The markets are tracking the same pattern that played out in 2015.

Most market action (more than 80%) today is driven by computer algorithms. These programs look for an asset class that is moving, and then buy based on the momentum.

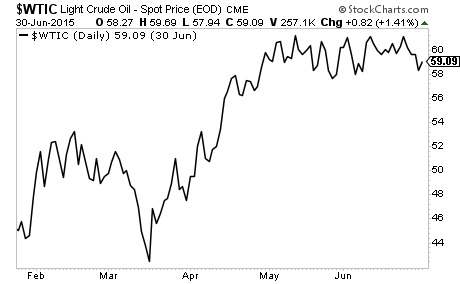

From March through May, the moving asset class is oil, which historically tends to rally during this period. In 2015, oil bottomed in March and rallied hard into June.

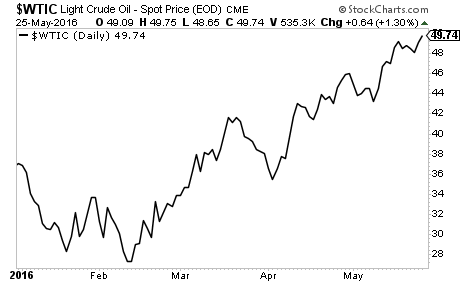

This year, the same pattern played out. However, the pattern hit a month early as traders and computers tried to front-run each other. Oil bottomed in February and has risen to $50 per barrel.

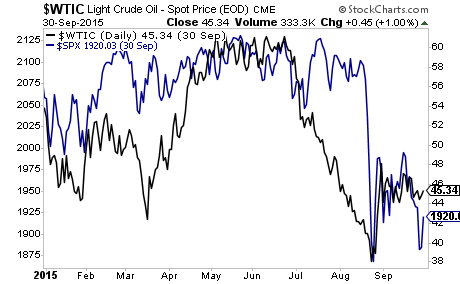

Anyone who is buying into this rally in the belief that it represents the start of a new bull market needs to consider what happened in 2015 when the seasonal trend ended: oil crashed, pulling stock down with it.

We’re currently preparing for a similar situation today.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.