no matter the price. However, all of that has changed this morning as the SNB abandoned its EUR/CHF “unofficial” floor at €1.20 and cut its three-month Libor Target in a surprise move. The franc has surged more than +20%, ending nearly 36-months of relative calm in this idyllic neutral country. Volatility in all asset classes has surged and Capital Market will still be feeling this sudden knock on effect for some time.

Swiss Parity Broken

The CHF rocketed beyond parity with the EUR, after Swiss policy makers stunned markets earlier this morning by doing away with their long-standing cap on the strength of their domestic currency. Plotting EUR/CHF graphs was the equivalent of looking at a non-functioning heart rate monitor that flatlined. The SNB has been intervening in the currency markets, more aggressively since September 2011 to prevent the Swiss franc from appreciating too high and at times the only buyer or EUR’s to prevent their currency from dropping below €1.20.

Now that has all changed. After three-and-a-half years of artificially capping the currency’s rise Swiss officials have scrapped the floor this morning, which has prompted a sharp franc rise across the board. Officials has also cut the deposit rate to -0.75%, another significant surprise as the negative interest rate announced in December was due to come into effect next week, alongside the ECB’s monetary policy meeting. It is no surprise that EUR/CHF is massively lower and volatility has increased sharply.

Swiss traders plotting new ranges

From a technical point of view, new trading range floors for EUR/CHF and USD/CHF have to be forged out. Disregarding blatant spikes that may or may not be validated during upcoming sessions, EUR/CHF seems to have found some stability at/near €1.000 (with the official EUR low continues to be disputed – €0.8000), while USD/CHF has since bounced form its three-year low near $0.7380 to $0.8720. The lack of a floor means that the SNB does not have to engage in aggressive intervention, but the volatility suggests that policy makers should be providing some level of liquidity/support.

Now that the gloves are off somewhat, and despite the CHF freefall and negative deposit rates, the pressure on the CHF to appreciate will continue. As already demonstrated across the various asset classes, investors are not averse to paying away to hold safe haven assets. From a technical point of view, €1.2000 EUR/CHF now becomes a strong resistance barrier, although any rally below or close to EUR/CHF parity will struggle. The more orderly USD/CHF charts are a tad easier to read, with varying resistance levels first appearing around $0.8974, 0.9545 and 0.9650. Traders are required to think in “Big” handles.

SNB’s Credibility Questioned

Today’s events by the SNB are obviously a very unexpected development by “any” Central Bank. Their actions have clearly deviated from their rhetoric script that they have gone to great pains to continually deliver to investors, especially over the past few quarters. SNB’s Jordan expected to “enforce the floor with utmost determination.” This sudden U-turn will definitely have a negative impact on the SNB’s credibility going forward. It’s obvious that the SNB is hoping to dissuade investors from viewing CHF as a safe-haven with its move to cut the deposit rate – but in unsure times, investors will pay away to preserve capital.

The appreciation of the franc now means lower important prices, increasing downward pressure on Swiss inflation and will eventually challenge Swiss exporters competitiveness. Nevertheless, negative rates will not rid the demand for safe haven assets that quickly!